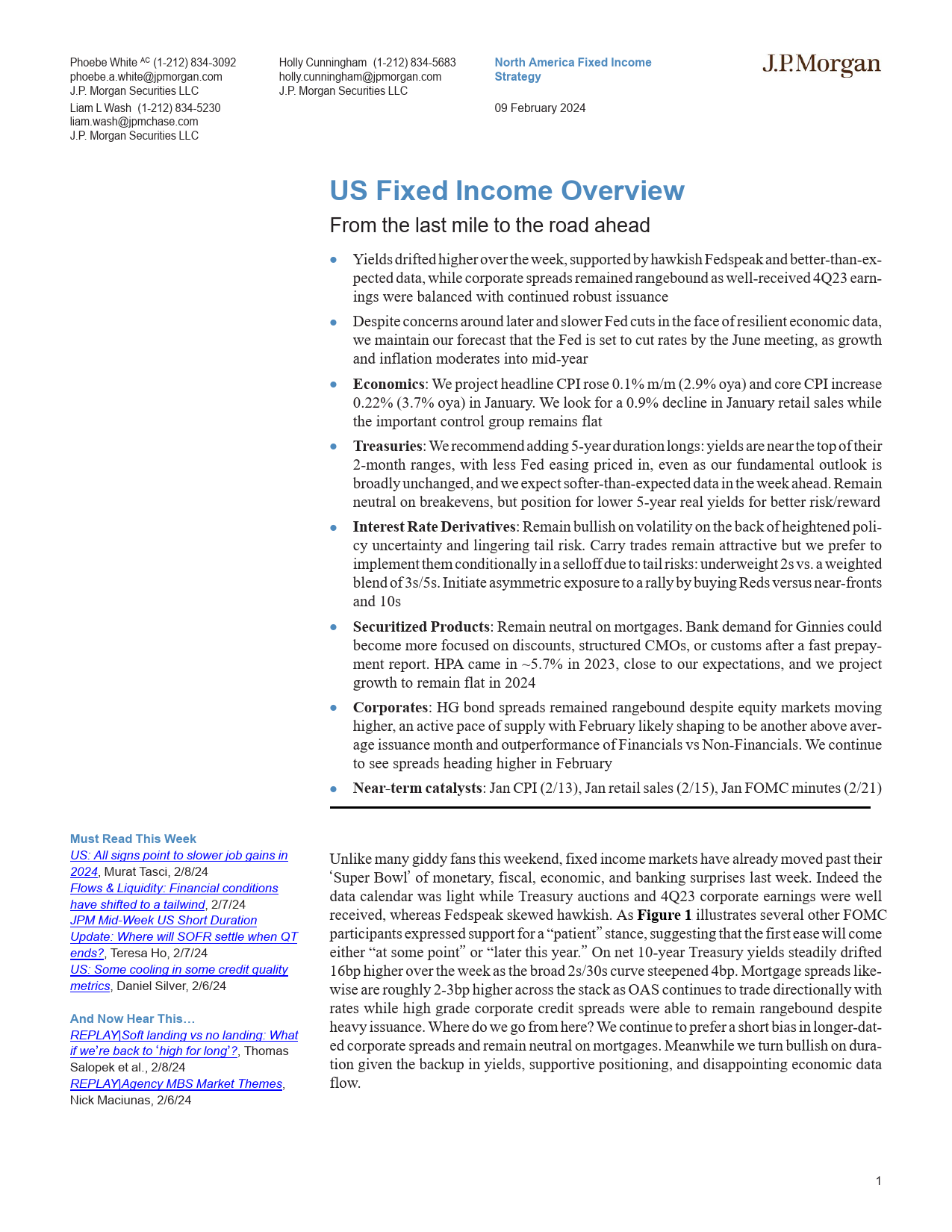

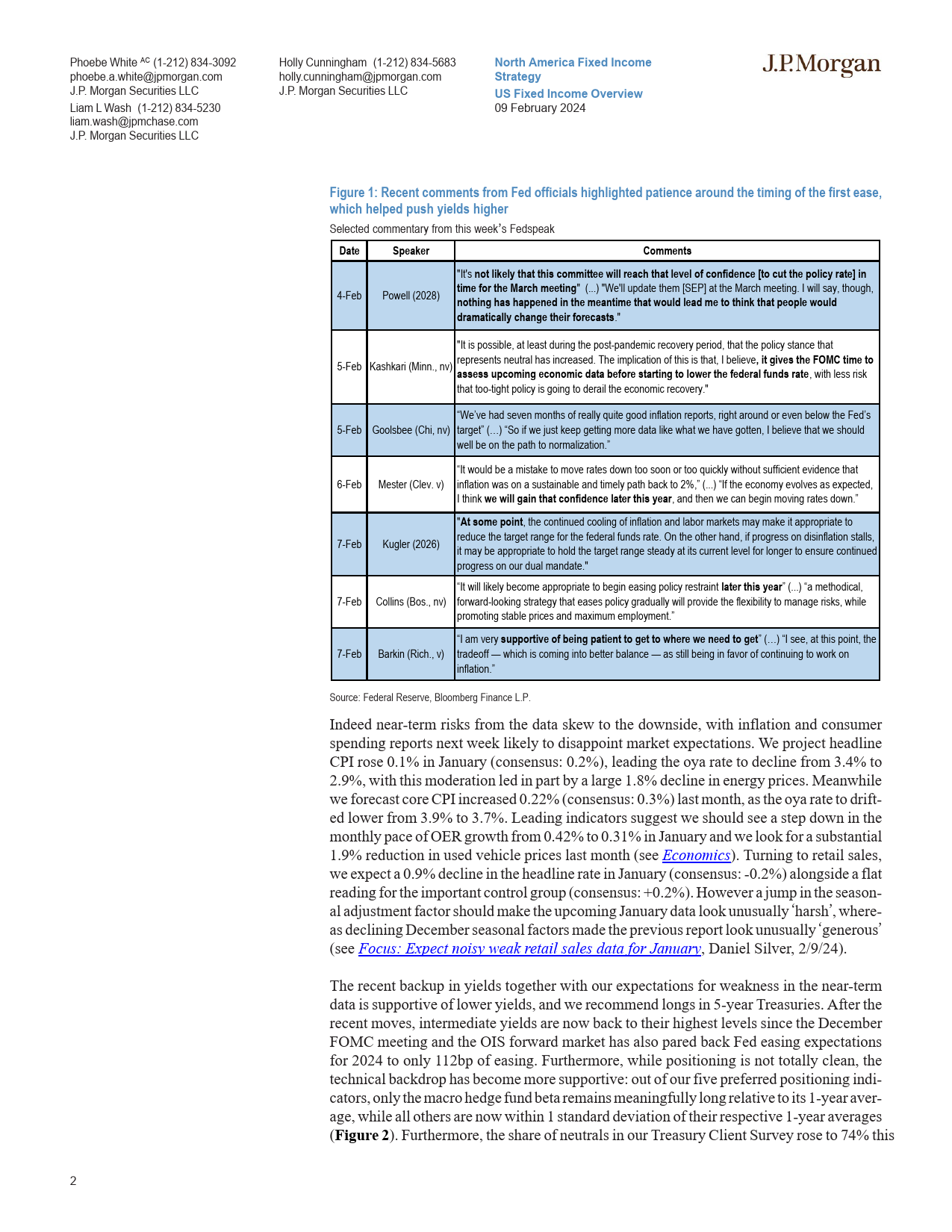

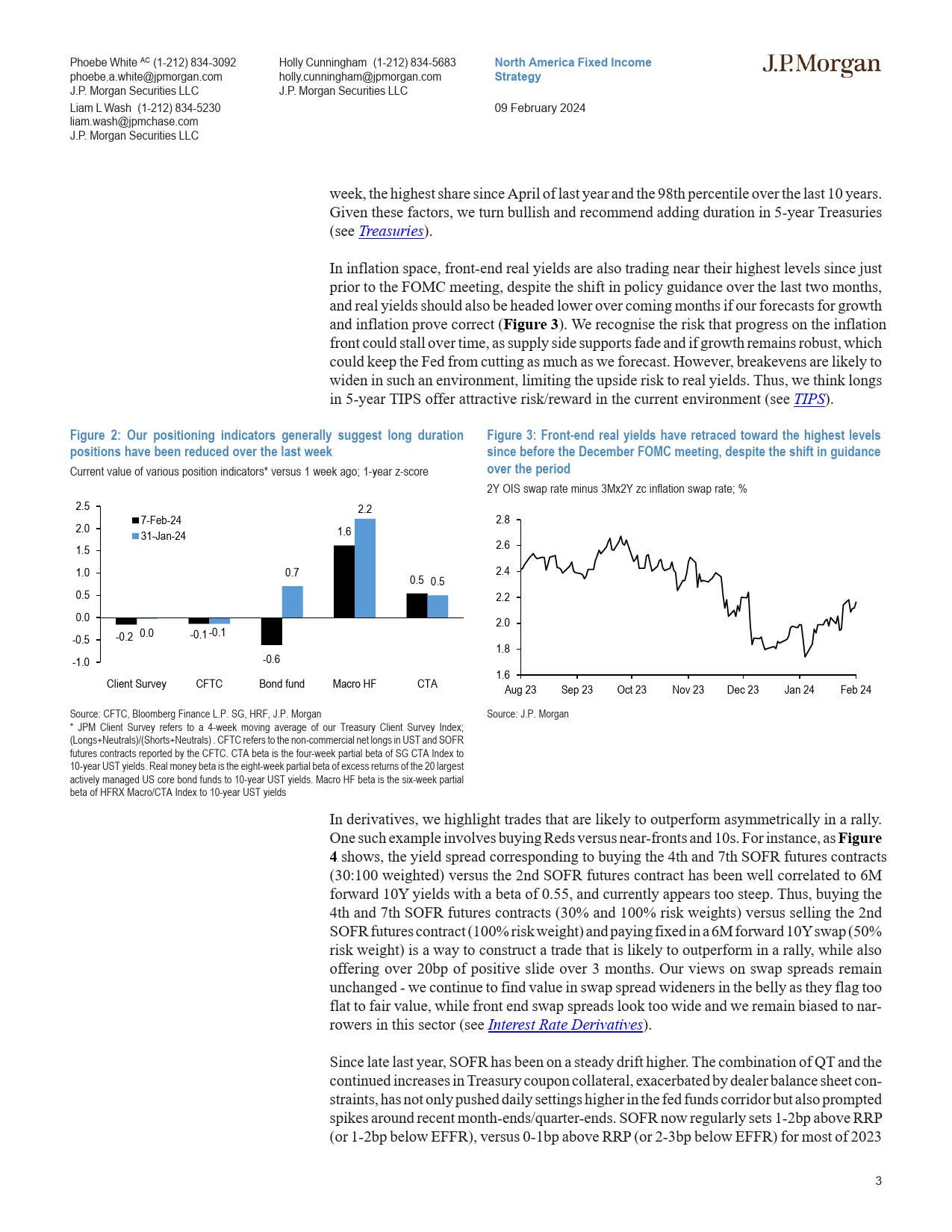

PhoebeWhiteAC(1-212)834-3092HollyCunningham(1-212)834-5683NorthAmericaFixedIncomeJPMORGANphoebe.a.white@jpmorgan.comholly.cunningham@jpmorgan.comStrategyJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesLLC09February2024LiamLWash(1-212)834-5230liam.wash@jpmchase.comJ.P.MorganSecuritiesLLCUSFixedIncomeOverviewFromthelastmiletotheroadahead•Yieldsdriftedhigherovertheweek,supportedbyhawkishFedspeakandbetter-than-ex-pecteddata,whilecorporatespreadsremainedrangeboundaswell-received4Q23earn-ingswerebalancedwithcontinuedrobustissuance•DespiteconcernsaroundlaterandslowerFedcutsinthefaceofresilienteconomicdata,wemaintainourforecastthattheFedissettocutratesbytheJunemeeting,asgrowthandinflationmoderatesintomid-year•Economics:WeprojectheadlineCPIrose0.1%m/m(2.9%oya)andcoreCPIincrease0.22%(3.7%oya)inJanuary.Welookfora0.9%declineinJanuaryretailsaleswhiletheimportantcontrolgroupremainsflat•Treasuries:Werecommendadding5-yeardurationlongs:yieldsarenearthetopoftheir2-monthranges,withlessFedeasingpricedin,evenasourfundamentaloutlookisbroadlyunchanged,andweexpectsofter-than-expecteddataintheweekahead.Remainneutralonbreakevens,butpositionforlower5-yearrealyieldsforbetterrisk/reward•InterestRateDerivatives:Remainbullishonvolatilityonthebackofheightenedpoli-cyuncertaintyandlingeringtailrisk.Carrytradesremainattractivebutweprefertoimpl...

发表评论取消回复