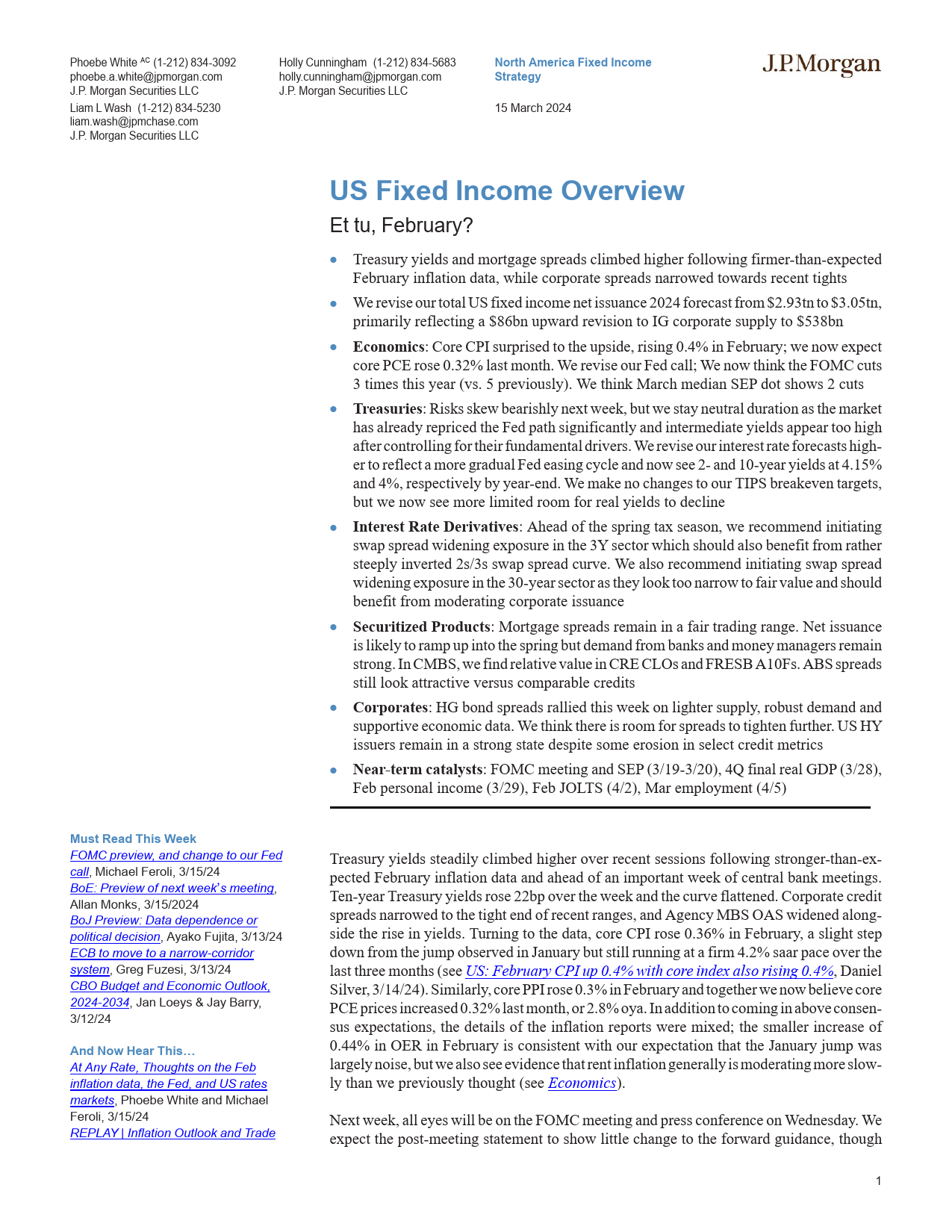

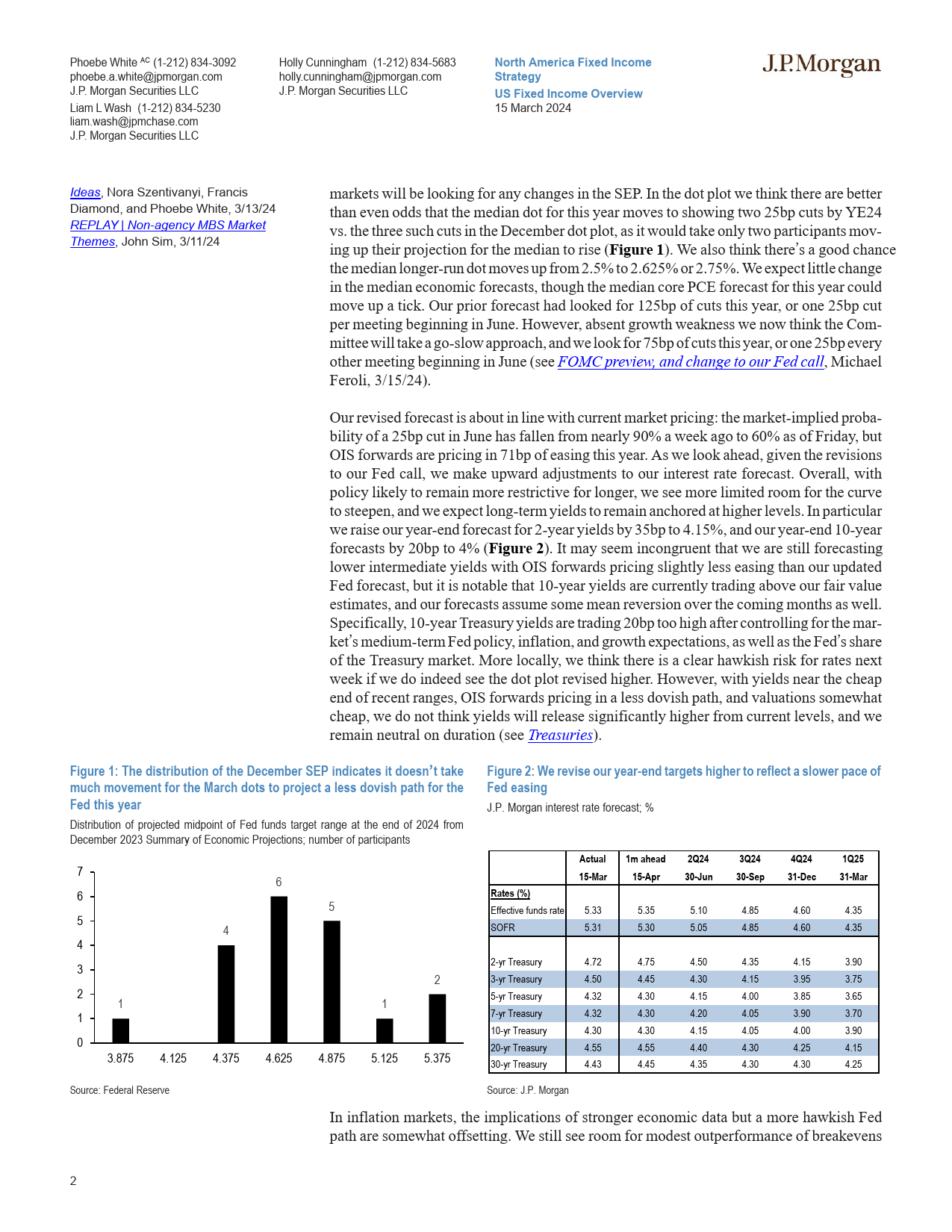

PhoebeWhiteAC(1-212)834-3092HollyCunningham(1-212)834-5683NorthAmericaFixedIncomeJPMORGANphoebe.a.white@jpmorgan.comholly.cunningham@jpmorgan.comStrategyJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesLLC15March2024LiamLWash(1-212)834-5230liam.wash@jpmchase.comJ.P.MorganSecuritiesLLCUSFixedIncomeOverviewEttu,February?•Treasuryyieldsandmortgagespreadsclimbedhigherfollowingfirmer-than-expectedFebruaryinflationdata,whilecorporatespreadsnarrowedtowardsrecenttights•WereviseourtotalUSfixedincomenetissuance2024forecastfrom$2.93tnto$3.05tn,primarilyreflectinga$86bnupwardrevisiontoIGcorporatesupplyto$538bn•Economics:CoreCPIsurprisedtotheupside,rising0.4%inFebruary;wenowexpectcorePCErose0.32%lastmonth.WereviseourFedcall;WenowthinktheFOMCcuts3timesthisyear(vs.5previously).WethinkMarchmedianSEPdotshows2cuts•Treasuries:Risksskewbearishlynextweek,butwestayneutraldurationasthemarkethasalreadyrepricedtheFedpathsignificantlyandintermediateyieldsappeartoohighaftercontrollingfortheirfundamentaldrivers.Wereviseourinterestrateforecastshigh-ertoreflectamoregradualFedeasingcycleandnowsee2-and10-yearyieldsat4.15%and4%,respectivelybyyear-end.WemakenochangestoourTIPSbreakeventargets,butwenowseemorelimitedroomforrealyieldstodecline•InterestRateDerivatives:Aheadofthespringtaxseason,werecommendinitiatingswapspreadwideningexposureinthe3Ys...

发表评论取消回复