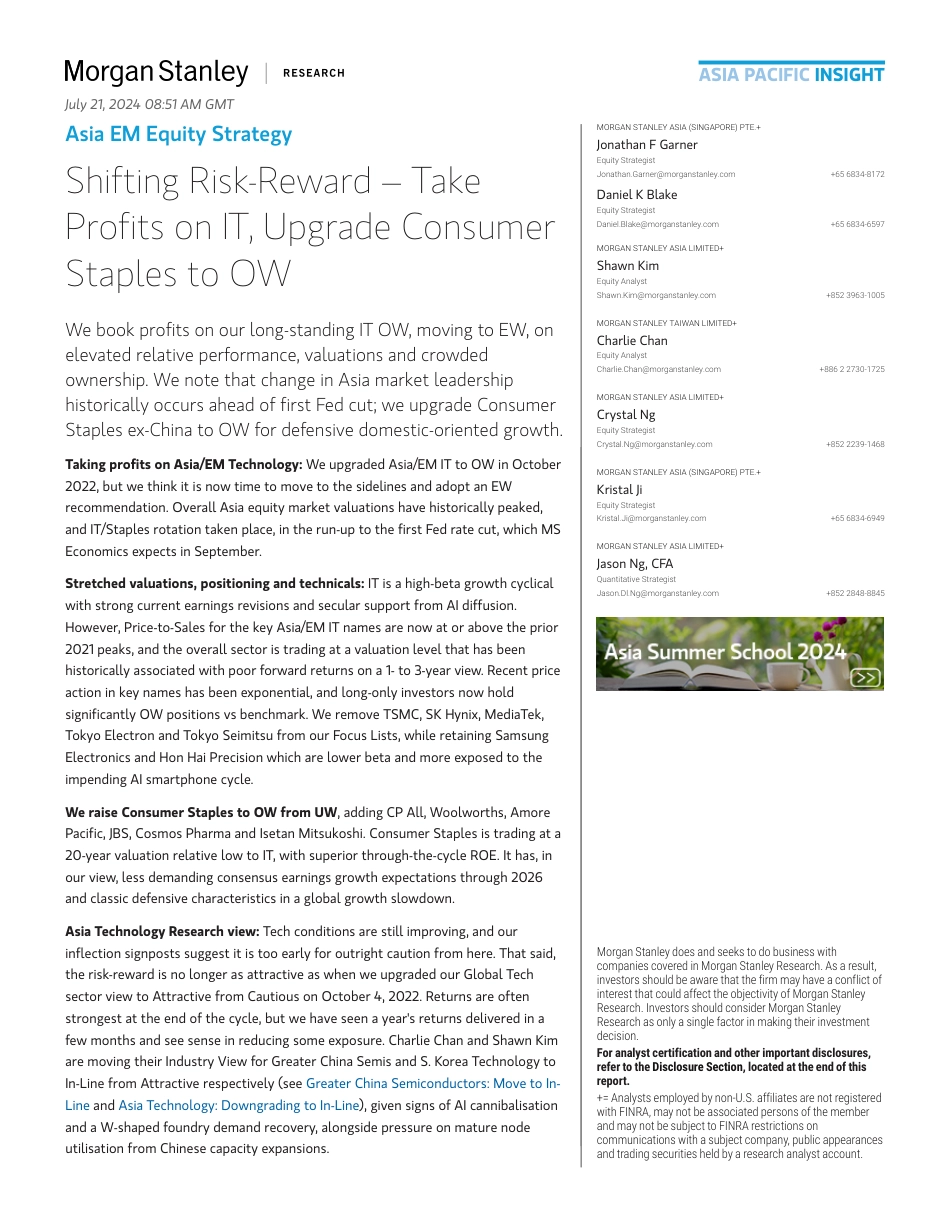

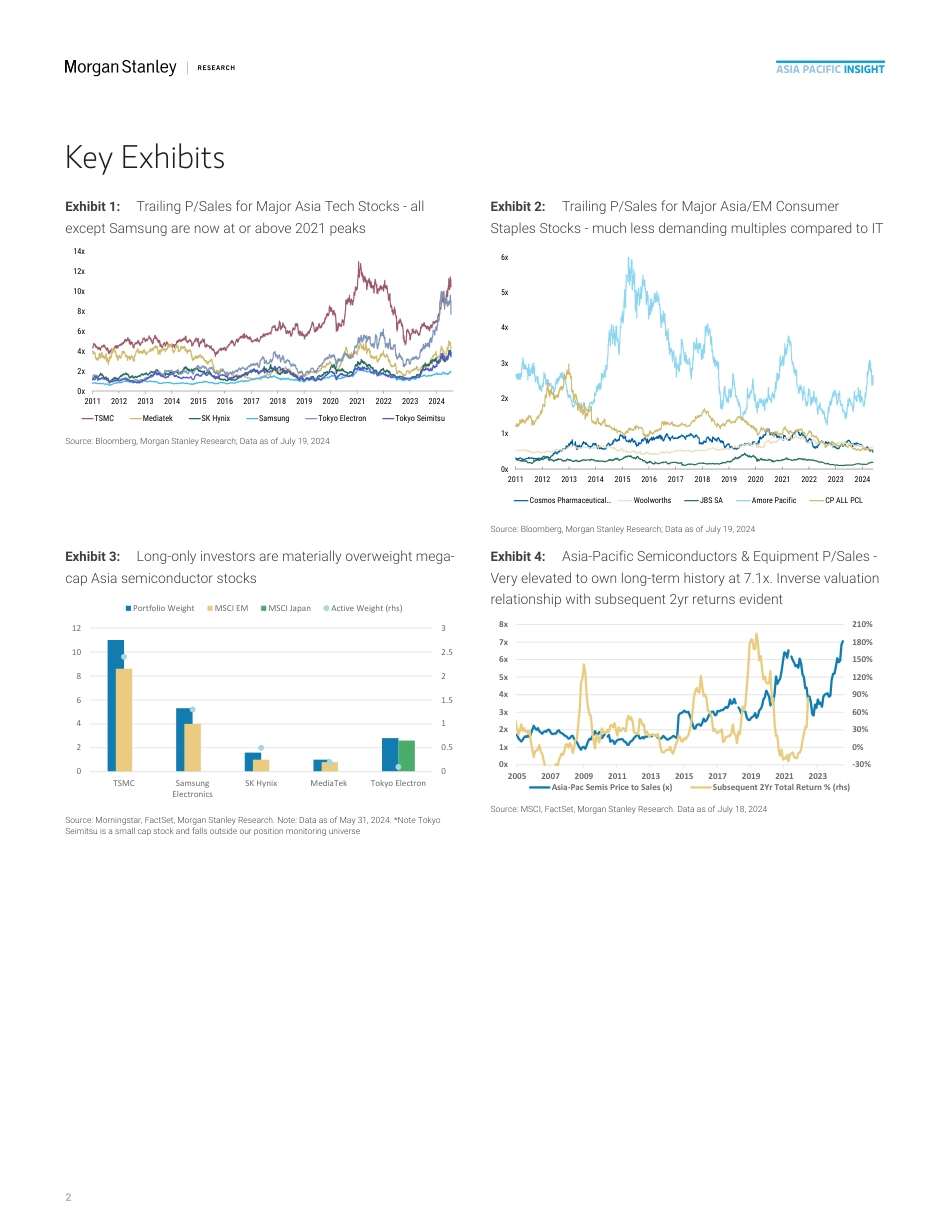

MAsiaPacificInsightAsiaEMEquityStrategyShiftingRisk-Reward–TakeProfitsonIT,UpgradeConsumerStaplestoOWMorganStanleyAsia(Singapore)Pte.+JonathanFGarnerEquityStrategistJonathan.Garner@morganstanley.com+656834-8172DanielKBlakeEquityStrategistDaniel.Blake@morganstanley.com+656834-6597MorganStanleyAsiaLimited+ShawnKimEquityAnalystShawn.Kim@morganstanley.com+8523963-1005MorganStanleyTaiwanLimited+CharlieChanEquityAnalystCharlie.Chan@morganstanley.com+88622730-1725MorganStanleyAsiaLimited+CrystalNgEquityStrategistCrystal.Ng@morganstanley.com+8522239-1468MorganStanleyAsia(Singapore)Pte.+KristalJiEquityStrategistKristal.Ji@morganstanley.com+656834-6949MorganStanleyAsiaLimited+JasonNg,CFAQuantitativeStrategistJason.Dl.Ng@morganstanley.com+8522848-8845Webookprofitsonourlong-standingITOW,movingtoEW,onelevatedrelativeperformance,valuationsandcrowdedownership.WenotethatchangeinAsiamarketleadershiphistoricallyoccursaheadoffirstFedcut;weupgradeConsumerStaplesex-ChinatoOWfordefensivedomestic-orientedgrowth.TakingprofitsonAsia/EMTechnology:WeupgradedAsia/EMITtoOWinOctober2022,butwethinkitisnowtimetomovetothesidelinesandadoptanEWrecommendation.OverallAsiaequitymarketvaluationshavehistoricallypeaked,andIT/Staplesrotationtakenplace,intherun-uptothefirstFedratecut,whichMSEconomicsexpectsinSeptember.Stretchedvaluations,positioninga...

发表评论取消回复