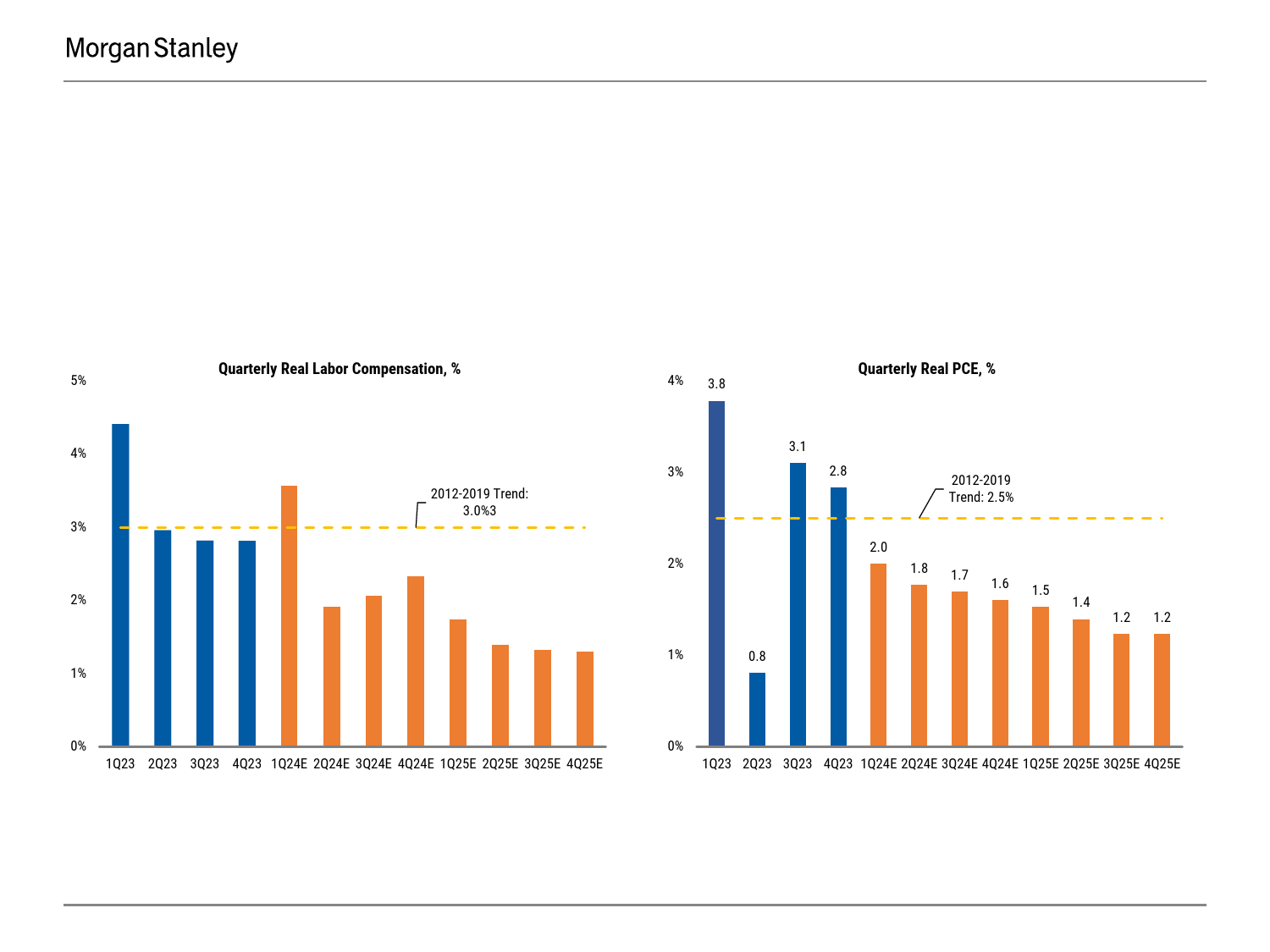

February23,202402:00PMGMTMorganStanleyResearchFebruary23,2024MorganStanley&CoLLCDelinquencyDownload:HealthoftheConsumerThroughaFinancialsLensSarahWolfe–USEconomistSarah.Wolfe@morganstanley.com;+1212761-0857HeatherBerger–ABSStrategistHeather.Berger@morganstanley.com;+1212761-2296JeffAdelson–LeadAnalyst,USConsumerFinanceJeff.Adelson@morganstanley.com;+1212761-1761JamesFaucette–LeadAnalyst,USFintech&PaymentsJames.Faucette@morganstanley.com;+1212296-5771WendyYan–FinancialsandREITsSectorSpecialistWenxin.Yan@morganstanley.com;+1212761-2836MorganStanleydoesandseekstodobusinesswithcompaniescoveredinMorganStanleyResearch.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofMorganStanleyResearch.InvestorsshouldconsiderMorganStanleyResearchasonlyasinglefactorinmakingtheirinvestmentdecision.Foranalystcertificationandotherimportantdisclosures,refertotheDisclosureSection,locatedattheendofthisreport.SarahWolfeUSEconomistMORGANSTANLEYRESEARCHFEBRUARY23,20242IncomedrivesconsumptionAresilientlabormarkethasfueledresilientconsumerspending,butrealincomegrowthslowsthrough2025.In2024and2025,realincomegrowthdeceleratesto3.0%4Q/4Qand1.6%4Q/4Q(4.2%in2023),aslabordemandandsupplycomeintobetterbalance,coolingjobgrowthandwagepressures.ReallaborcompensationslowingRealconsumerspendingrunsb...

发表评论取消回复