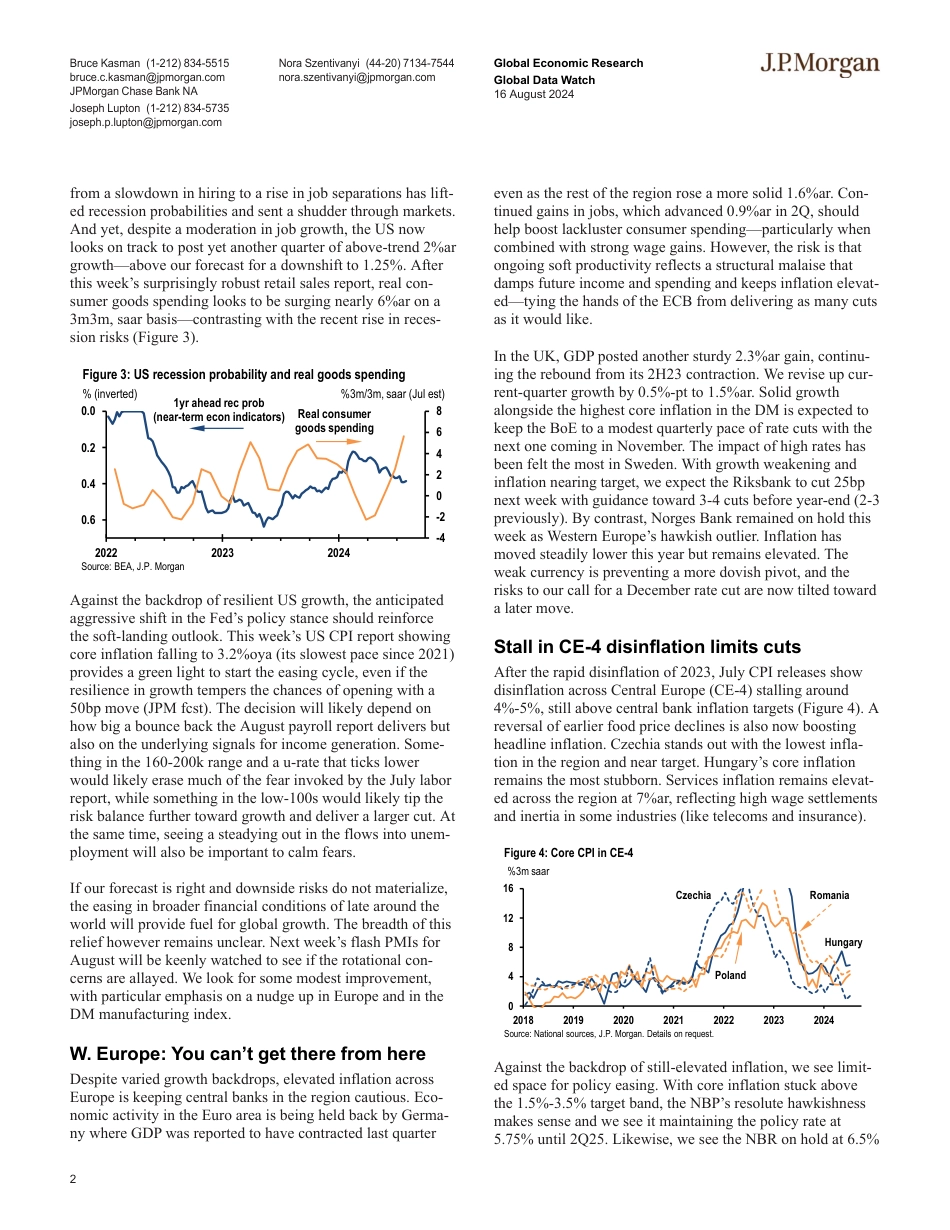

GlobalEconomicResearch16August2024JPMORGANwww.jpmorganmarkets.comContentsRBA:Learningthehardway13GlobalEconomicOutlookSummary4GlobalCentralBankWatch6EconomicActivityTracking8SelectedrecentresearchfromJ.P.MorganEconomics10J.P.MorganMarketWatch11DataWatchesUnitedStates10Focus:benchmarktorevisedownpayrollsmodestly10Euroarea17Japan17Canada21Mexico23Brazil25Argentina27UnitedKingdom32EmergingEurope36SouthAfrica40AustraliaandNewZealand40China,HongKong,andTaiwan42Korea44ASEAN46India50RegionalDataCalendars53EconomicandPolicyResearchBruceKasman(1-212)834-5515bruce.c.kasman@jpmorgan.comJPMorganChaseBankNAJosephLupton(1-212)834-5735joseph.p.lupton@jpmorgan.comJPMorganChaseBankNANoraSzentivanyi(44-20)7134-7544nora.szentivanyi@jpmorgan.comJ.P.MorganSecuritiesplcGlobalDataWatch•USrecessionfearsmoderatewithbettergrowthandinflationdata•StillstickyinflationshouldgivemorepausetoEuropeancentralbanks•WeakJulycreditandgrowthdatapromptanotherChinadowngrade•Upnext:DMAugflashPMIs(fcst:rotation);Riks-25bp;BI,BoKholdIttakesasteadyhandChangeisalwayshard.Thisincludesperiodsoftransitioninthebusinesscycle.Distinguishingbetweenaslideintorecessionfromamid-cycleslowdownisoneofthemoredifficulttasksinforecasting.Standingatsuchajunctureinthisfour-yearoldglobalexpansion,itisunderstandabletofeeluneasy.Inthesedifficulttimes,itisbesttofallbackon...

发表评论取消回复