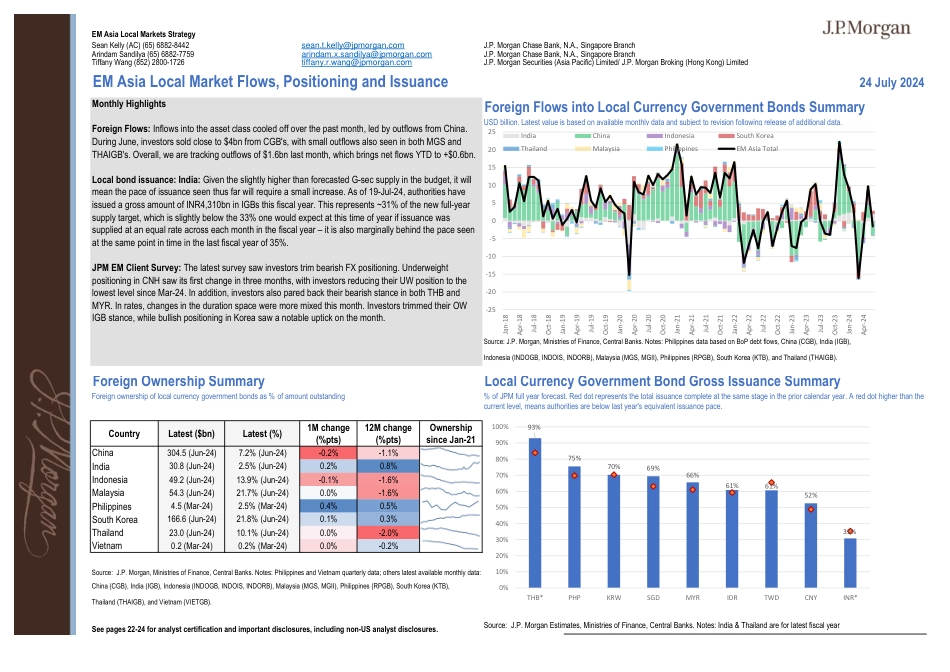

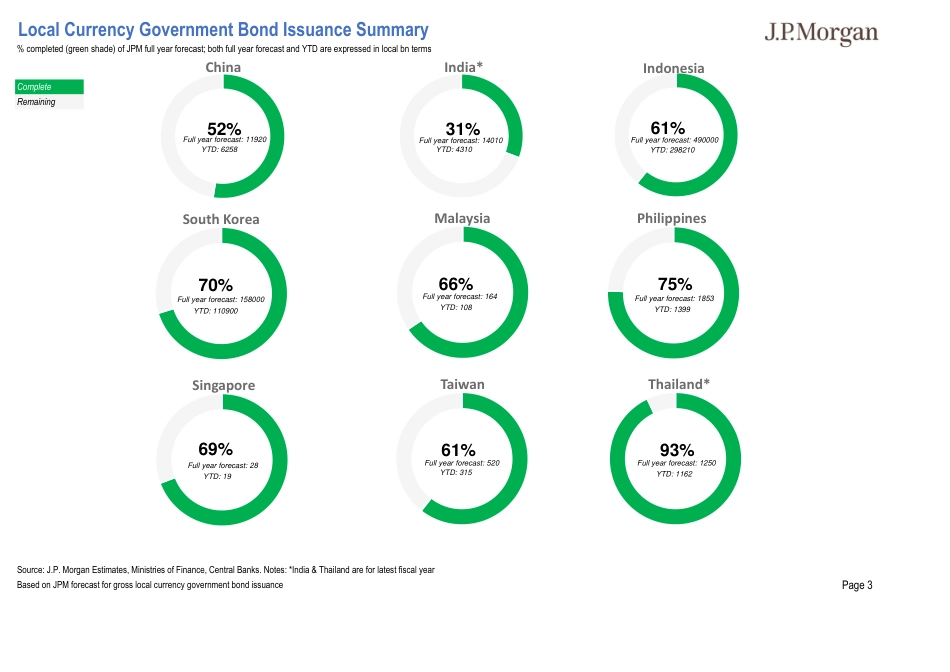

EMAsiaLocalMarketsStrategySeanKelly(AC)(65)6882-8442sean.t.kelly@jpmorgan.comJ.P.MorganChaseBank,N.A.,SingaporeBranchArindamSandilya(65)6882-7759arindam.x.sandilya@jpmorgan.comJ.P.MorganChaseBank,N.A.,SingaporeBranchTiffanyWang(852)2800-1726tiffany.r.wang@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)Limited/J.P.MorganBroking(HongKong)LimitedEMAsiaLocalMarketFlows,PositioningandIssuance24July2024ForeignFlowsintoLocalCurrencyGovernmentBondsSummaryUSDbillion.Latestvalueisbasedonavailablemonthlydataandsubjecttorevisionfollowingreleaseofadditionaldata.Source:J.P.Morgan,MinistriesofFinance,CentralBanks.Notes:PhilippinesdatabasedonBoPdebtflows,China(CGB),India(IGB),Indonesia(INDOGB,INDOIS,INDORB),Malaysia(MGS,MGII),Philippines(RPGB),SouthKorea(KTB),andThailand(THAIGB).ForeignOwnershipSummaryLocalCurrencyGovernmentBondGrossIssuanceSummaryForeignownershipoflocalcurrencygovernmentbondsas%ofamountoutstandingCountryLatest($bn)Latest(%)1Mchange(%pts)12Mchange(%pts)OwnershipsinceJan-21China304.5(Jun-24)7.2%(Jun-24)-0.2%-1.1%India30.8(Jun-24)2.5%(Jun-24)0.2%0.8%Indonesia49.2(Jun-24)13.9%(Jun-24)-0.1%-1.6%Malaysia54.3(Jun-24)21.7%(Jun-24)0.0%-1.6%Philippines4.5(Mar-24)2.5%(Mar-24)0.4%0.5%SouthKorea166.6(Jun-24)21.8%(Jun-24)0.1%0.3%Thailand23.0(Jun-24)10.1%(Jun-24)0.0%-2.0%Vietnam0.2(Mar-24)0.2%(Mar-24)0.0%-0.2%Source:J.P.Mor...

发表评论取消回复