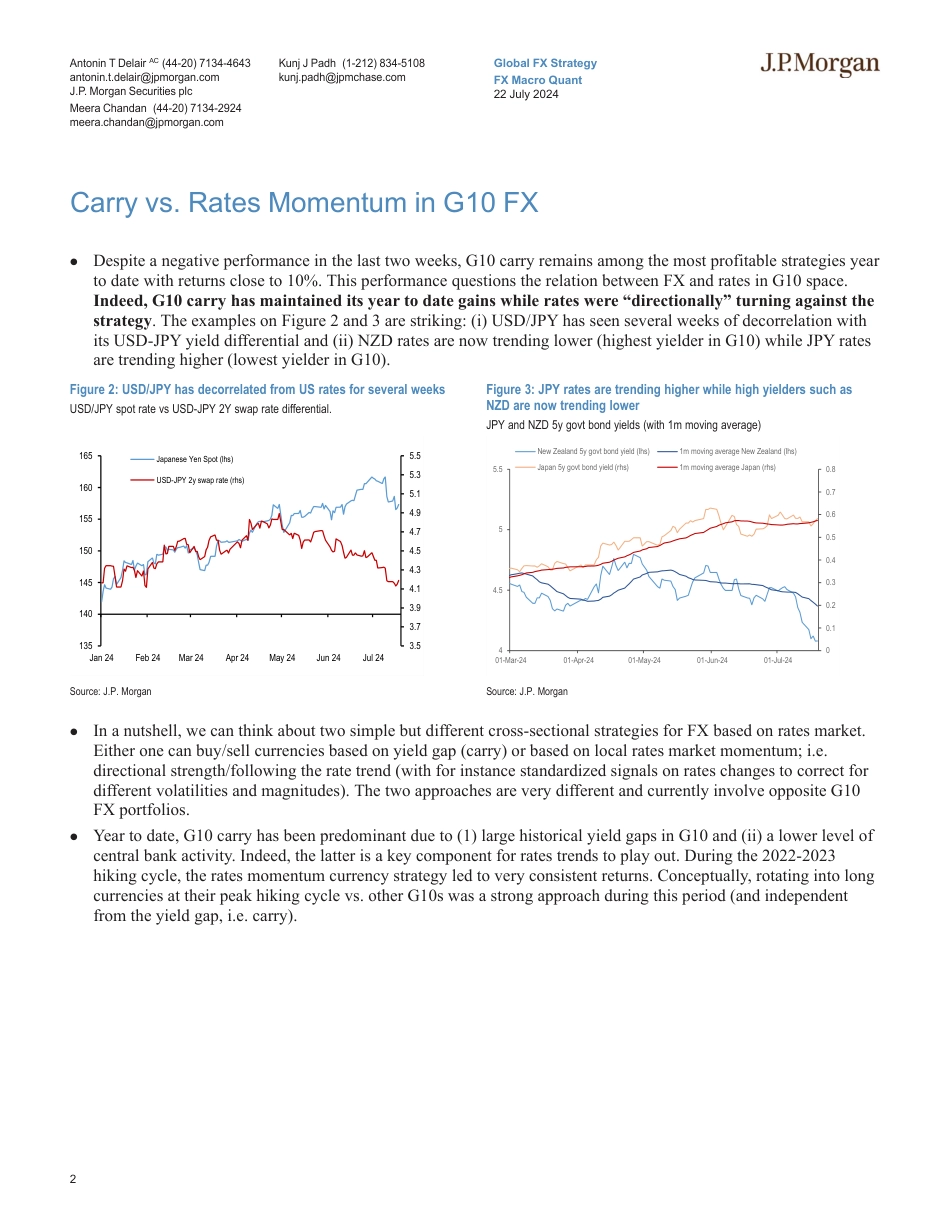

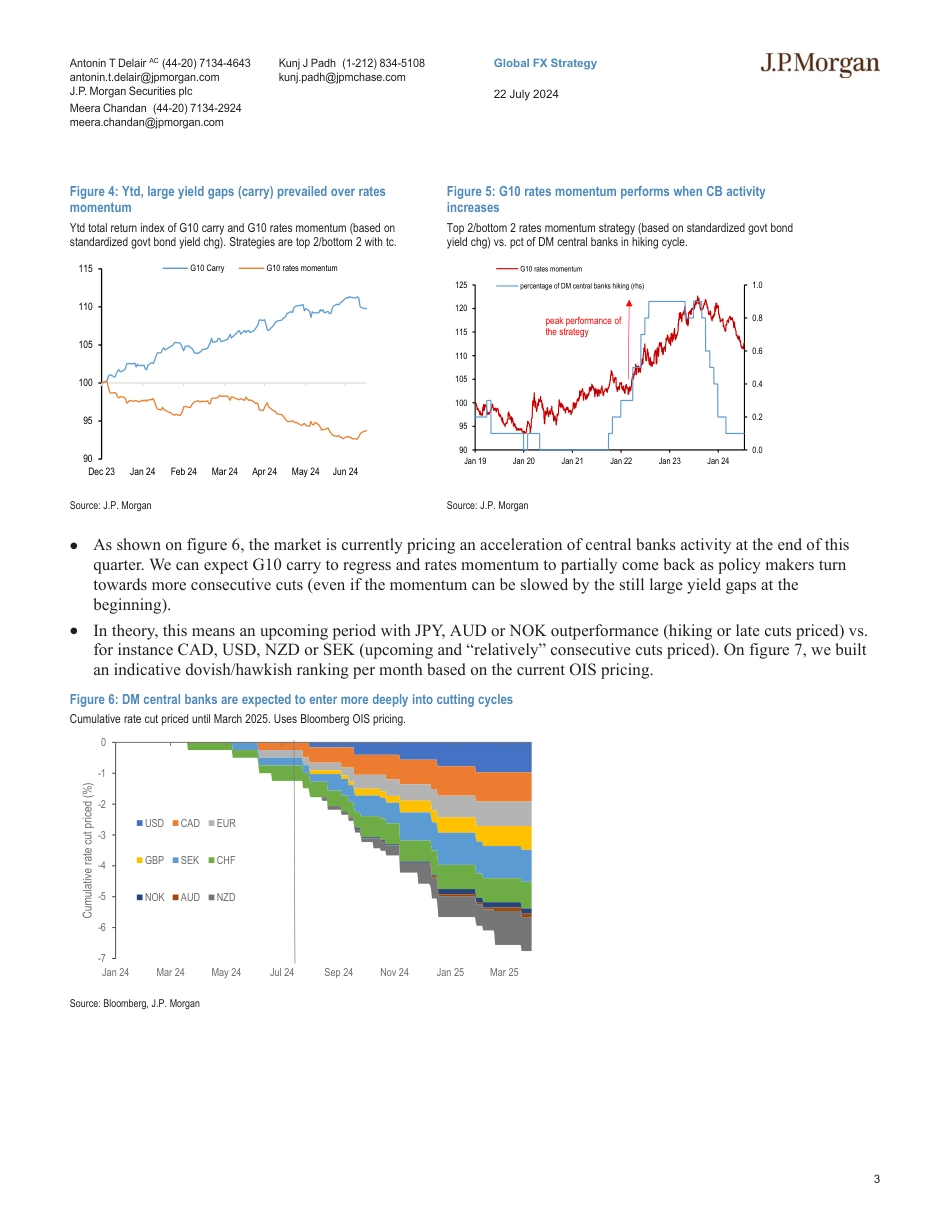

GlobalFXStrategy22July2024JPMORGANwww.jpmorganmarkets.comGlobalFXStrategyAntoninTDelairAC(44-20)7134-4643antonin.t.delair@jpmorgan.comJ.P.MorganSecuritiesplcMeeraChandan(44-20)7134-2924meera.chandan@jpmorgan.comJ.P.MorganSecuritiesplcKunjJPadh(1-212)834-5108kunj.padh@jpmchase.comJ.P.MorganSecuritiesLLC•Ourgrowthstrategyhasa+40%weightallocatedtoUSD.Thislargerweight(vs.previousmonths)isexplainedbylesscountrieswithastronggrowthmomentum.However,thesignalisnotbreakinghistoricalrelevancelevels.•GlobalcarrybasketsonlyshowatinyreboundaftertheMay/Junecollapse(+4%ytd).Wedon’truleoutpositivereturnsgoingforward,buttheriskrewardforthefactorisnowlowdueto:(i)compressedyieldonthebasketvs.(ii)riskoffundersrepricingonFedeasingandpotentiallackofappetiteforEMhighbetasthroughUSelections.Othersignalsdeliveredstrongerreturnsonaglobalportfolioyeartodatesuchasrelativegrowthorpricemomentum.•Despitelossesinthelasttwoweeks,G10carryremainsamongthemostprofitablestrategiesyeartodatewithreturnscloseto10%.Inourmidyearoutlook,wehighlightedthatthisdynamicwaslikelytocontinueiftheFedstaysrelativelyhawkish.ThisscenariohasnowbeenchallengedbysofterUSdata.•Notably,ratesmomentum(direction/trend)hasbeenignoredbyG10FXmarketsastheyieldgap(carry)waspredominant.TheprojectedincreaseinDMcentralbankactivity(andlargercutsbyyearendfortheFed)canchallengeth...

发表评论取消回复