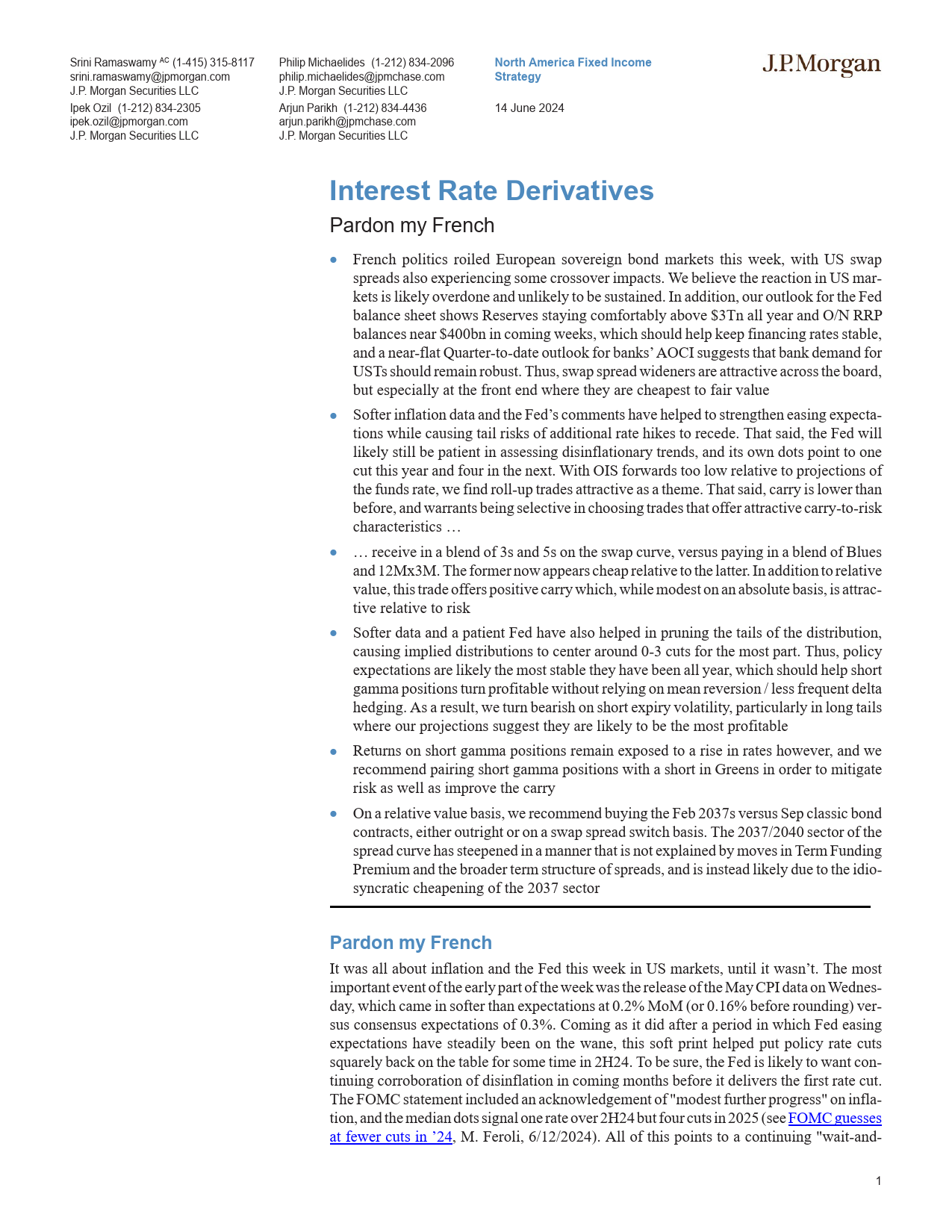

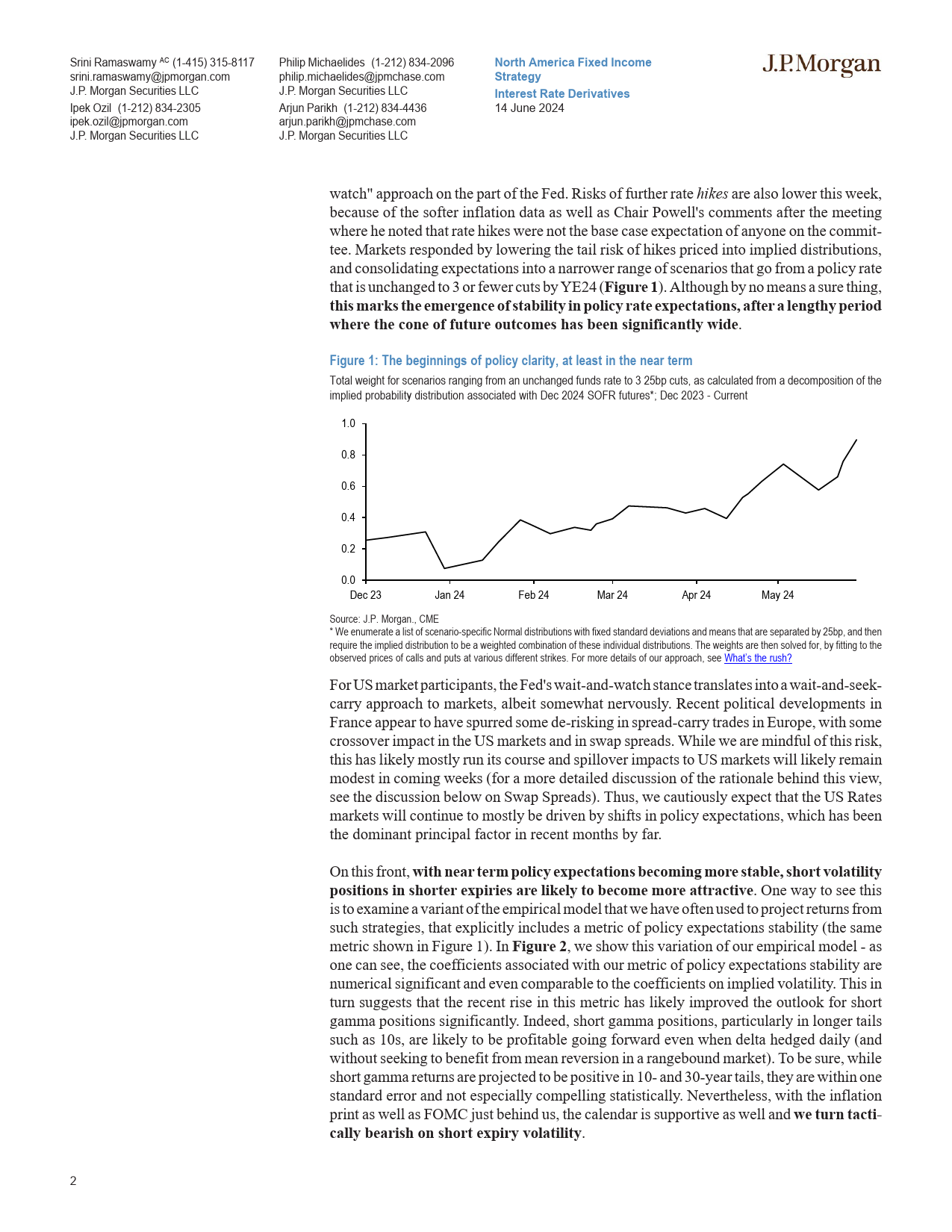

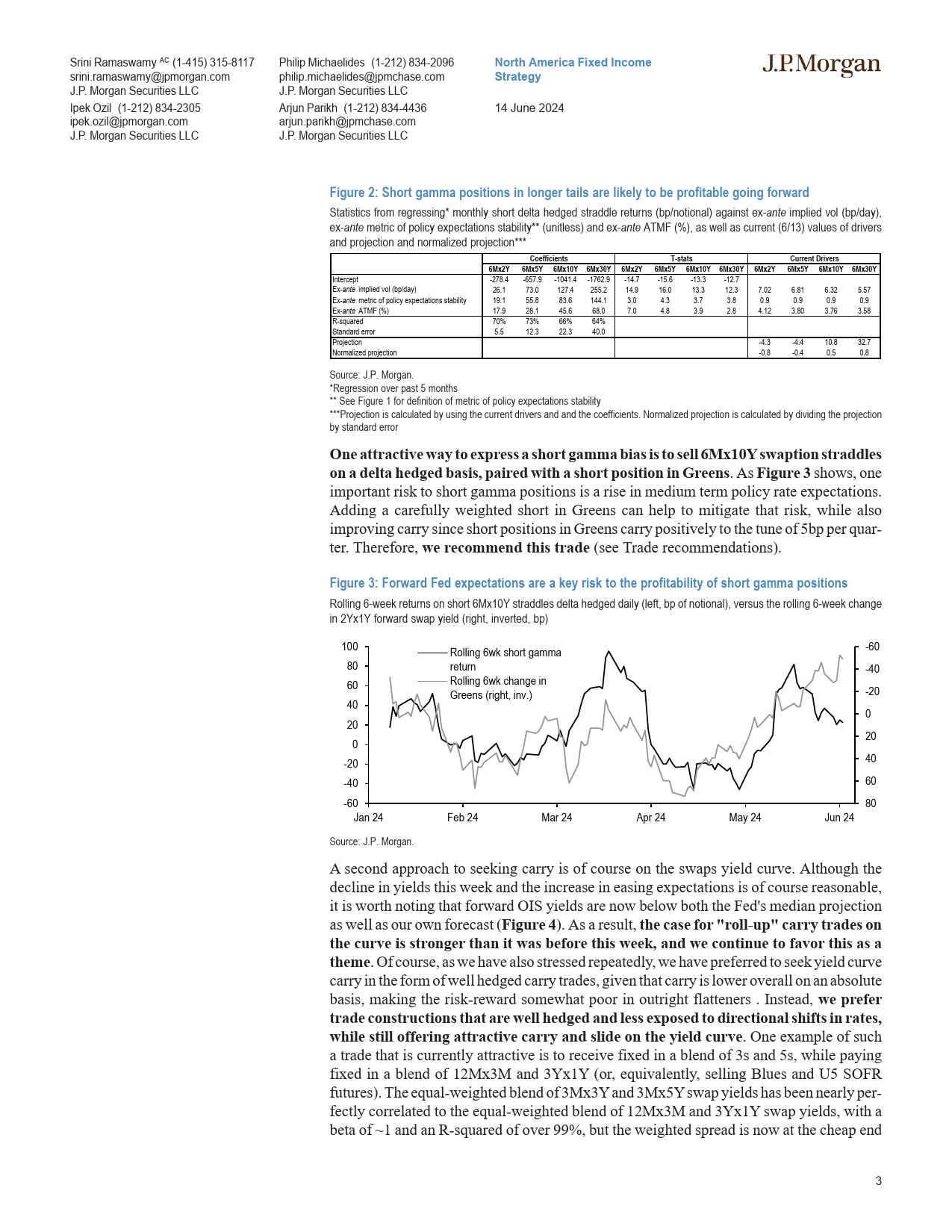

SriniRamaswamyAC(1-415)315-8117PhilipMichaelides(1-212)834-2096NorthAmericaFixedIncomeJPMORGANsrini.ramaswamy@jpmorgan.comphilip.michaelides@jpmchase.comStrategyJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesLLC14June2024IpekOzil(1-212)834-2305ArjunParikh(1-212)834-4436ipek.ozil@jpmorgan.comarjun.parikh@jpmchase.comJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesLLCInterestRateDerivativesPardonmyFrench•FrenchpoliticsroiledEuropeansovereignbondmarketsthisweek,withUSswapspreadsalsoexperiencingsomecrossoverimpacts.WebelievethereactioninUSmar-ketsislikelyoverdoneandunlikelytobesustained.Inaddition,ouroutlookfortheFedbalancesheetshowsReservesstayingcomfortablyabove$3TnallyearandO/NRRPbalancesnear$400bnincomingweeks,whichshouldhelpkeepfinancingratesstable,andanear-flatQuarter-to-dateoutlookforbanks’AOCIsuggeststhatbankdemandforUSTsshouldremainrobust.Thus,swapspreadwidenersareattractiveacrosstheboard,butespeciallyatthefrontendwheretheyarecheapesttofairvalue•SofterinflationdataandtheFed’scommentshavehelpedtostrengtheneasingexpecta-tionswhilecausingtailrisksofadditionalratehikestorecede.Thatsaid,theFedwilllikelystillbepatientinassessingdisinflationarytrends,anditsowndotspointtoonecutthisyearandfourinthenext.WithOISforwardstoolowrelativetoprojectionsofthefundsrate,wefindroll-uptradesattractiveasatheme.Thatsaid,carryislowert...

发表评论取消回复