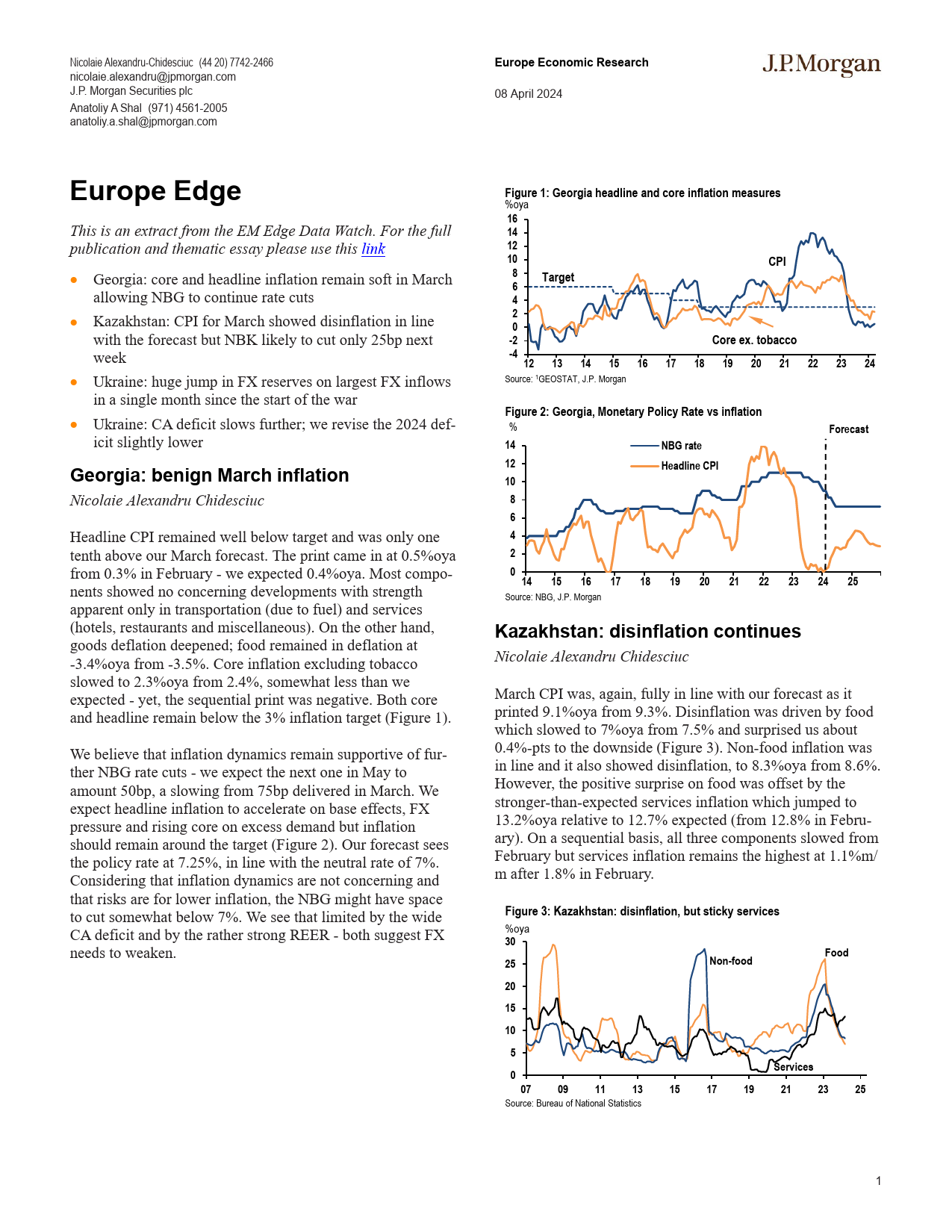

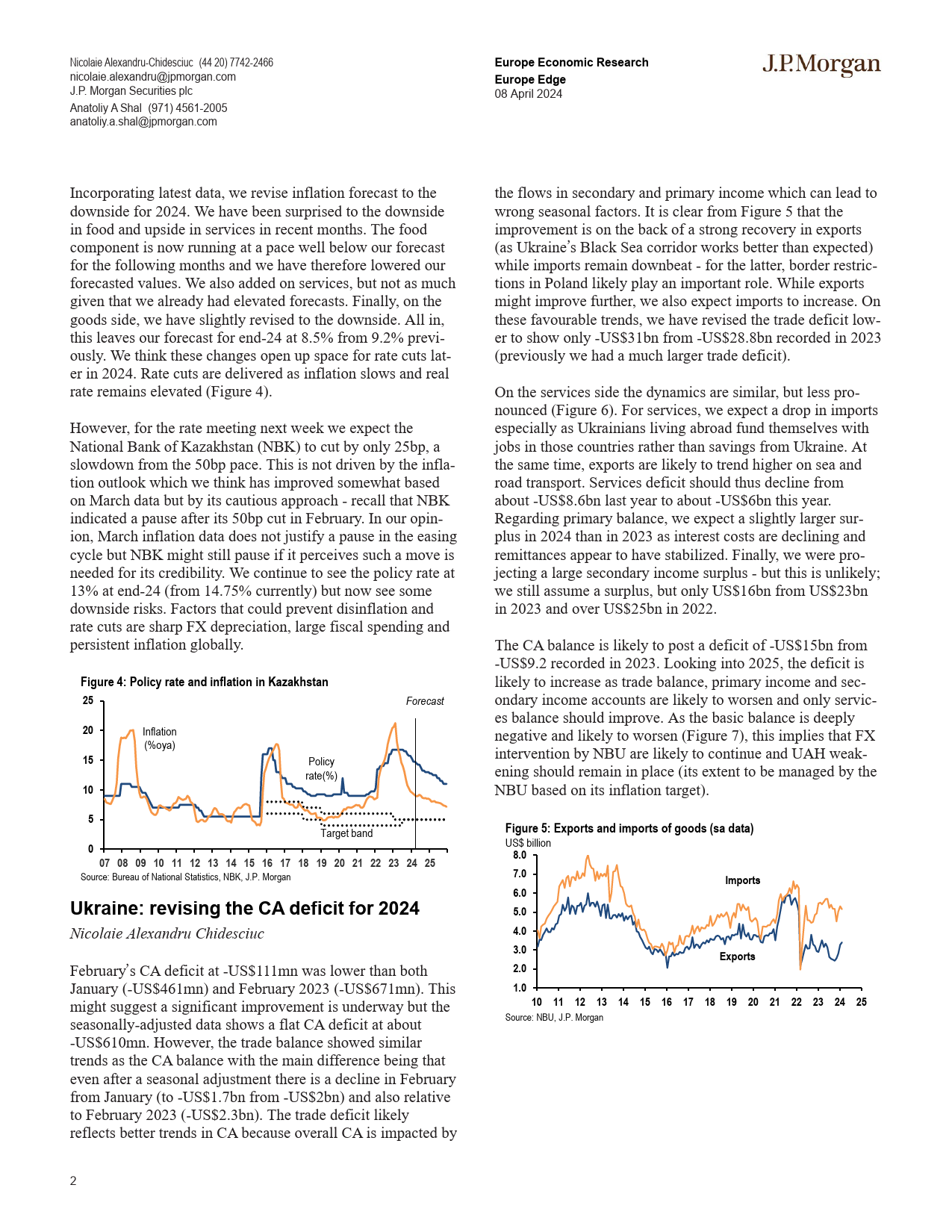

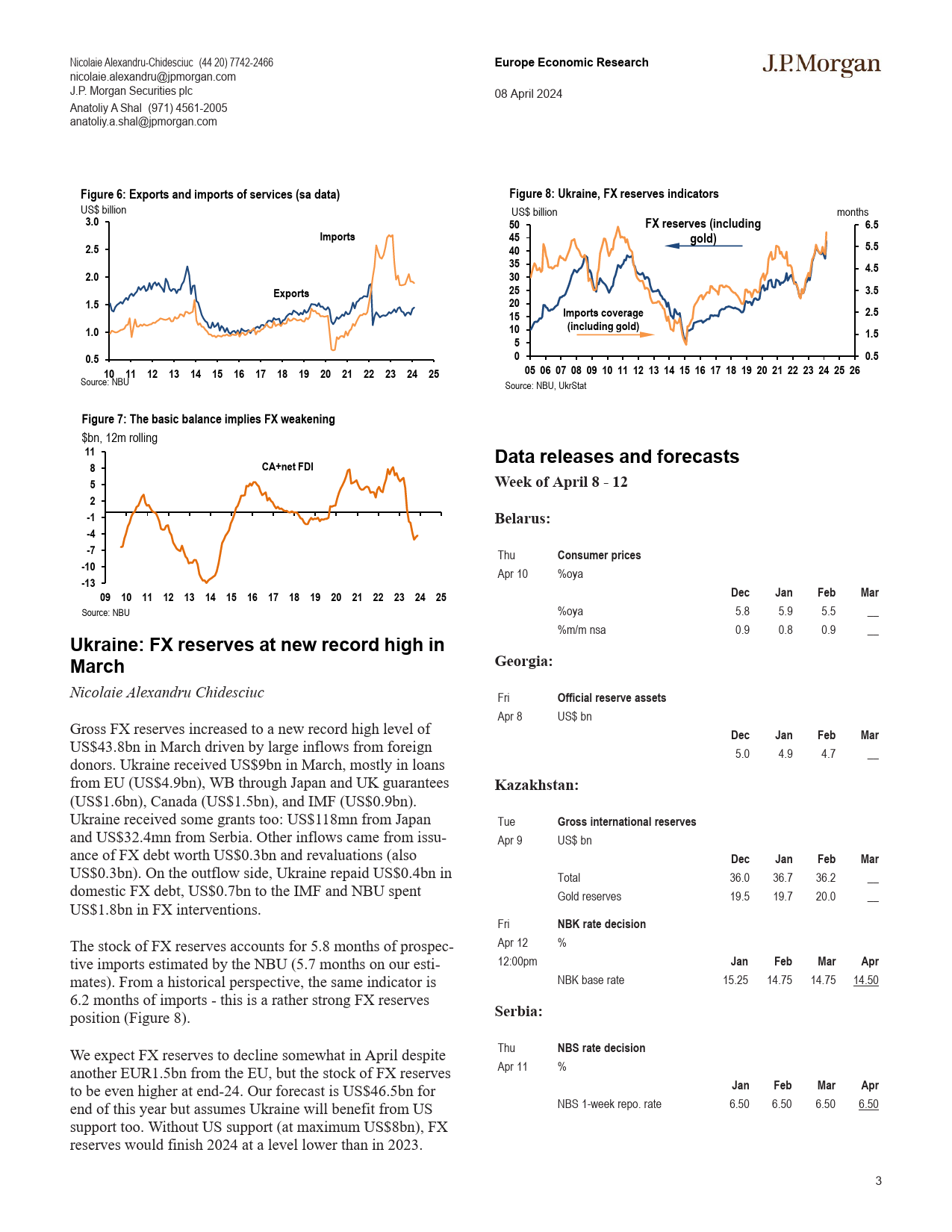

NicolaieAlexandru-Chidesciuc(4420)7742-2466EuropeEconomicResearchJPMORGANnicolaie.alexandru@jpmorgan.com08April2024J.P.MorganSecuritiesplcAnatoliyAShal(971)4561-2005anatoliy.a.shal@jpmorgan.comEuropeEdgeFigure1:Georgiaheadlineandcoreinflationmeasures%oyaThisisanextractfromtheEMEdgeDataWatch.Forthefullpublicationandthematicessaypleaseusethislink16•Georgia:coreandheadlineinflationremainsoftinMarch14allowingNBGtocontinueratecuts12•Kazakhstan:CPIforMarchshoweddisinflationinline10CPIwiththeforecastbutNBKlikelytocutonly25bpnext8Targetweek6•Ukraine:hugejumpinFXreservesonlargestFXinflows4inasinglemonthsincethestartofthewar2•Ukraine:CAdeficitslowsfurther;werevisethe2024def-0icitslightlylower-2Coreex.tobaccoGeorgia:benignMarchinflation-412131415161718192021222324NicolaieAlexandruChidesciucSource:1GEOSTAT,J.P.MorganHeadlineCPIremainedwellbelowtargetandwasonlyonetenthaboveourMarchforecast.Theprintcameinat0.5%oyaFigure2:Georgia,MonetaryPolicyRatevsinflationForecastfrom0.3%inFebruary-weexpected0.4%oya.Mostcompo-%nentsshowednoconcerningdevelopmentswithstrengthapparentonlyintransportation(duetofuel)andservices14NBGrate(hotels,restaurantsandmiscellaneous).Ontheotherhand,goodsdeflationdeepened;foodremainedindeflationat12HeadlineCPI-3.4%oyafrom-3.5%.Coreinflationexcludingtobaccoslowedto2.3%oyafrom2.4%,somewhatlessthanwe10ex...

发表评论取消回复