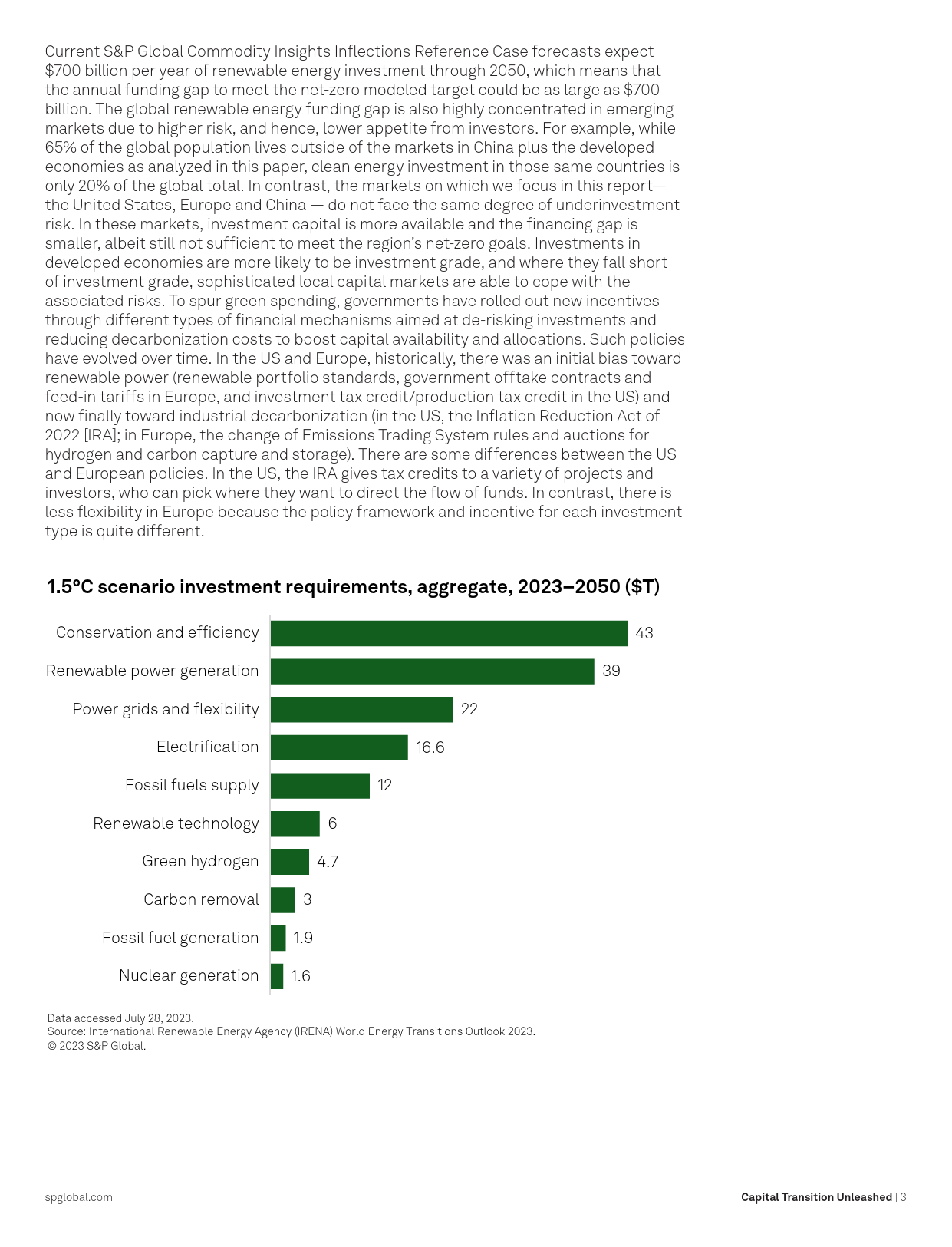

RenewableEnergyFundingin2023:A“CapitalTransition”UnleashedSeptember2023Thisarticle,byS&PGlobalRatingsandS&PGlobalCommodityInsights,isathoughtleadershipreportthatneitheraddressesviewsaboutindividualratingsnorisaratingaction.S&PGlobalRatingsandS&PGlobalCommodityInsightsareseparateandindependentdivisionsofS&PGlobal.spglobal.com©2023S&PGlobal.Allrightsreserved.AuthorsS&PGlobalRatingsTrevorD’Olier-LeesGonzaloCantabranaFernandezAneeshPrabhuLauraLiPierreGeorgesEvanGunterS&PGlobalCommodityInsightsPeterGardettRogerDiwanEduardSaladeVedrunaChrisDeLuciaContributorsAngelaLongCarlaDonagheyKeyTakeawaysGovernmentsareturningtocapital–Manygovernmentsaroundtheworldhavebeenmakingprogressmobilizingpublicandmarketsbecauseofprivatecapitaltoacceleratetheenergytransition,withsignificantmoneyinflowsintotheimmensescaleofprojectsinrecentyears.Theseinflowsarenecessarytomeetthetriplingoffundinginvestmentexpectedneedsforlow-carbonprojectsacrosssectorsby2030tomeet2050net-zerogoals.tobeneededinthecomingdecades.–TheseinflowsareparticularlypronouncedintheUnitedStates,ChinaandtheEuropeanUnion–respondingtohigh-levelpolicygoals,yetexecutedthroughdistinctivefinancingchannels.Theseachievements,however,stillfallshortofwhatisneededtomeetnet-zerogreenhousegasemissionsgoalsaslaidoutintheParisAgreement–particularlygivenloweractivityoutsidethesek...

发表评论取消回复