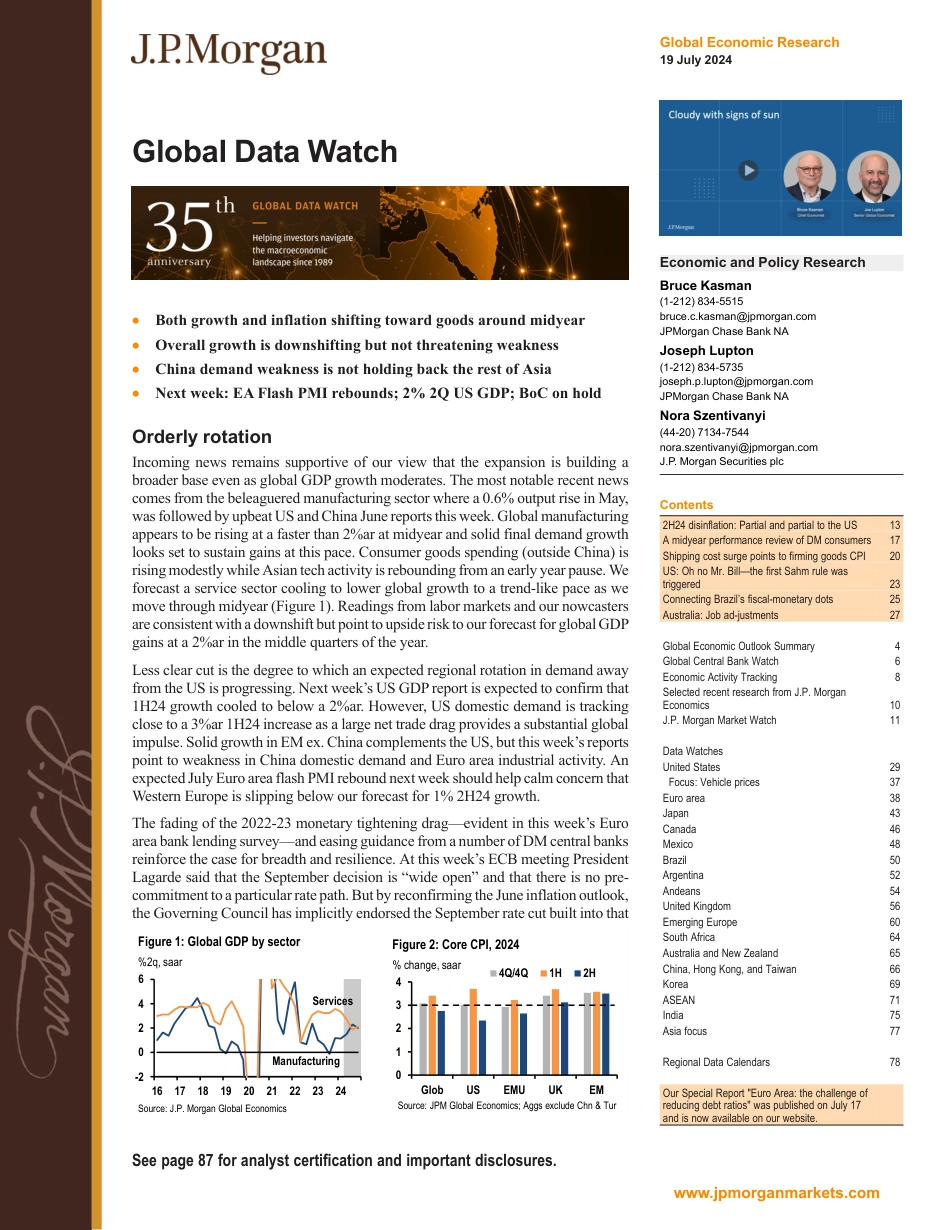

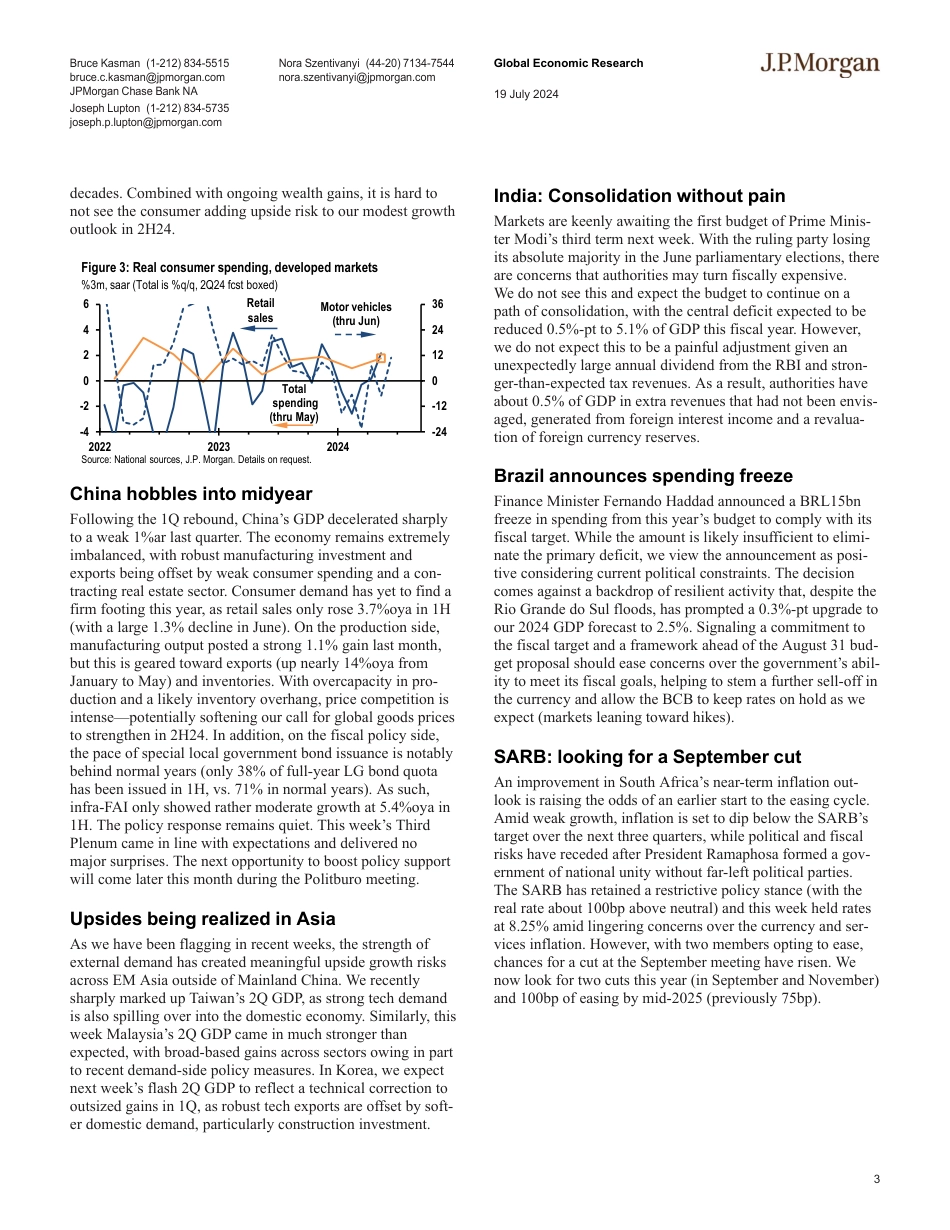

GlobalEconomicResearch19July2024JPMORGANwww.jpmorganmarkets.comContents2H24disinflation:PartialandpartialtotheUS13AmidyearperformancereviewofDMconsumers17ShippingcostsurgepointstofirminggoodsCPI20US:OhnoMr.Bill—thefirstSahmrulewastriggered23ConnectingBrazil’sfiscal-monetarydots25Australia:Jobad-justments27GlobalEconomicOutlookSummary4GlobalCentralBankWatch6EconomicActivityTracking8SelectedrecentresearchfromJ.P.MorganEconomics10J.P.MorganMarketWatch11DataWatchesUnitedStates29Focus:Vehicleprices37Euroarea38Japan43Canada46Mexico48Brazil50Argentina52Andeans54UnitedKingdom56EmergingEurope60SouthAfrica64AustraliaandNewZealand65China,HongKong,andTaiwan66Korea69ASEAN71India75Asiafocus77RegionalDataCalendars78OurSpecialReport"EuroArea:thechallengeofreducingdebtratios"waspublishedonJuly17andisnowavailableonourwebsite.EconomicandPolicyResearchBruceKasman(1-212)834-5515bruce.c.kasman@jpmorgan.comJPMorganChaseBankNAJosephLupton(1-212)834-5735joseph.p.lupton@jpmorgan.comJPMorganChaseBankNANoraSzentivanyi(44-20)7134-7544nora.szentivanyi@jpmorgan.comJ.P.MorganSecuritiesplcGlobalDataWatch•Bothgrowthandinflationshiftingtowardgoodsaroundmidyear•Overallgrowthisdownshiftingbutnotthreateningweakness•ChinademandweaknessisnotholdingbacktherestofAsia•Nextweek:EAFlashPMIrebounds;2%2QUSGDP;BoConholdOrderlyrotationIncomingnewsrema...

发表评论取消回复