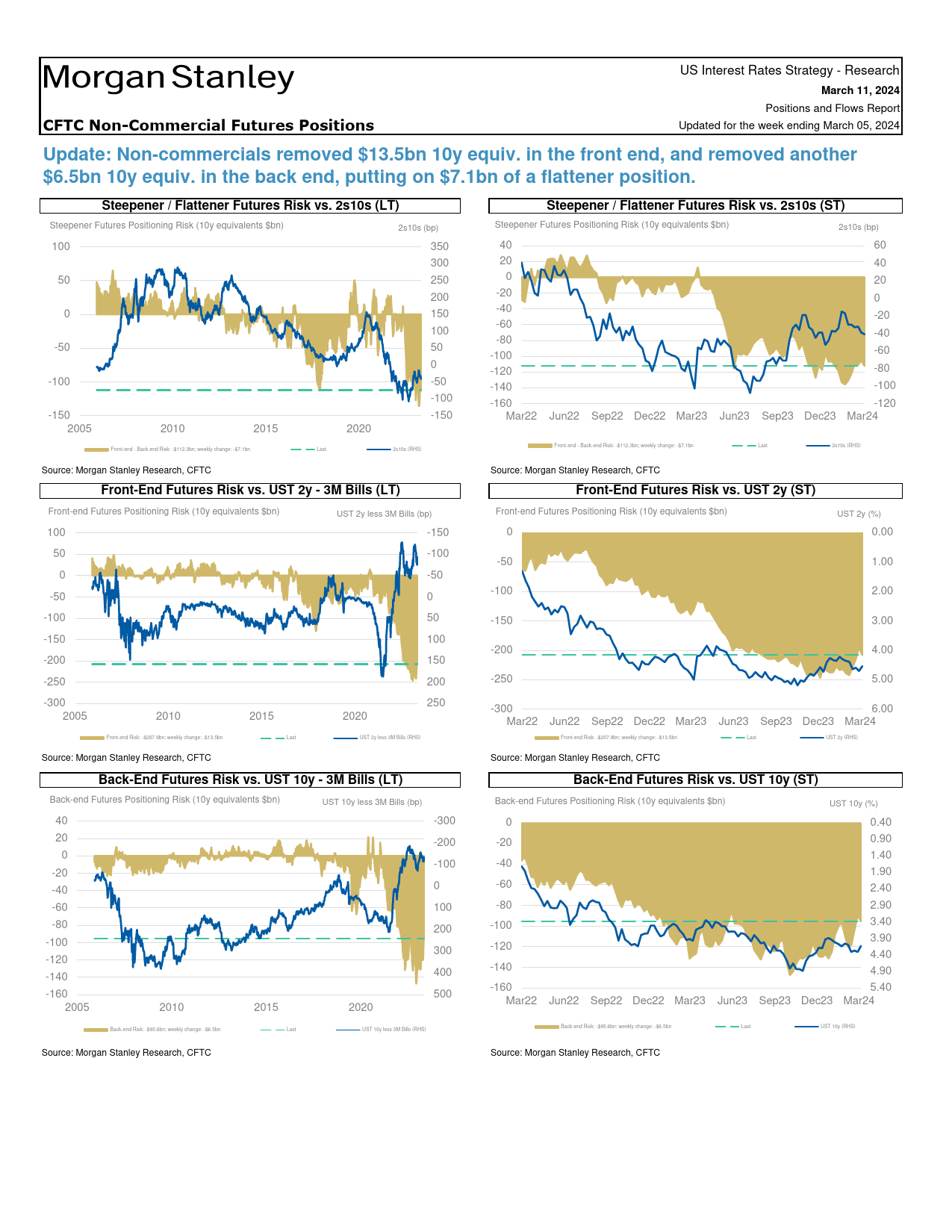

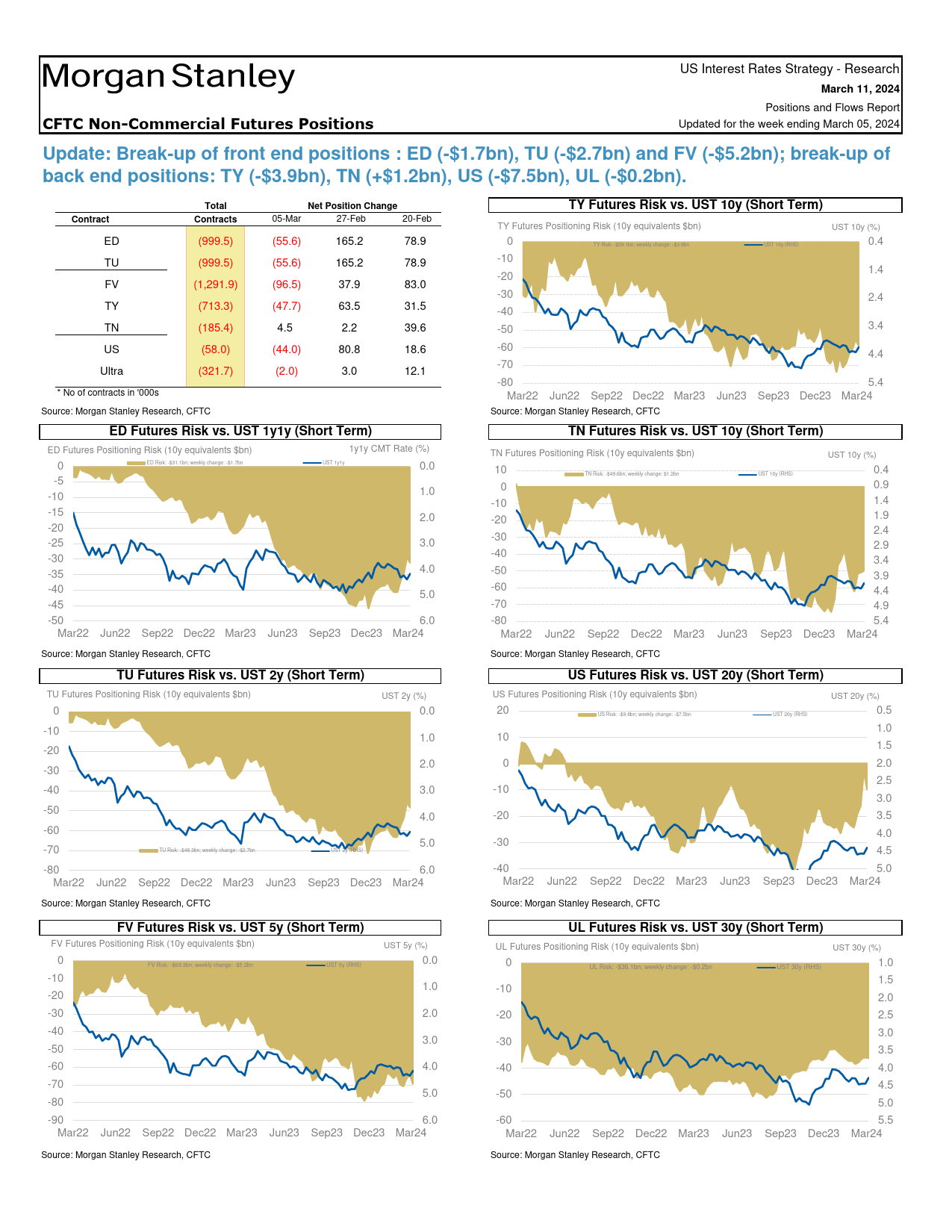

MORGANSTANLEYRESEARCHMarch11,202410:59AMGMTMorganStanley&Co.LLCFrancescoGrechiStrategistFrancesco.Grechi@morganstanley.com+1212761-1005NorthMarch11,2024AmericaaInterestRateStrategyAmericaPositionsandFlowsReportNorthWeeklyMarketPositioningDataCFTCNon-CommercialFuturesPositions(P.2)TICDataForeignFlows(P.16)(UpdatedfortheweekendingMarch05,2024,paramounts)(UpdatedforDecember,paramounts)WeeklyChange:DecembersawnetinflowsintheEquities,ledbyprivateTotalfrontend:-$13.5bninvestors.Japan(+$16.6bn)andFrance(+$5.8bn)werethetopED:-$1.7bnTU:-$2.7bnFV:-$5.2bnTreasurybuyersinDecember.HongKong(-$-15.9bn)andCanada(-Totalbackend:-$6.5bn$10.8bn)werethetopTreasurysellers.TY:-$3.9bnTN:$1.2bnUS:-$7.5bnUL:-$0.2bnPFRPrimer(P.18)TradersinFinancialFutures(P.4)(UpdatedfortheweekendingMarch05,2024,paramounts)ChartoftheWeek:AssetManagers:AssetManagersincreasedtheirnetshorts(%ofOI)tothehighestlevelUpdate:Puton-$13.1bnofaflattenerposition.IncreasedtheirinlastsixmonthsinSOFRcontracts.netshorts(%ofOI)tothehighestlevelinlastsixmonthsinSOFRcontracts.Source:MorganStanleyResearch,CFTCLeveragedFunds:Update:Puton-$16.2bnofaflattenerposition.Increasedtheirnetshorts(%ofOI)tothelowestlevelinsixmonthsinULcontracts.Dealers:Update:Puton-$6.8bnofaflattenerposition.Increasedtheirnetlongs(%ofOI)tothehighestlevelinlastsixmonthsinSOFRcontracts.OtherReportable...

发表评论取消回复