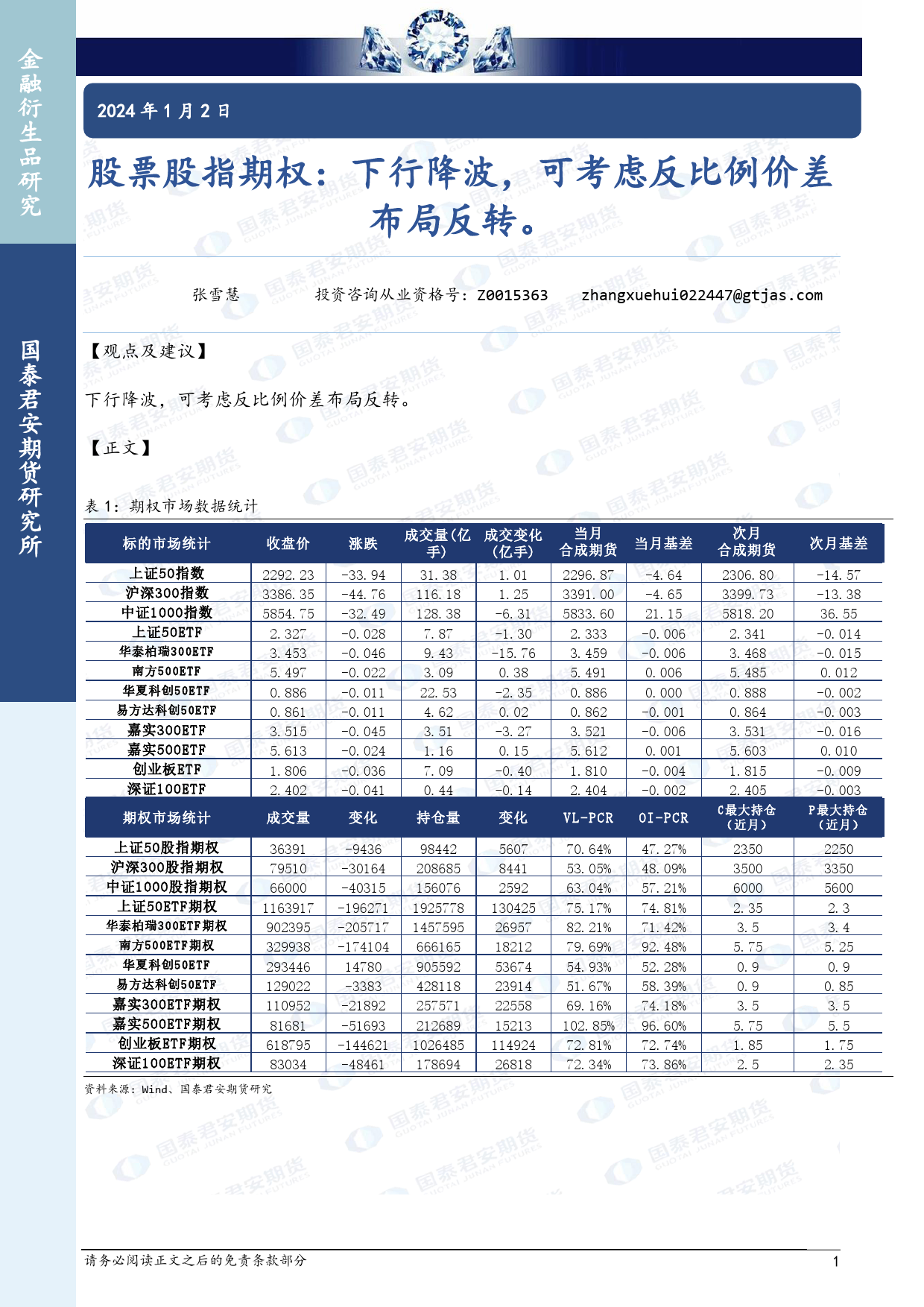

金金融衍生品研究融衍生2024年1月2日品股票股指期权:下行降波,可考虑反比例价差研究布局反转。张雪慧投资咨询从业资格号:Z0015363zhangxuehui022447@gtjas.com国【观点及建议】泰君下行降波,可考虑反比例价差布局反转。安期【正文】货研表1:期权市场数据统计究所成交手量)(亿成(亿交手变)化合当成月期货当月基差次月标的市场统计收盘价涨跌合成期货次月基差上证50指数2292.23-33.9431.381.012296.87-4.642306.80-14.57沪深300指数3386.35-44.76116.181.253391.00-4.653399.73-13.38中证1000指数5854.75-32.49128.38-6.315833.6021.155818.2036.55上证50ETF-0.028-1.30-0.006-0.0142.327-0.0467.87-15.762.333-0.0062.341-0.015华泰柏瑞300ETF3.453-0.0229.430.383.4590.0063.4680.012南方500ETF5.497-0.0113.09-2.355.4910.0005.485-0.0020.886-0.01122.530.020.886-0.0010.888-0.003华夏科创50ETF0.861-0.0454.62-3.270.862-0.0060.864-0.016易方达科创50ETF3.515-0.0243.510.153.5210.0013.5310.0105.613-0.0361.16-0.405.612-0.0045.603-0.009嘉实300ETF1.806-0.0417.09-0.141.810-0.0021.815-0.003嘉实500ETF2.4020.442.4042.405创业板ETF深证100ETF期权市场统计成交量变化持仓量变化VL-PCROI-PCRC最大持仓P最大持仓(近月)(近月)上证50股指期权36391-943698442560770.64%47.27%23502250沪深300股指期权79510-30164208685844153.05%48.09%35003350中证1000股指期权66000-40315156076259263.04%57.21%60005600上证50ETF期权1163917-196271192577813042575.17%74.81%2.352.3902395-20571714575952695782.21%71.42%3.53.4...

发表评论取消回复