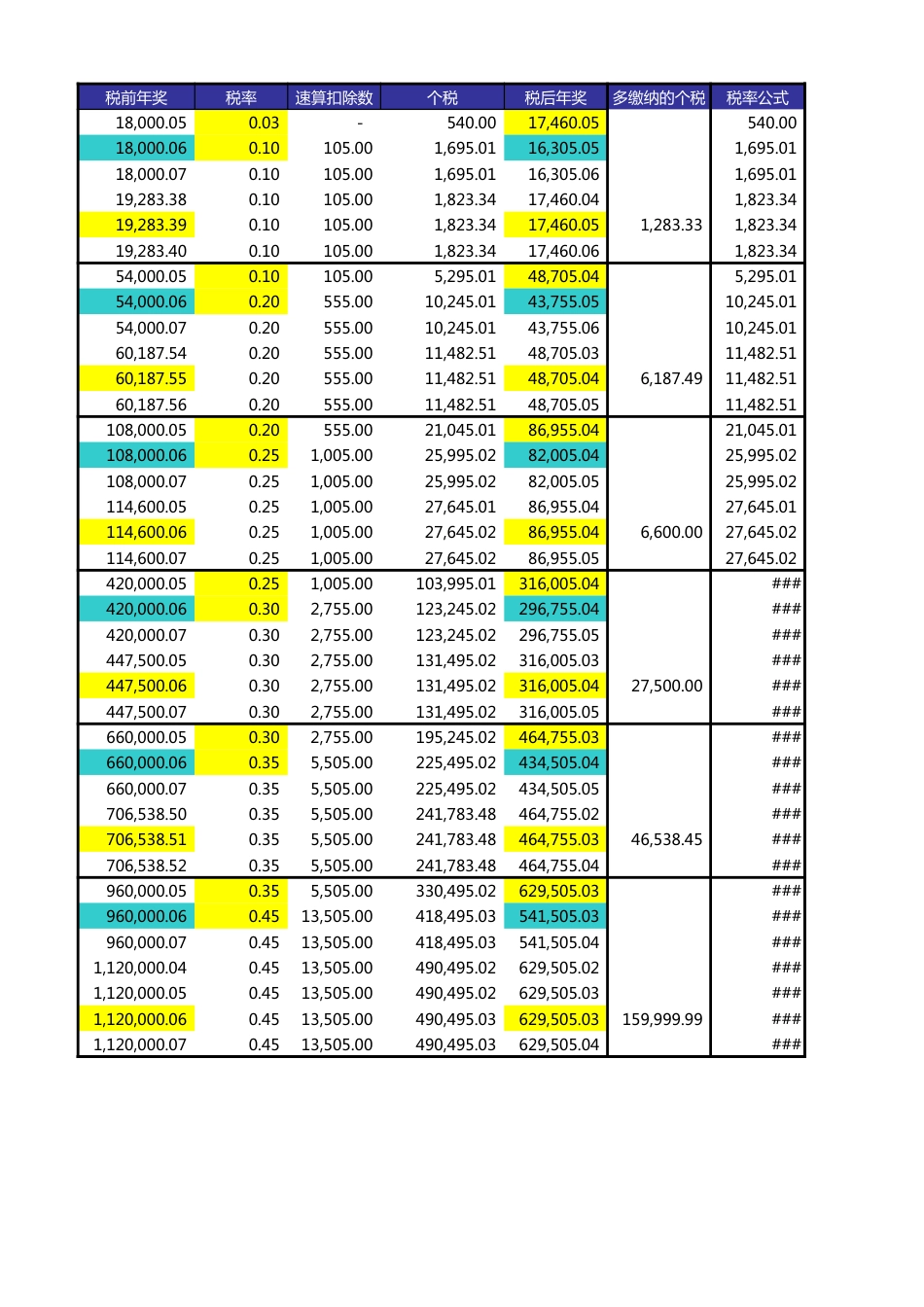

起征点3,500.00序号倒挂区间下限倒挂区间上限税率速算扣除数118,000.0619,283.39(0,1500]3%-254,000.0660,187.55(1500,4500]10%1053108,000.06114,600.06(4500,9000]20%5554420,000.06447,500.06(9000,35000]25%1,0055660,000.06706,538.51(35000,55000]30%2,7556960,000.061,120,000.06(55000,80000]35%5,5057(80000,∞]45%13,505工资计税公式MAX((A1-3500)*{3,10,20,25,30,35,45}%-{0,105,555,1005,2755,5505,13505},0)年奖计税公式Round(A2*LOOKUP(ROUND(A2/12,2),{0,1500.01,4500.01,9000.01,35000.01,55000.01,80000.01},{3,10,2调整效果年奖调整额1,300.0013013011,610.0053,090.0011,480.0053,220.00调整前工资应税工资起征点税率速算扣除数个税税后工资6,700.003,500.0010.0%105.00565.006,135.00年奖应税奖金税率确认税率速算扣除数个税税后奖金应纳税额[需扣除3500]1.根据临界点,要得到最多的税后年奖,推荐:1)当18000.05<税前年奖≤19283.39元时,调整奖金总额=18000.05,这样税后所得是最高的;2)当54000.05<税前年奖≤60187.55元时,调整奖金总额=54000.05,这样税后所得是最高的;3)当108000.05<税前年奖≤114600.06元时,调整奖金总额=108000.05,这样税后所得是最高的;4)当420000.05<税前年奖≤447500.06时,调整奖金总额=420000.05,这样税后所得是最高的;5)当660000.05<税前年奖≤706538.51元时,调整奖金总额=660000.05,这样税后所得是最高的;6)当960000.05<税前年奖≤1120000.06元时,调整奖金总额=960000.05,这样税后所得是最高的;2.解决年奖由于税率倒挂的思路:1)由于年终奖计算的方式,导...

发表评论取消回复