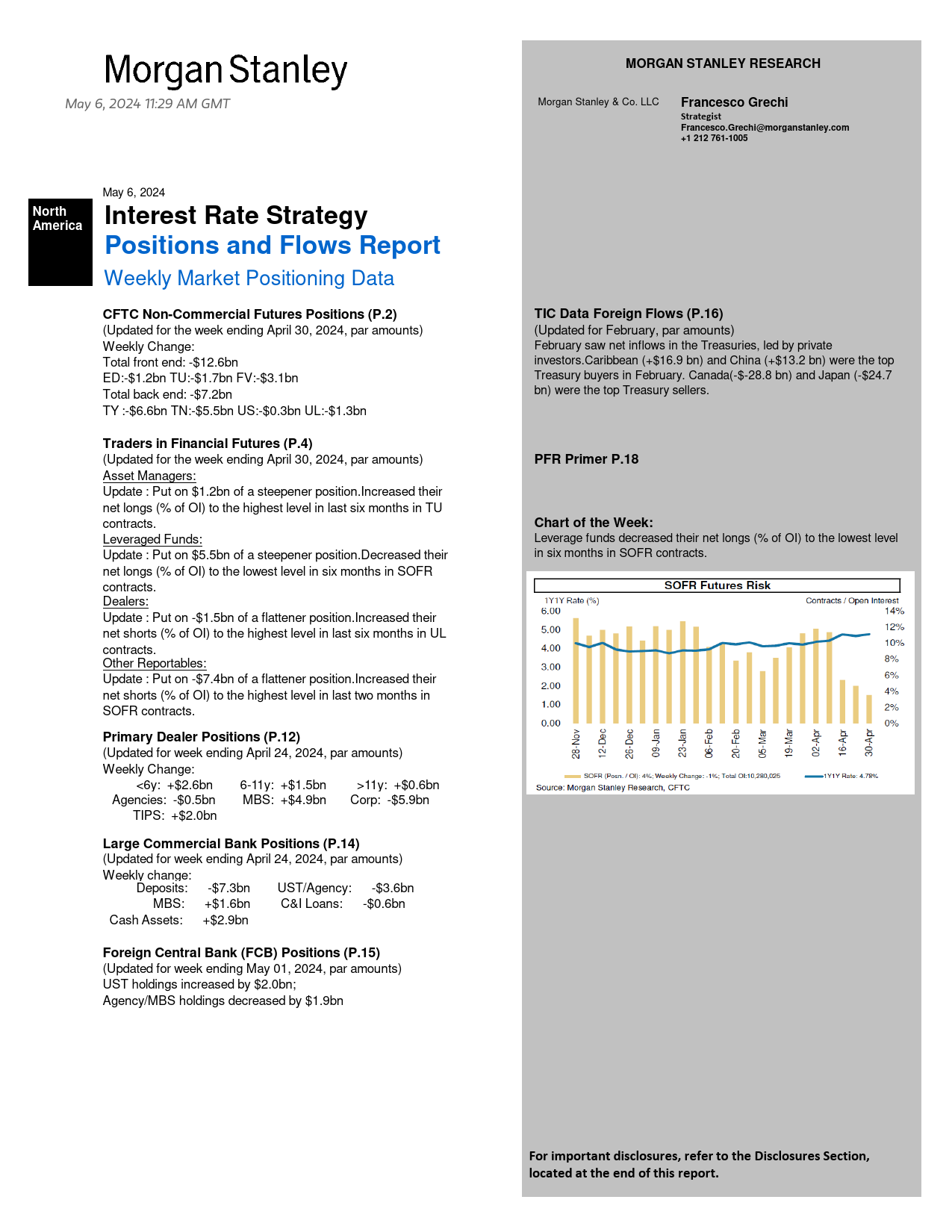

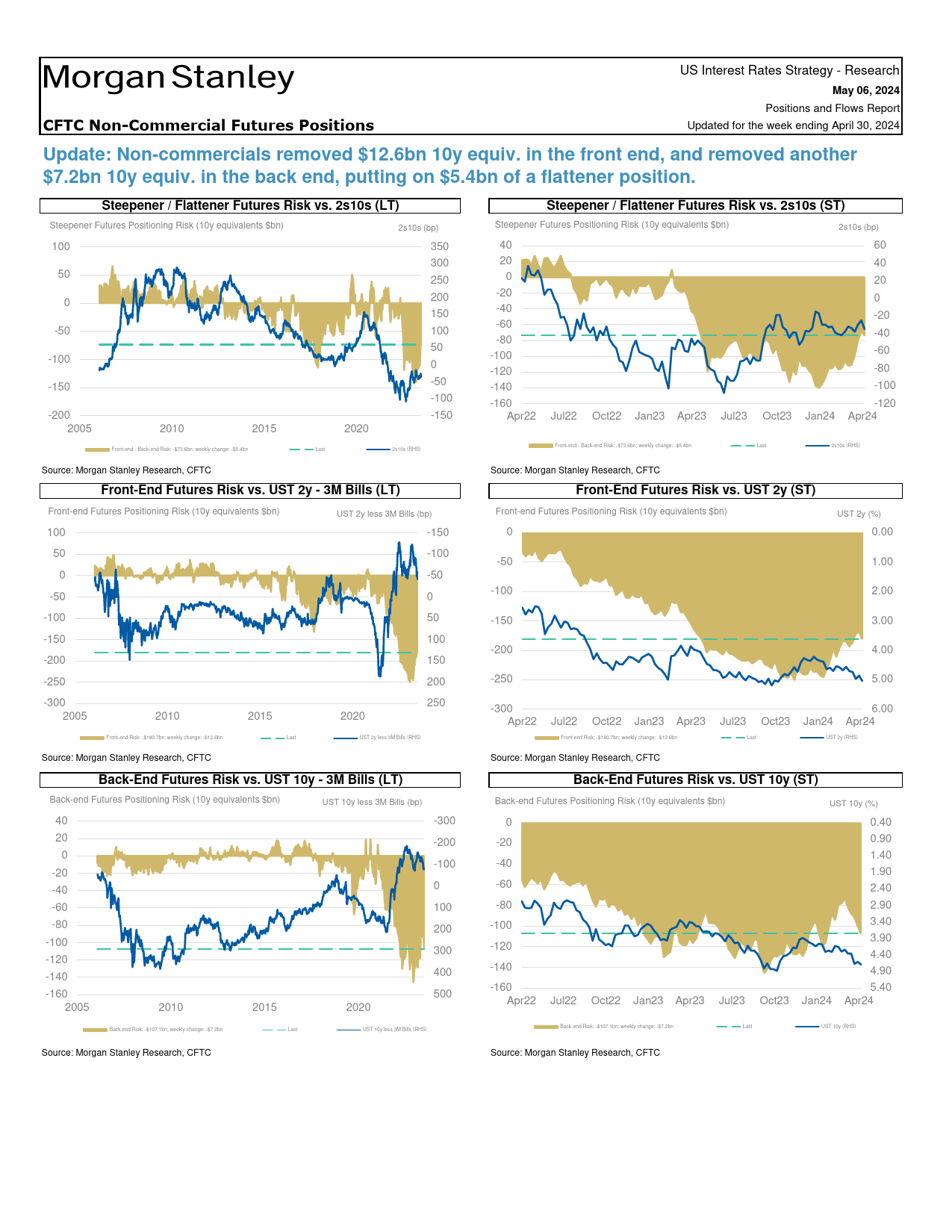

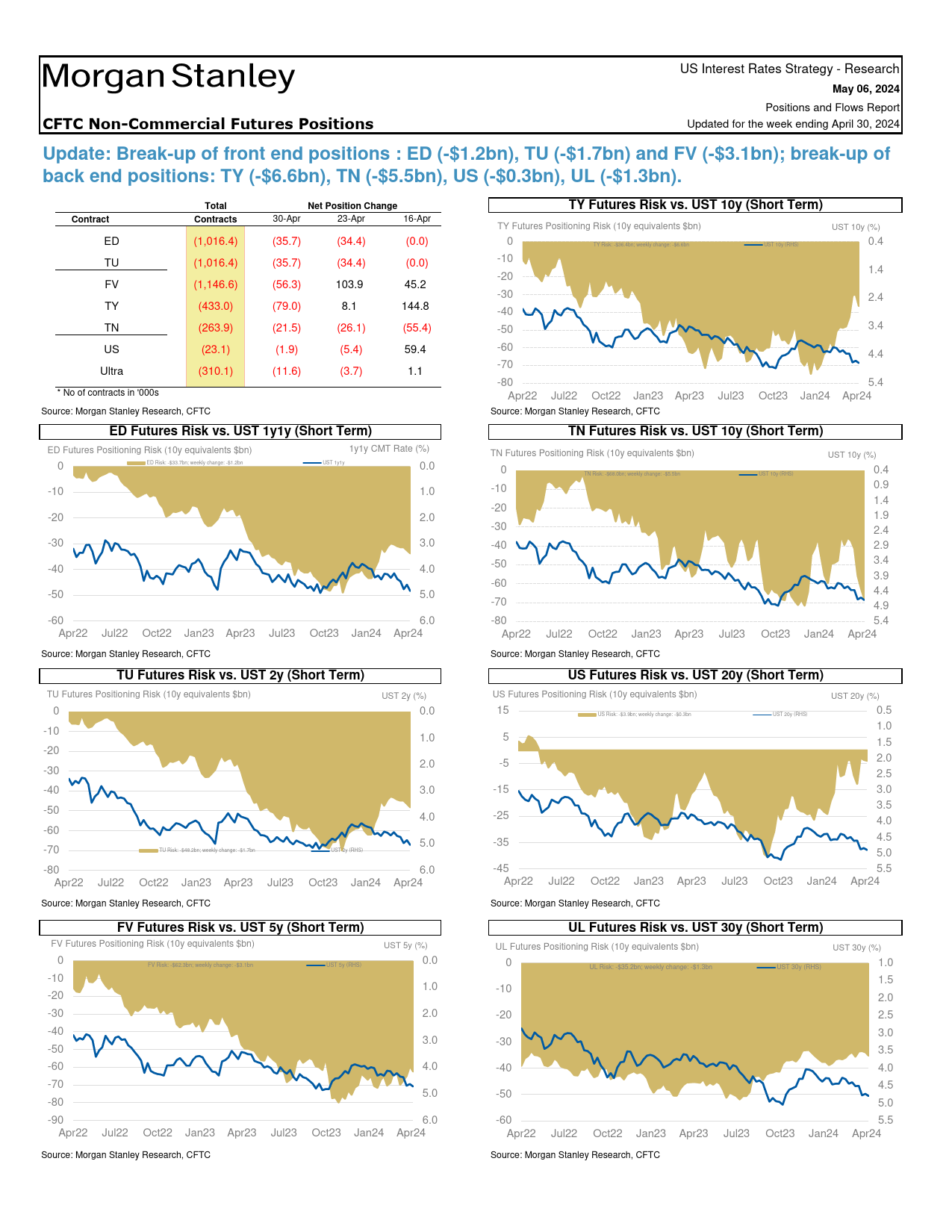

MORGANSTANLEYRESEARCHMay6,202411:29AMGMTMorganStanley&Co.LLCFrancescoGrechiStrategistFrancesco.Grechi@morganstanley.com+1212761-1005NorthMay6,2024AmericaaInterestRateStrategyAmericaPositionsandFlowsReportNorthWeeklyMarketPositioningDataCFTCNon-CommercialFuturesPositions(P.2)TICDataForeignFlows(P.16)(UpdatedfortheweekendingApril30,2024,paramounts)(UpdatedforFebruary,paramounts)WeeklyChange:FebruarysawnetinflowsintheTreasuries,ledbyprivateTotalfrontend:-$12.6bninvestors.Caribbean(+$16.9bn)andChina(+$13.2bn)werethetopED:-$1.2bnTU:-$1.7bnFV:-$3.1bnTreasurybuyersinFebruary.Canada(-$-28.8bn)andJapan(-$24.7Totalbackend:-$7.2bnbn)werethetopTreasurysellers.TY:-$6.6bnTN:-$5.5bnUS:-$0.3bnUL:-$1.3bnPFRPrimerP.18TradersinFinancialFutures(P.4)(UpdatedfortheweekendingApril30,2024,paramounts)ChartoftheWeek:AssetManagers:Leveragefundsdecreasedtheirnetlongs(%ofOI)tothelowestlevelUpdate:Puton$1.2bnofasteepenerposition.IncreasedtheirinsixmonthsinSOFRcontracts.netlongs(%ofOI)tothehighestlevelinlastsixmonthsinTUcontracts.Source:MorganStanleyResearch,CFTCLeveragedFunds:Update:Puton$5.5bnofasteepenerposition.Decreasedtheirnetlongs(%ofOI)tothelowestlevelinsixmonthsinSOFRcontracts.Dealers:Update:Puton-$1.5bnofaflattenerposition.Increasedtheirnetshorts(%ofOI)tothehighestlevelinlastsixmonthsinULcontracts.OtherReportables:Update:Puton-$7...

发表评论取消回复