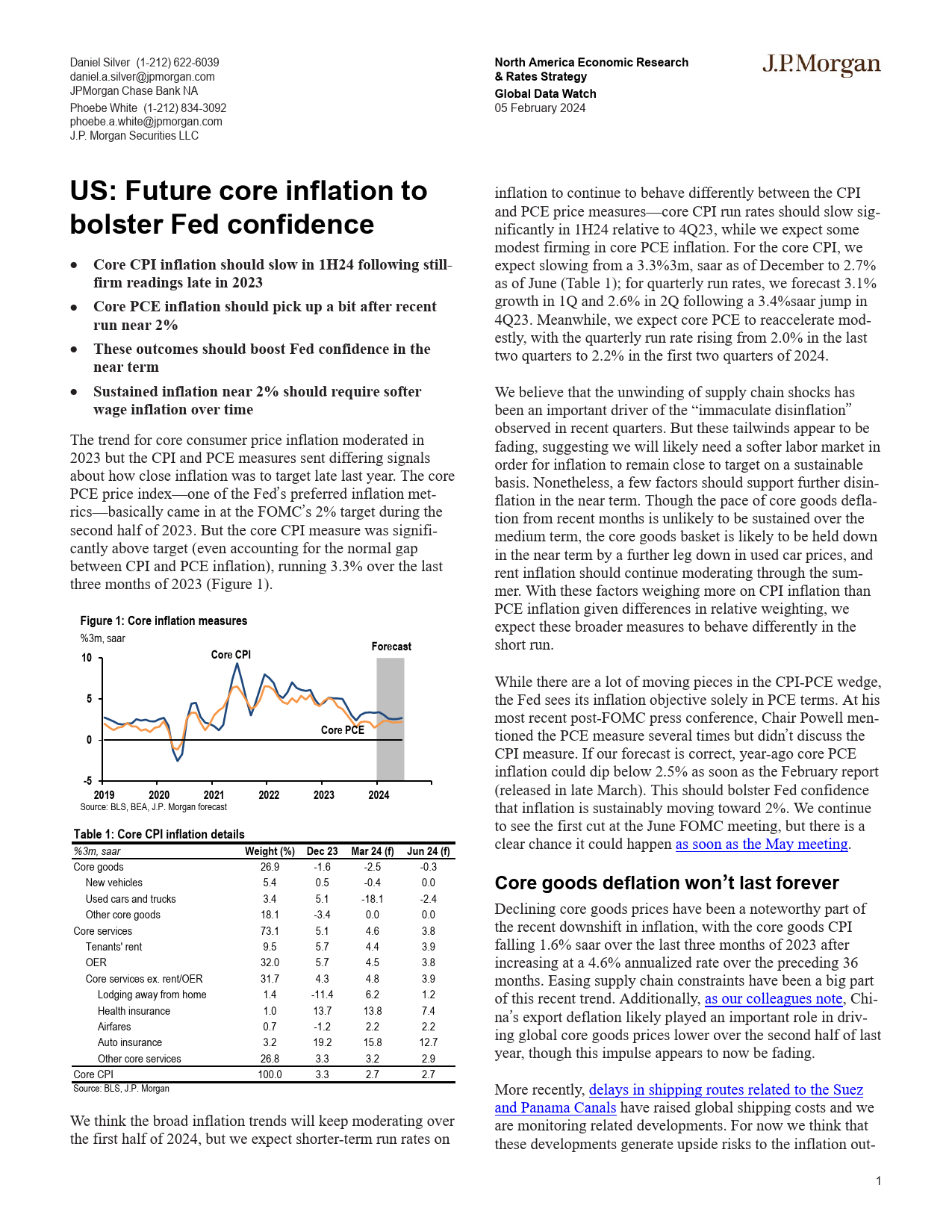

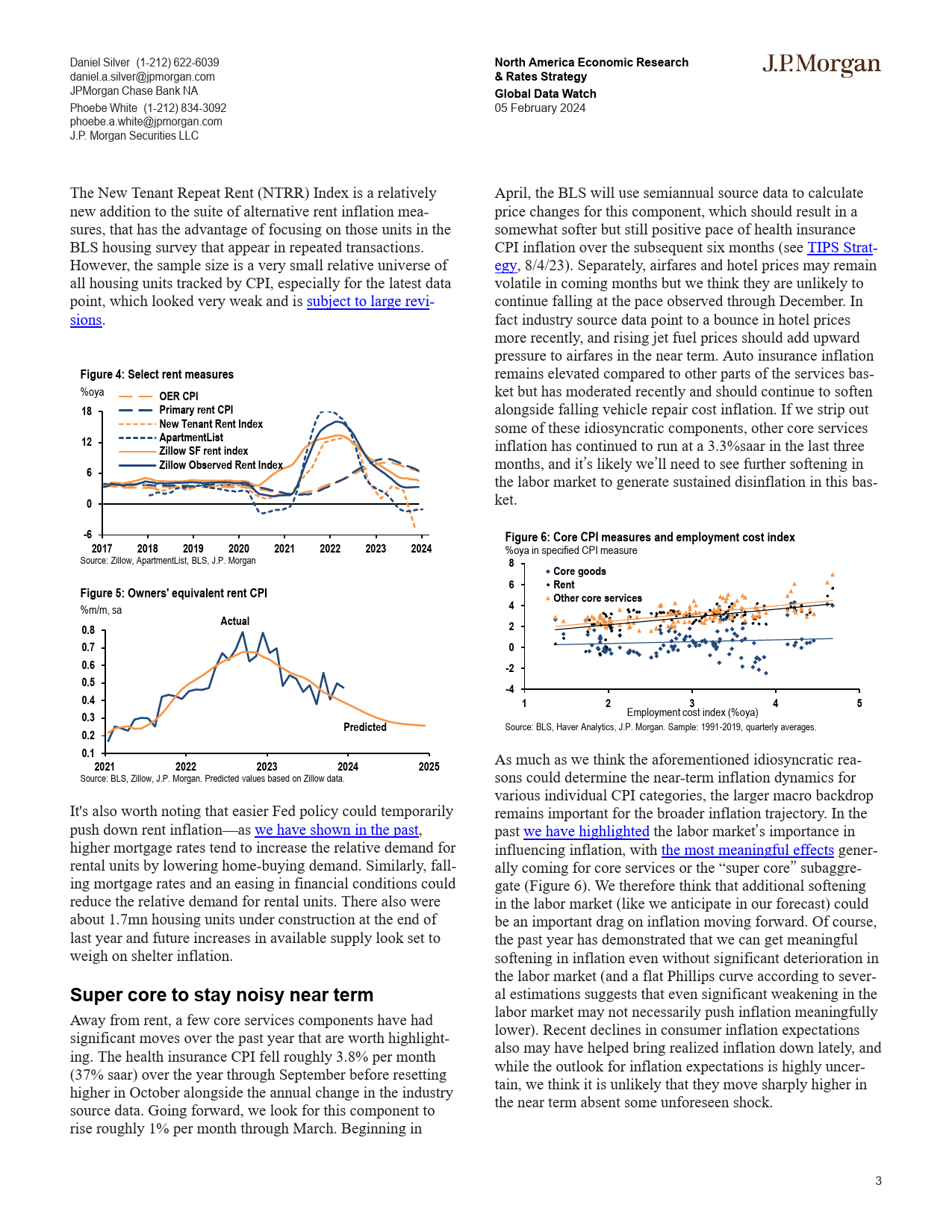

DanielSilver(1-212)622-6039NorthAmericaEconomicResearchJPMORGANdaniel.a.silver@jpmorgan.com&RatesStrategyJPMorganChaseBankNAGlobalDataWatchPhoebeWhite(1-212)834-309205February2024phoebe.a.white@jpmorgan.comJ.P.MorganSecuritiesLLCUS:FuturecoreinflationtoinflationtocontinuetobehavedifferentlybetweentheCPIbolsterFedconfidenceandPCEpricemeasures—coreCPIrunratesshouldslowsig-nificantlyin1H24relativeto4Q23,whileweexpectsome•CoreCPIinflationshouldslowin1H24followingstill-modestfirmingincorePCEinflation.ForthecoreCPI,weexpectslowingfroma3.3%3m,saarasofDecemberto2.7%firmreadingslatein2023asofJune(Table1);forquarterlyrunrates,weforecast3.1%growthin1Qand2.6%in2Qfollowinga3.4%saarjumpin•CorePCEinflationshouldpickupabitafterrecent4Q23.Meanwhile,weexpectcorePCEtoreacceleratemod-estly,withthequarterlyrunraterisingfrom2.0%inthelastrunnear2%twoquartersto2.2%inthefirsttwoquartersof2024.•TheseoutcomesshouldboostFedconfidenceintheWebelievethattheunwindingofsupplychainshockshasbeenanimportantdriverofthe“immaculatedisinflation”neartermobservedinrecentquarters.Butthesetailwindsappeartobefading,suggestingwewilllikelyneedasofterlabormarketin•Sustainedinflationnear2%shouldrequiresofterorderforinflationtoremainclosetotargetonasustainablebasis.Nonetheless,afewfactorsshouldsupportfurtherdisin-wageinflationovertimeflationintheneart...

发表评论取消回复