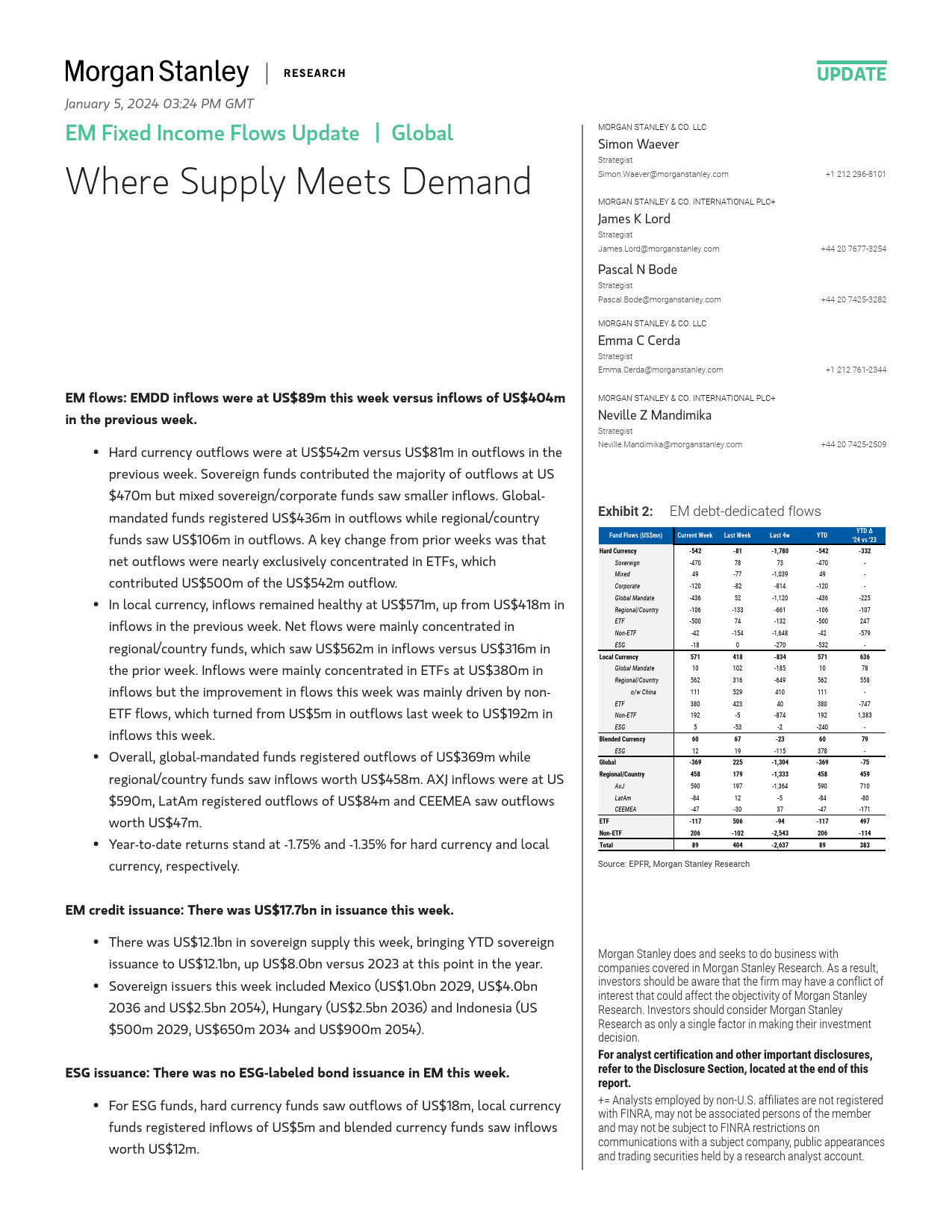

MJanuary5,202403:24PMGMTMorganStanley&Co.LLCUpdateEMFixedIncomeFlowsUpdateGlobalSimonWaever+1212296-8101+44207677-3254WhereSupplyMeetsDemandStrategist+44207425-3282Simon.Waever@morganstanley.comEMflows:EMDDinflowswereatUS$89mthisweekversusinflowsofUS$404m+1212761-2344inthepreviousweek.MorganStanley&Co.Internationalplc++44207425-2509•HardcurrencyoutflowswereatUS$542mversusUS$81minoutflowsintheJamesKLordpreviousweek.SovereignfundscontributedthemajorityofoutflowsatUS$470mbutmixedsovereign/corporatefundssawsmallerinflows.Global-StrategistmandatedfundsregisteredUS$436minoutflowswhileregional/countryJames.Lord@morganstanley.comfundssawUS$106minoutflows.AkeychangefrompriorweekswasthatnetoutflowswerenearlyexclusivelyconcentratedinETFs,whichPascalNBodecontributedUS$500moftheUS$542moutflow.Strategist•Inlocalcurrency,inflowsremainedhealthyatUS$571m,upfromUS$418minPascal.Bode@morganstanley.cominflowsinthepreviousweek.Netflowsweremainlyconcentratedinregional/countryfunds,whichsawUS$562mininflowsversusUS$316minMorganStanley&Co.LLCthepriorweek.InflowsweremainlyconcentratedinETFsatUS$380mininflowsbuttheimprovementinflowsthisweekwasmainlydrivenbynon-EmmaCCerdaETFflows,whichturnedfromUS$5minoutflowslastweektoUS$192mininflowsthisweek.StrategistEmma.Cerda@morganstanley.com•Overall,global-mandatedfundsregisteredoutflowsofUS$36...

发表评论取消回复