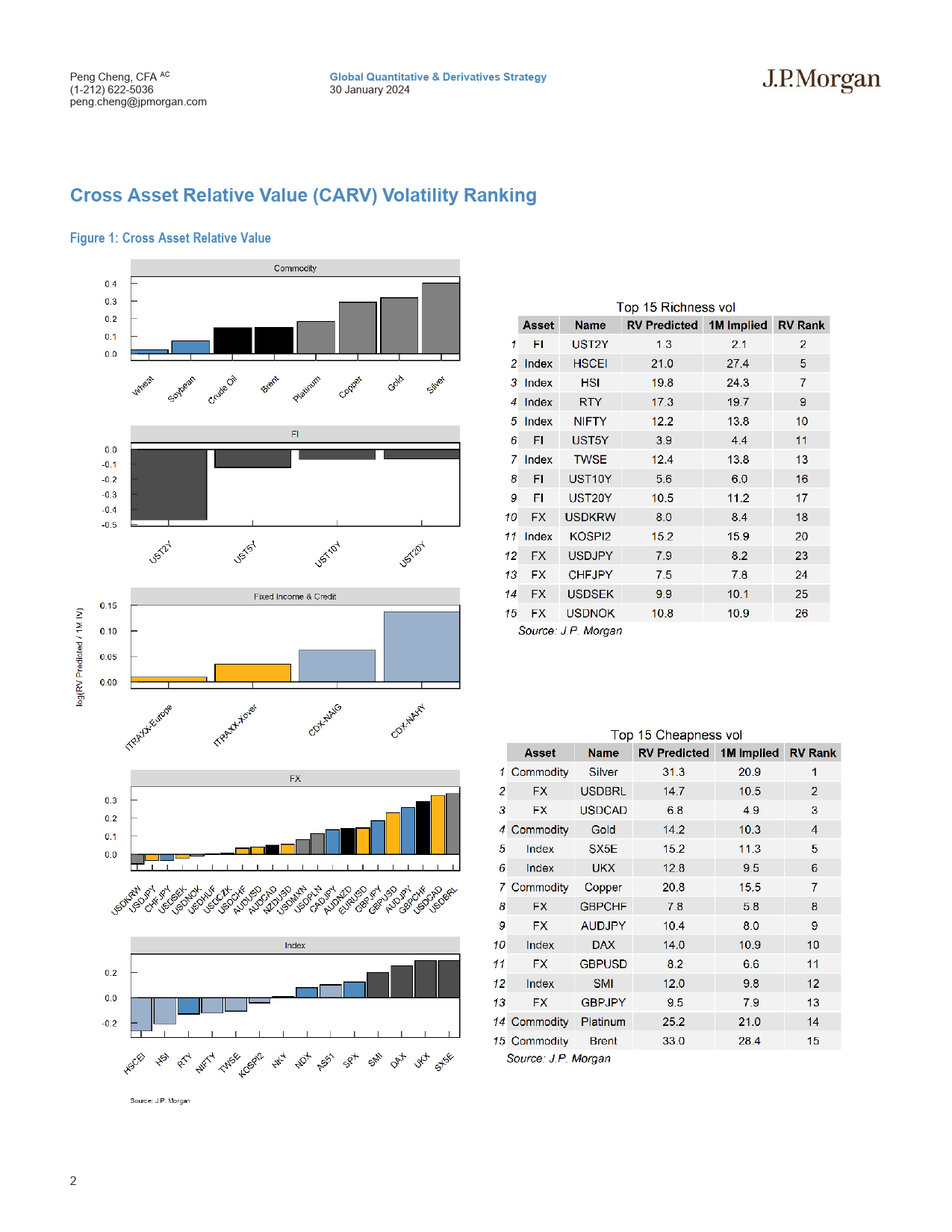

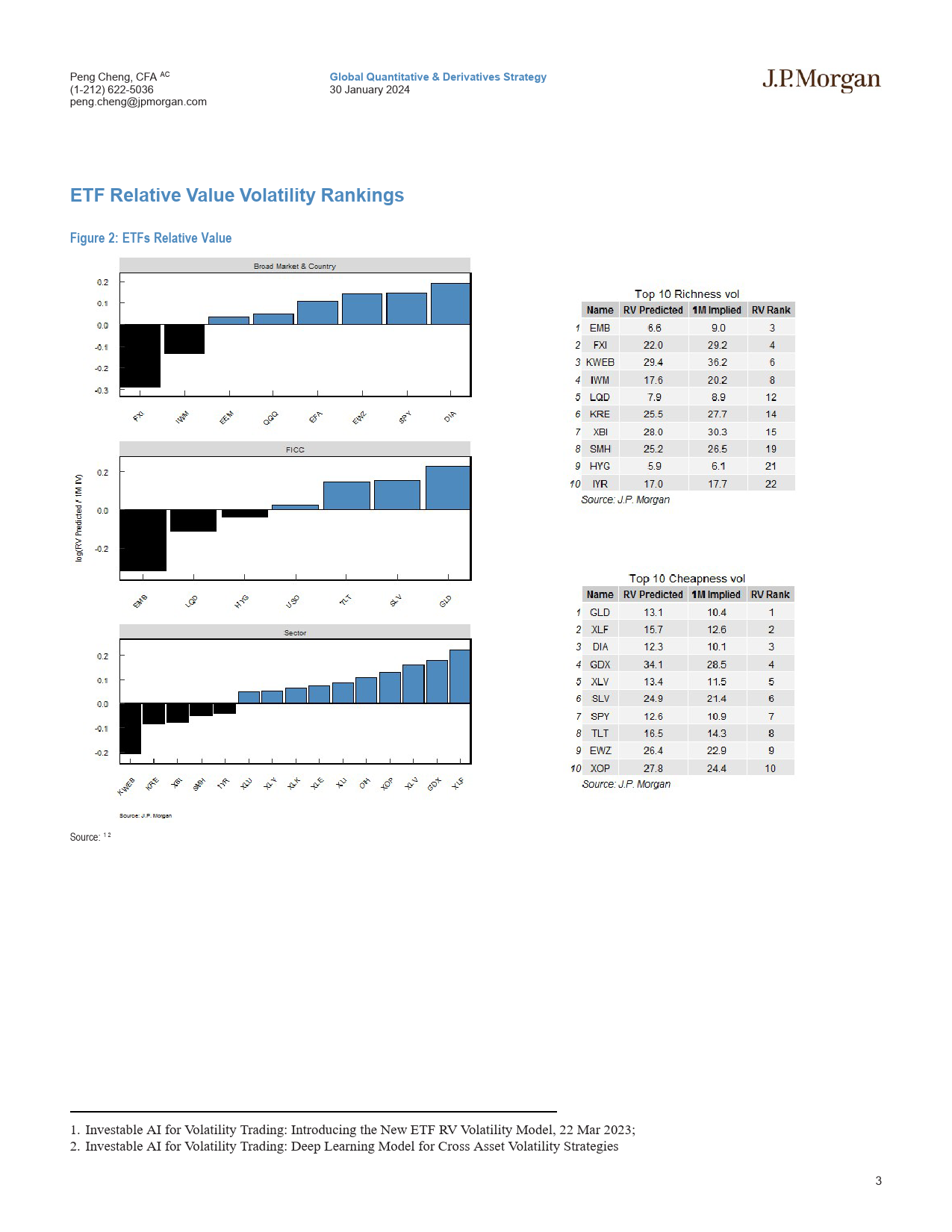

JPMORGANGlobalQuantitative&DerivativesStrategy30January2024CrossAssetVolatilityMachineLearningBasedTradeRecommendations•Startingfromthisweek,weareintroducingthenewCrossassetscreen,GlobalQuantitativeandDerivativesStrategyreplacingtheoldCARV,FXandGoldVolmodels.Asareminder,thenewcrossassetmodelleveragesattentionbasedneuralnetworkandhigh-PengCheng,CFAACfrequencydatatodeterminerelativevalueamongthevolatilityofover50assetsacrossGlobalindices,FX(USD/G10,USD/EM,JPY/G10,Others),(1-212)622-5036Commodity,RatesandCreditindices.Ourdetailedback-testoveralongtimepeng.cheng@jpmorgan.comperiodfrom2012to2023byassetclassaswellasattheportfoliolevelcanbefoundhere.LadislavJankovicAC•Atthecross-assetlevel,theCARVmodelhasashortbiasonRatesfuturesand(1-212)834-9618ladislav.jankovic@jpmchase.comAsianindices,whilelongvolbiasonMetals,EuropeanindicesandG10FX.Thelonglegalignswithour12-yearback-testresults,wherewefoundlongvolEmmaWuACpositionsonMetals,sterlingandEU/UKequitiesvolprovedhistoricallyprofitable(Figure1).CrosAetRlaivVu(1-212)834-2174emma.wu@jpmorgan.com•SimilartotheCARVmodel,intheETFRVmodel,ETFswithmetalsexposureMarkoKolanovic,PhDrankhighlyonthecheapendofthespectrum,whileEMBcontinuestobetherichestwithaMtMgainof+1.4vegainthreeweeks(or+0.4vegainoneweek).(1-212)622-3677Therefore,werecommendpairinglongGLDvolvs.shortEMBvol.Onthemark...

发表评论取消回复