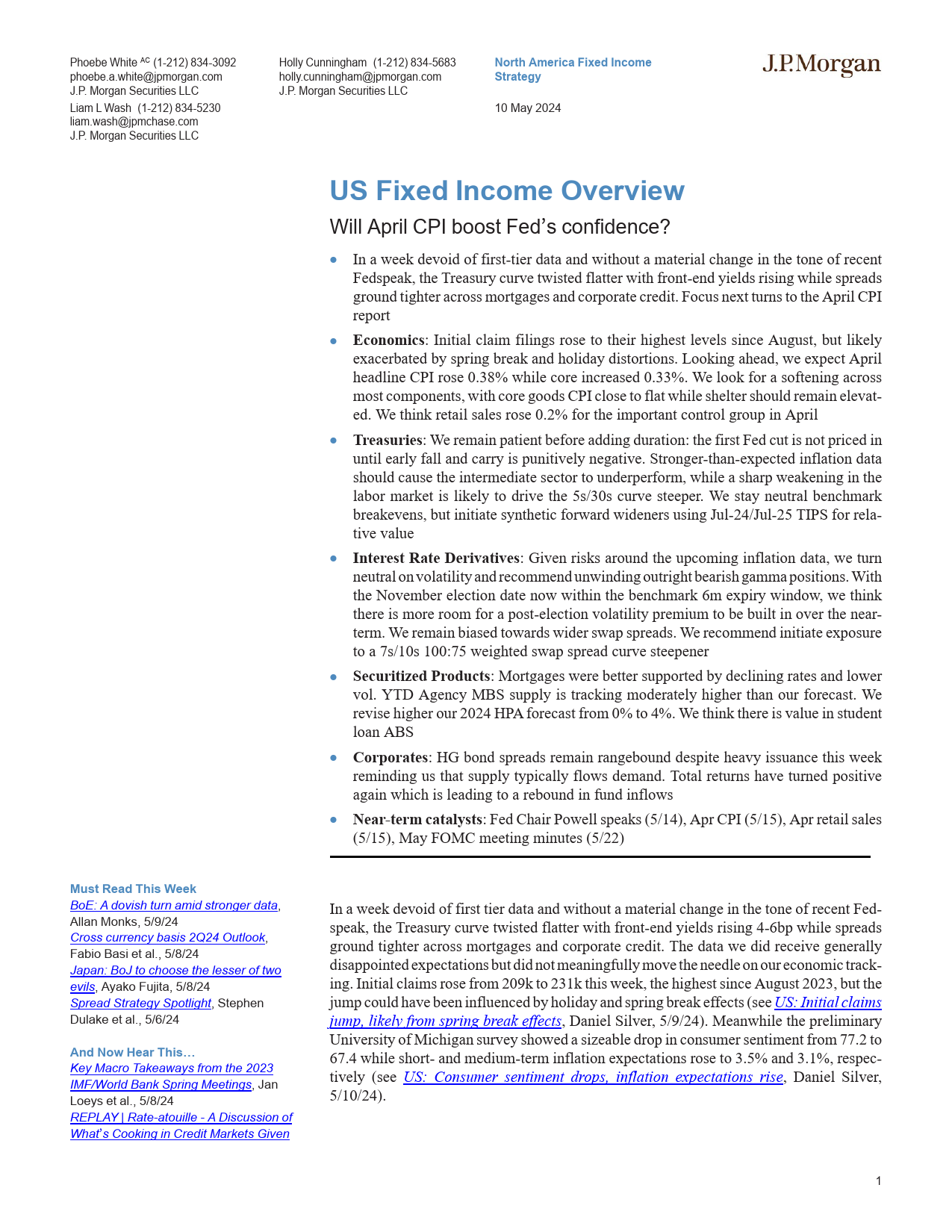

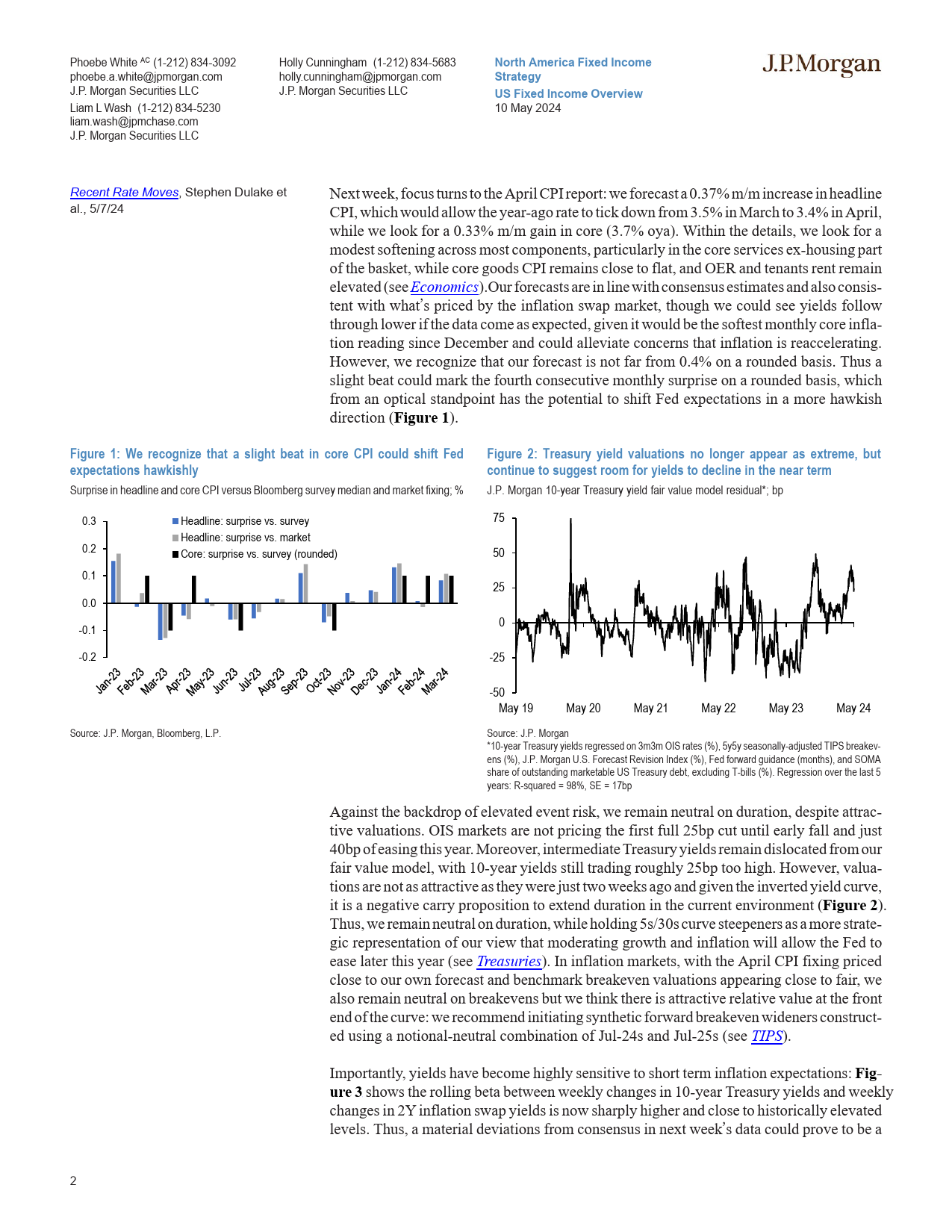

PhoebeWhiteAC(1-212)834-3092HollyCunningham(1-212)834-5683NorthAmericaFixedIncomeJPMORGANphoebe.a.white@jpmorgan.comholly.cunningham@jpmorgan.comStrategyJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesLLC10May2024LiamLWash(1-212)834-5230liam.wash@jpmchase.comJ.P.MorganSecuritiesLLCUSFixedIncomeOverviewWillAprilCPIboostFed’sconfidence?•Inaweekdevoidoffirst-tierdataandwithoutamaterialchangeinthetoneofrecentFedspeak,theTreasurycurvetwistedflatterwithfront-endyieldsrisingwhilespreadsgroundtighteracrossmortgagesandcorporatecredit.FocusnextturnstotheAprilCPIreport•Economics:InitialclaimfilingsrosetotheirhighestlevelssinceAugust,butlikelyexacerbatedbyspringbreakandholidaydistortions.Lookingahead,weexpectAprilheadlineCPIrose0.38%whilecoreincreased0.33%.Welookforasofteningacrossmostcomponents,withcoregoodsCPIclosetoflatwhilesheltershouldremainelevat-ed.Wethinkretailsalesrose0.2%fortheimportantcontrolgroupinApril•Treasuries:Weremainpatientbeforeaddingduration:thefirstFedcutisnotpricedinuntilearlyfallandcarryispunitivelynegative.Stronger-than-expectedinflationdatashouldcausetheintermediatesectortounderperform,whileasharpweakeninginthelabormarketislikelytodrivethe5s/30scurvesteeper.Westayneutralbenchmarkbreakevens,butinitiatesyntheticforwardwidenersusingJul-24/Jul-25TIPSforrela-tivevalue•InterestRateDerivatives:Givenrisk...

发表评论取消回复