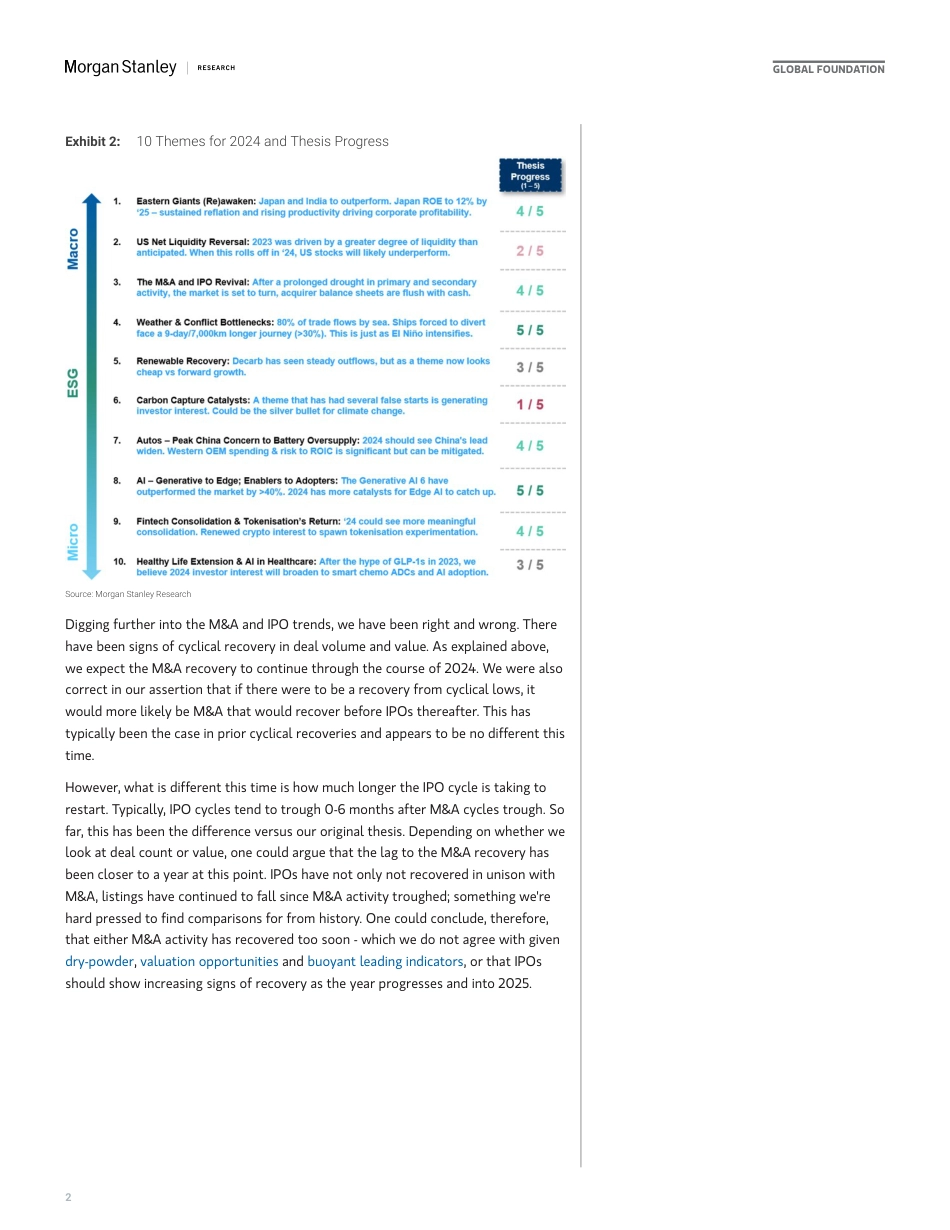

MGlobalFoundationThematicsVentureVision:M&A>IPOMorganStanley&Co.Internationalplc+EdwardStanleyEquityStrategistEdward.Stanley@morganstanley.com+44207425-0840MatiasOvrumEquityStrategistMatias.Ovrum@morganstanley.com+44207425-9902OurVentureVisionweeklieslookat(1)early-stagecross-themefundingpatterns;(2)relativevaluationsbetweenthemes;(3)publicversusprivatevaluations;(4)theresultinganomalieswithincertainthemes.Pleaseletusknowifyouwouldlikeourexceldatabaseof>45,000VCdealscategorisedbytheme,country,valueanddate.Wealsosendthisfileasaweeklydistributionifyouwouldliketoreceiveitregularly.Seehereforourglobalmarketsynopsis.SeehereforourlongeranalysisonthestateoftheVCmarket,particularlyasitrelatestonon-USVentureandinnovationacceleration.Thisweekwepublishedour"10Themesfor2024"progressreport.TheM&Astoryisplayingoutasexpected.IPOsontheotherhand...thewaitgoeson.Westruggletofindpriorprecedentforthecurrentcorrelationdivergence.MorganStanley-perouroriginalreport-expects2024tobeayearof>$5trillioninM&Avolumeacrosstheworld.Whilethiswouldbea47%upliftfrom2023,itwouldsimplymeanareturntothepre-Covidaveragelevel.TheYTDlevelisatc.$1.8trillion,whichthereforeleavesworktobedoneinthesecondhalfoftheyear,butwhichwebelieve-giventhebottominginactivityandrecentre-accelerationindealannouncements-shouldstillbeachievable.M&Aactivityisnowstartingtode...

发表评论取消回复