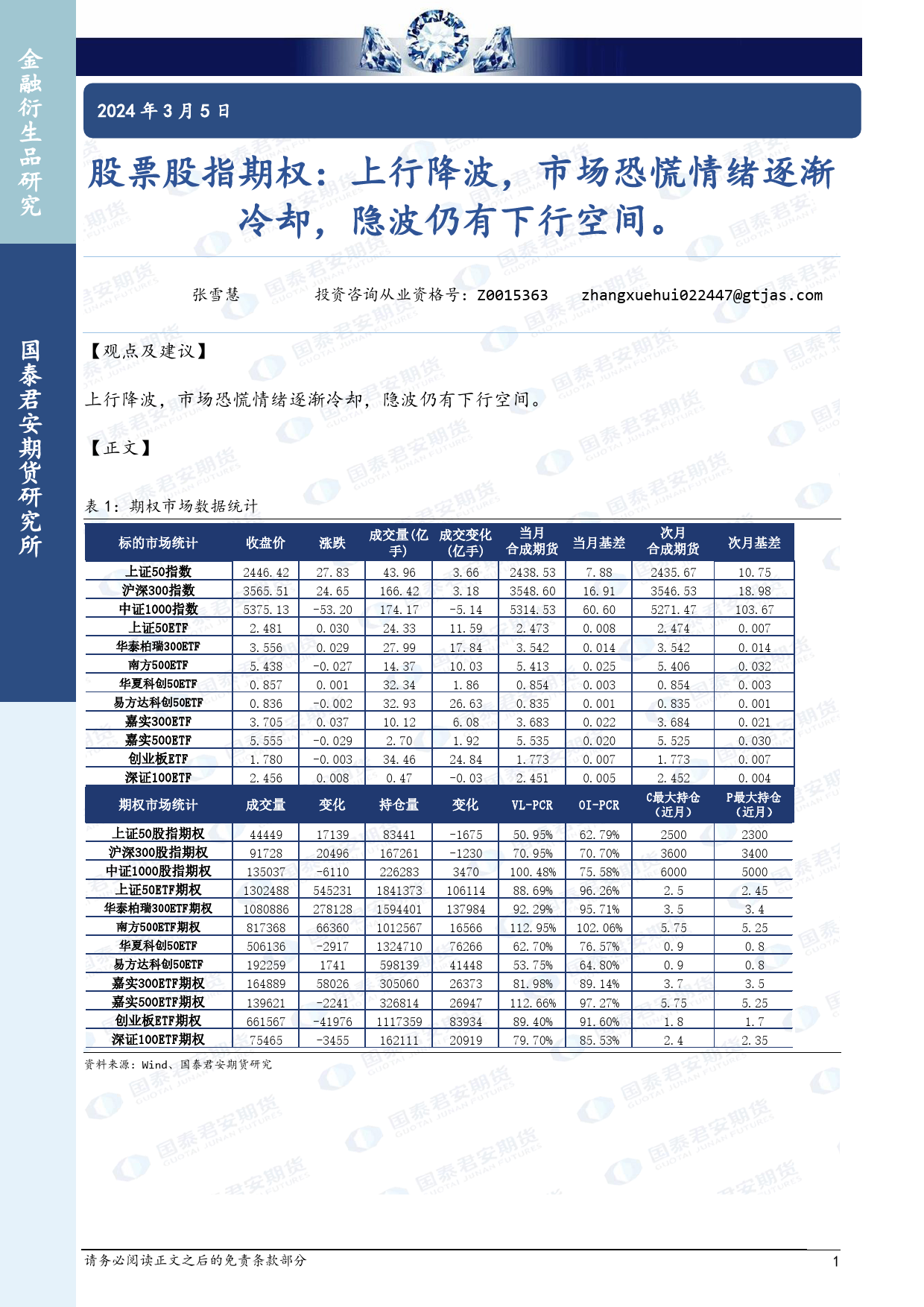

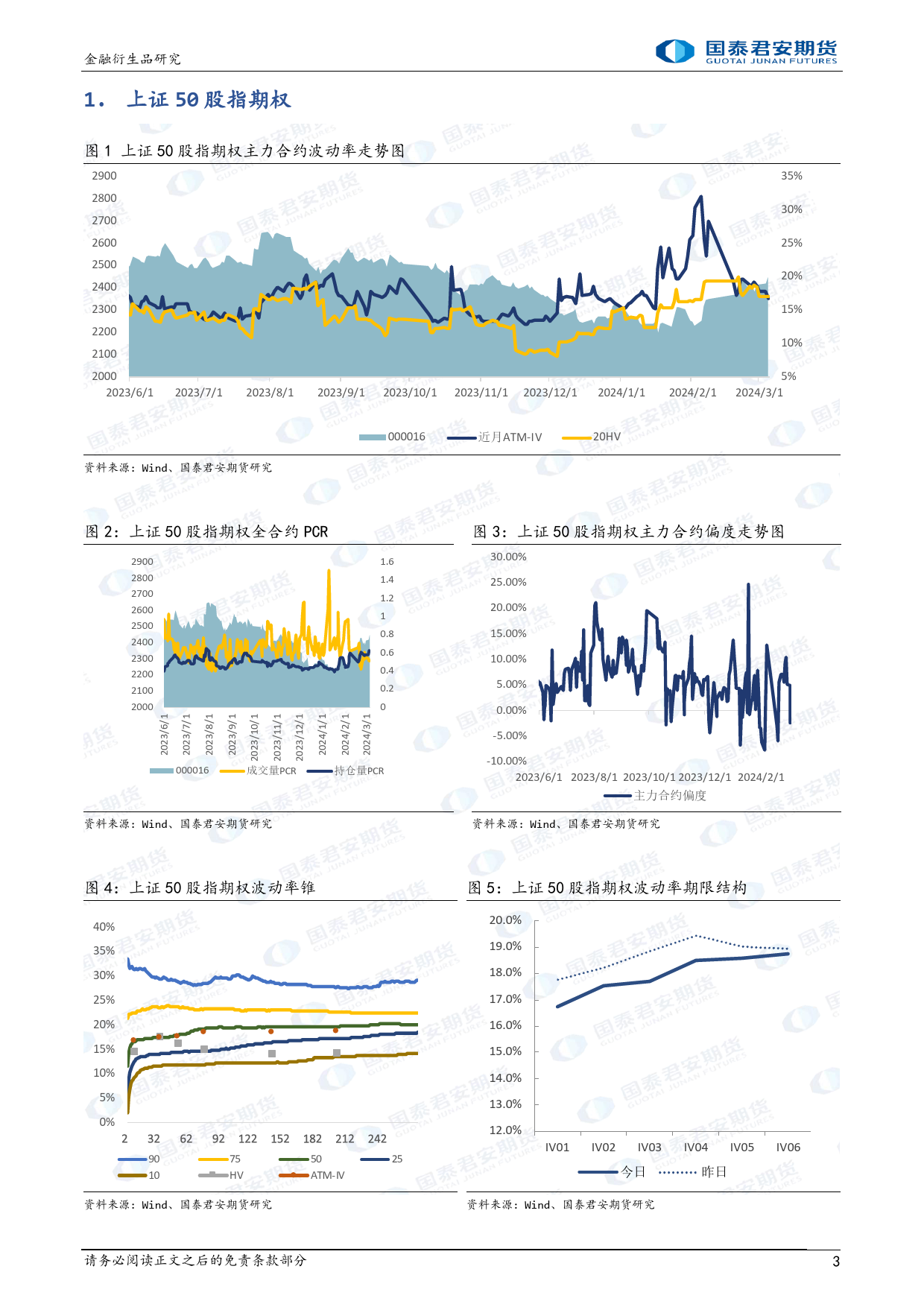

金金融衍生品研究融衍生2024年3月5日品股票股指期权:上行降波,市场恐慌情绪逐渐研究冷却,隐波仍有下行空间。张雪慧投资咨询从业资格号:Z0015363zhangxuehui022447@gtjas.com国【观点及建议】泰君上行降波,市场恐慌情绪逐渐冷却,隐波仍有下行空间。安期【正文】货研表1:期权市场数据统计究所标的市场统计收盘价涨跌成交手量)(亿成(交亿手变)化合当成月期货当月基差次月次月基差合成期货上证50指数2446.4227.8343.963.662438.537.882435.6710.75沪深300指数3565.5124.65166.423.183548.6016.913546.5318.98中证1000指数5375.13-53.20174.17-5.145314.5360.605271.47103.670.03024.3311.590.0080.007上证50ETF2.4810.02927.9917.842.4730.0142.4740.014华泰柏瑞300ETF3.556-0.02714.3710.033.5420.0253.5420.0325.4380.00132.341.865.4130.0035.4060.003南方500ETF0.857-0.00232.9326.630.8540.0010.8540.001华夏科创50ETF0.8360.03710.126.080.8350.0220.8350.021易方达科创50ETF3.705-0.0291.923.6830.0203.6840.030嘉实300ETF5.555-0.0032.7024.845.5350.0075.5250.007嘉实500ETF1.7800.00834.46-0.031.7730.0051.7730.0042.4560.472.4512.452创业板ETF深证100ETF期权市场统计成交量变化持仓量变化VL-PCROI-PCRC最大持仓P最大持仓(近月)(近月)上证50股指期权444491713983441-167550.95%62.79%25002300沪深300股指期权9172820496167261-123070.95%70.70%36003400中证1000股指期权135037-61102262833470100.48%75.58%600050001302488545231184137310611488.69%96.26%2.52.45上证50ETF期权1080886278128159440113798492.29...

发表评论取消回复