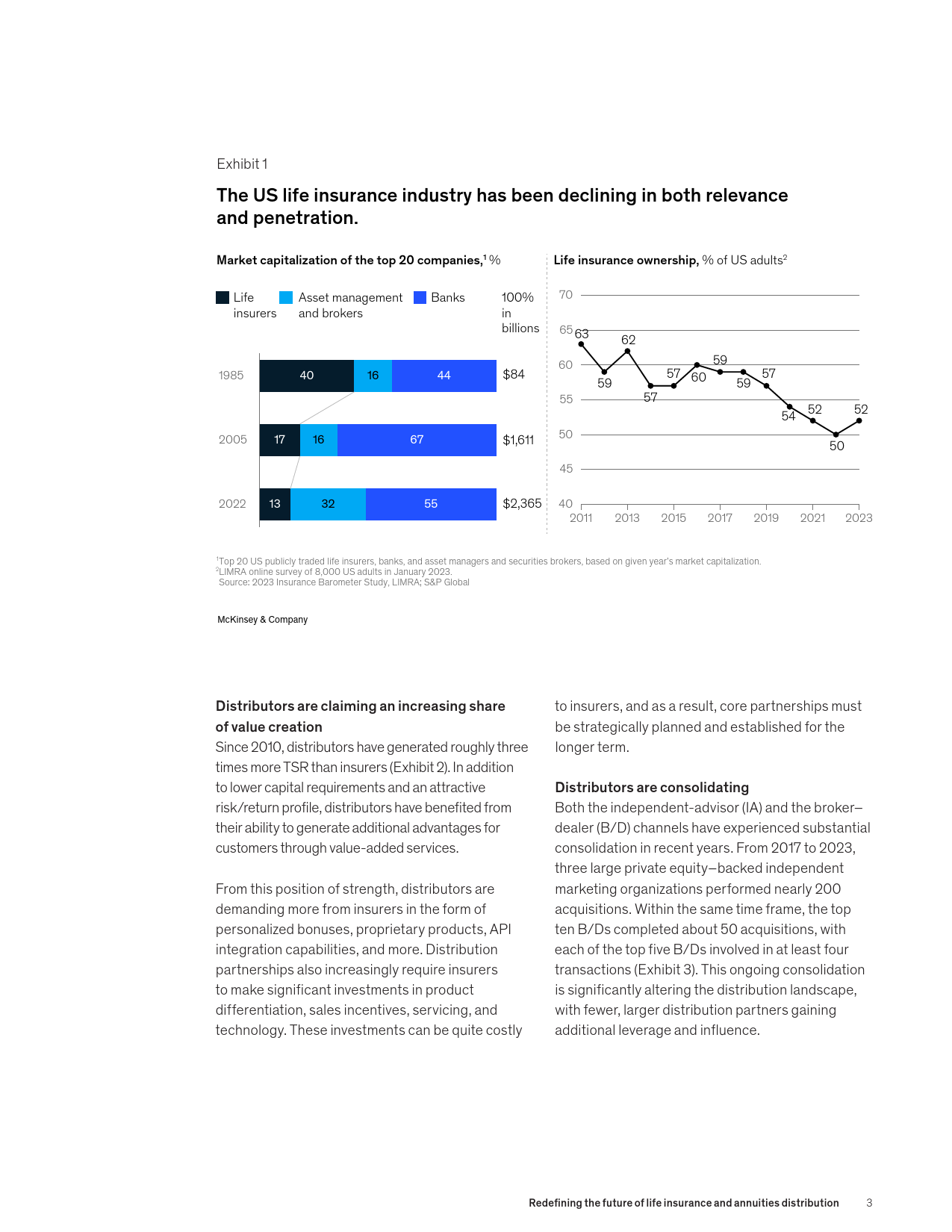

FinancialServicesPracticeRedefiningthefutureoflifeinsuranceandannuitiesdistributionFundamentalshiftsintheinsuranceindustryareacceleratingchangesinthedistributionlandscape.Howcaninsurerspositionthemselvesforthenextwaveofgrowth?ThisarticleisacollaborativeeffortbyRamnathBalasubramanian,CristianBoldan,MattLeo,DavidSchiff,andYvesVontobel,representingviewsfromMcKinsey’sInsurancePractice.January2024Sincetheglobalfinancialcrisisof2008,Northoperatingmodeltoalignwithstrategicgoals,andAmericanlifeandannuitiesinsurershavefacedemployingdigitalandAIasameanstodifferentiatenumerousdisruptionsasanindustry,includingthemselvesinthemarketplace.profitabilitychallengesdrivenbylowinterestrates,aglobalpandemic,highinflationfollowedbyarapidTrendsshapingUSlifeinsuranceriseininterestrates,volatilityinequitymarkets,anddistributiongeopoliticaluncertainty.Lifeinsurance,thetraditionalwaythatindividualsWhileinsurersfocusedonmanagingthesehaveprotectedtheirlivelihoods,hasbecomelessdisruptions,severalstructuralchangesconverged,relevanttothefinancialfuturesofUSfamilies.Lifecreatinganeedforinsurerstoreconsidertheirinsurershavecontinuedtolosegroundtobanks,distributionstrategies.Althoughrisinginterestratesassetmanagers,andbrokeragefirms,drivenbyhaveprovidedsomesalestailwindsinrecentyearsincreasedcompetitionfromeasilyaccessible(particularlyforfixe...

发表评论取消回复