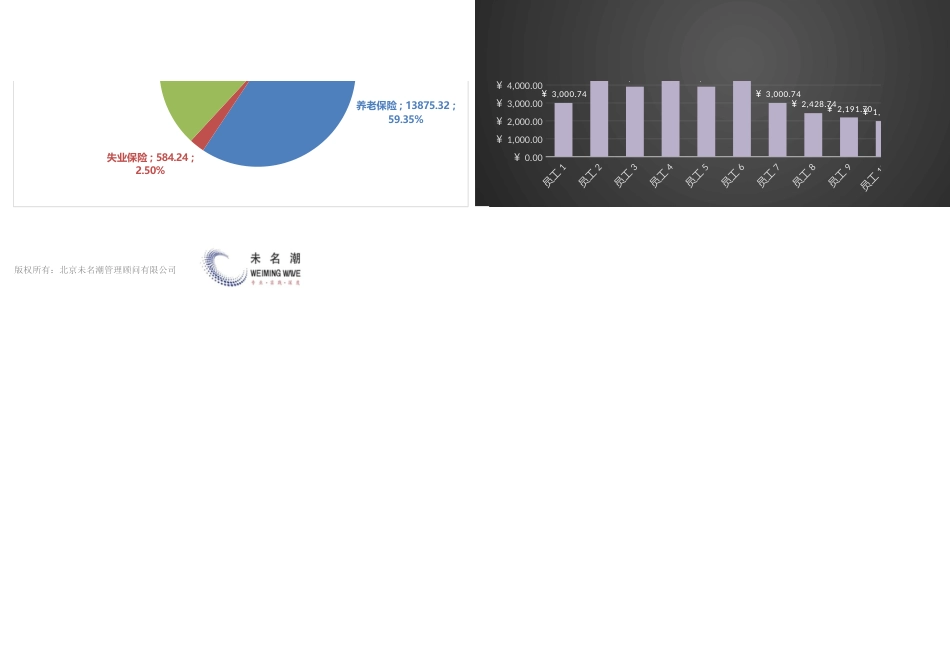

人力资源管理工具——薪酬福利部门姓名月度基本工资养老保险失业保险医疗保险工伤保险生育保险住房公积金公司缴纳1874.00368.0036.809.20462.4095.4813.870.0036.990.00552.00552.0022280.00960.0096.0024.001200.00243.0036.000.0096.000.001440.001440.0031140.00480.0048.0012.00600.00123.0018.000.0048.000.00720.00720.0042280.00960.0096.0024.001200.00243.0036.000.0096.000.001440.001440.0051140.00480.0048.0012.00600.00123.0018.000.0048.000.00720.00720.0062280.00960.0096.0024.001200.00243.0036.000.0096.000.001440.001440.007874.00368.0036.809.20462.4095.4813.870.0036.990.00552.00552.008665.00280.0028.007.00462.4095.4813.870.0036.990.00420.00420.009585.58246.5624.666.16462.4095.4813.870.0036.990.00360.00360.0010585.58246.5624.666.16462.4095.4813.870.0036.990.00258.00258.0011585.58246.5624.666.16462.4095.4813.870.0036.990.00258.00258.0012585.58246.5624.666.16462.4095.4813.870.0036.990.00258.00258.00公司社保福利费用结构分析表(含住房公积金)说明:此表主要详细记录员工的月基本工资、各类社保项目(含住房公积金)公司缴纳情况、个人缴纳情况,便于每月对公司整体的保险缴纳情况进行统计以及跟踪分析,分包括:各费用项目结构分析、员工社保福利费用对比分析。使用方法:按照对应项目填入每个月的实际数据即可,合计部分为自动生成。注:填入数据应该以每个月核准后的缴的实际数据为准,所列数据仅供参考。序号公司缴纳金额合计个人缴纳金额合计个人缴纳公司缴纳个人缴...

发表评论取消回复