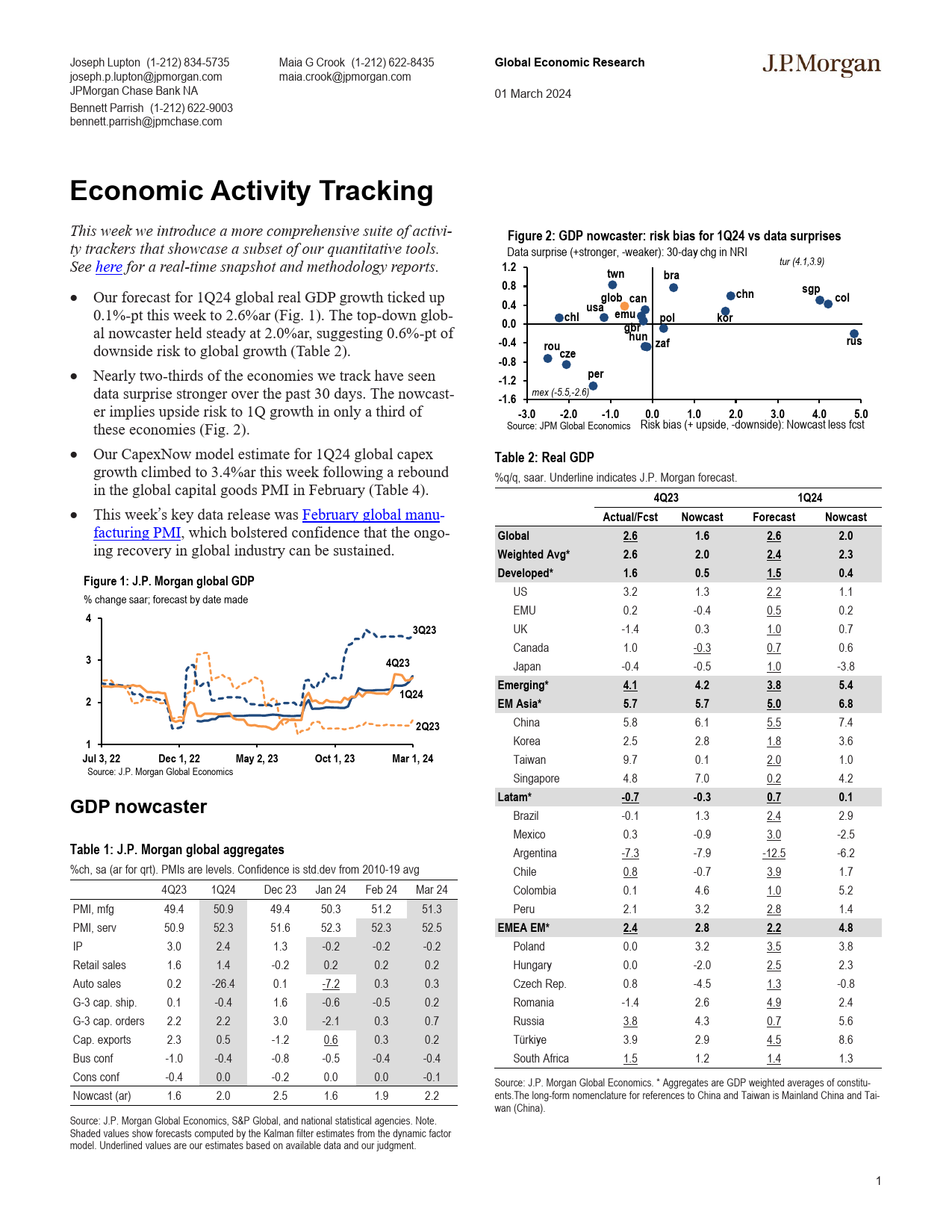

JosephLupton(1-212)834-5735MaiaGCrook(1-212)622-8435GlobalEconomicResearchJPMORGANjoseph.p.lupton@jpmorgan.commaia.crook@jpmorgan.com01March2024JPMorganChaseBankNABennettParrish(1-212)622-9003bennett.parrish@jpmchase.comEconomicActivityTrackingThisweekweintroduceamorecomprehensivesuiteofactivi-Figure2:GDPnowcaster:riskbiasfor1Q24vsdatasurprisestytrackersthatshowcaseasubsetofourquantitativetools.Seehereforareal-timesnapshotandmethodologyreports.Datasurprise(+stronger,-weaker):30-daychginNRItur(4.1,3.9)•Ourforecastfor1Q24globalrealGDPgrowthtickedup1.2twnbrasgpcol0.1%-ptthisweekto2.6%ar(Fig.1).Thetop-downglob-0.8chnalnowcasterheldsteadyat2.0%ar,suggesting0.6%-ptofkorrusdownsiderisktoglobalgrowth(Table2).0.4globcanusa•Nearlytwo-thirdsoftheeconomieswetrackhaveseenchlemupol0.0gbrdatasurprisestrongeroverthepast30days.Thenowcast-erimpliesupsideriskto1Qgrowthinonlyathirdof-0.4rouczehunzaftheseeconomies(Fig.2).-0.8•OurCapexNowmodelestimatefor1Q24globalcapex-1.2pergrowthclimbedto3.4%arthisweekfollowingareboundintheglobalcapitalgoodsPMIinFebruary(Table4).-1.6mex(-5.5,-2.6)•Thisweek’skeydatareleasewasFebruaryglobalmanu--3.0-2.0-1.00.01.02.03.04.05.0Source:JPMGlobalEconomicsRiskbias(+upside,-downside):NowcastlessfcstfacturingPMI,whichbolsteredconfidencethattheongo-ingrecoveryinglobalindustrycanbesustained.Table2:RealG...

发表评论取消回复