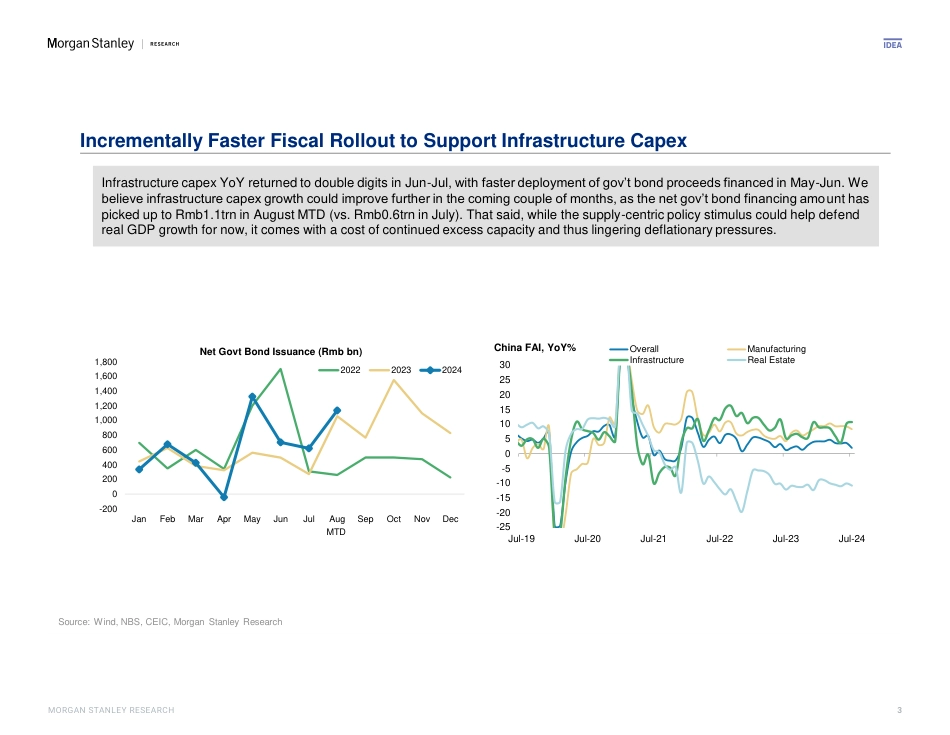

MIdeaChinaEconomics|AsiaPacificBullvs.Bear:NominalGDPWellBelowConsensusMorganStanleyAsiaLimitedRobinXingChiefChinaEconomistRobin.Xing@morganstanley.com+8522848-6511JennyZheng,CFAEconomistJenny.L.Zheng@morganstanley.com+8523963-4015ZhipengCaiEconomistZhipeng.Cai@morganstanley.com+8522239-7820HarryZhaoEconomistHarry.Zhao@morganstanley.com+8522239-7229PolitburoandPBoCpledged"additionaltools"tosupportgrowth.Butpolicyremainedreactive,andour3QnominalGDPisthustrackingat~4%Y,wellbelowconsensusof4.7%Y,althoughrealGDPistrackingat4.5%Y(Consensus:4.7%Y).Tobringyouavarietyofperspectives,wehavepickedseveralchartsthatconsiderbothbullandbearargumentsforChina'seconomy:•Bullarguments:Paceoffiscalbudgetrollouthasaccelerated,andPBoCpledged"additionalpolicytools"toaccommodatefiscaleasing.AstartofFedratecutcyclefromSeptembermayhelpeaseRMBdepreciationpressuresandreduceconstraintsonPBoC'smonetaryeasing.•Beararguments:Thecontinuedreactiveandsupply-centricpolicyhasnotbeenabletostemprivatedemandweakness,asreflectedbythefadedeffectofmid-Mayhousing-easingmeasures,softeningwagegrowth(particularlyforentry-leveljobs),andthebroad-basedconsumptionslowdown.Thesesuggestdeflationarypressuresremainelevated.Forimportantdisclosures,refertotheDisclosureSection,locatedattheendofthisreport.August16,202409:15AMGMTMIdea2BullArgumentsMIdeaMorganStanley...

发表评论取消回复