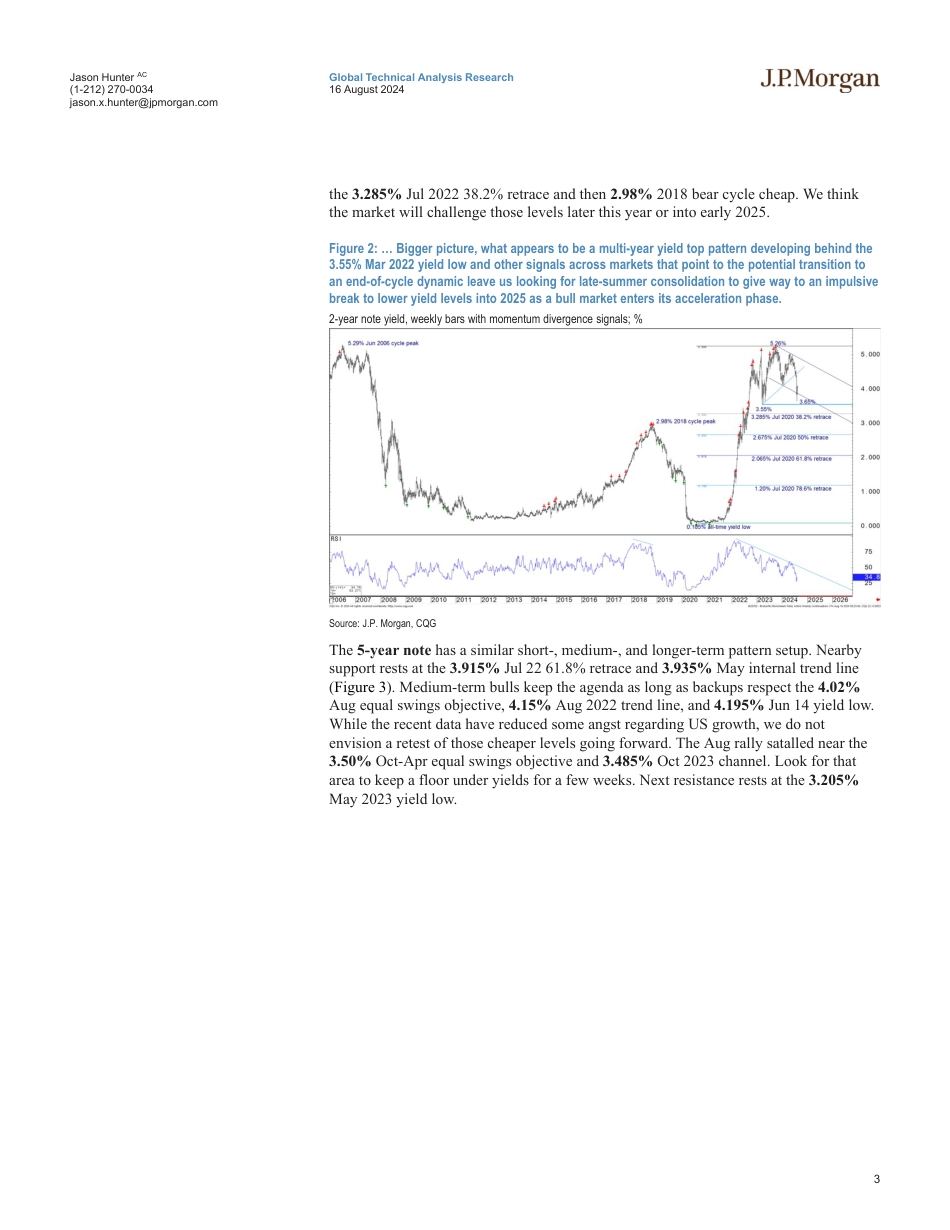

GlobalTechnicalAnalysisResearch16August2024JPMORGANwww.jpmorganmarkets.comTechnicalStrategyJasonHunterAC(1-212)270-0034jason.x.hunter@jpmorgan.comJ.P.MorganSecuritiesLLC•The2-yearnotebackupfrom3.65%approachesthefirstzoneofpotentialsupportat4.115-4.20%.Weexpectthemarkettofinditsfootingnearthatsupportorthe4.30-4.35%secondconfluenceoflevelsoverthenearterm.Biggerpicture,whatappearstobeamulti-yearyieldtoppatterndevelopingbehindthe3.55%Mar2022yieldlowandothersignalsacrossmarketsthatpointtothepotentialtransitiontoanend-of-cycledynamicleaveuslookingforlate-summerconsolidationtogivewaytoanimpulsivebreaktoloweryieldlevelsinto2025asabullmarketentersitsaccelerationphase.•The5-yearnoteconsolidatesafterthemid-summeraccelerationtoloweryields.Weexpectthe3.91-4.02%supportzonetocapyieldsthroughlatesummer.Abreakthrough4.15-4.20%isneededtoderailthebullishpatternstructureatthispoint.Therallystallednearthe3.50%Oct-Aprequalswingsobjectiveandtheassociatedchanneltrendline.Wesuspectthatareawillactasresistanceforafewweeks.•The10-yearnoteyieldbullishlyconsolidatesbehindthe3.625%Apr202378.6%retraceandinfrontofkeysupportat4.02-4.14%.Weexpectthosetwozonestodefinethetradingrangeintotheearlyfall.Thenextzoneofchartresistancesitsat3.22-3.248%,targetsforlaterthisyearorearly2025.•The30-yearbondbullishlyconsolidatesricherthanthe4.33-4.345%Jun...

发表评论取消回复