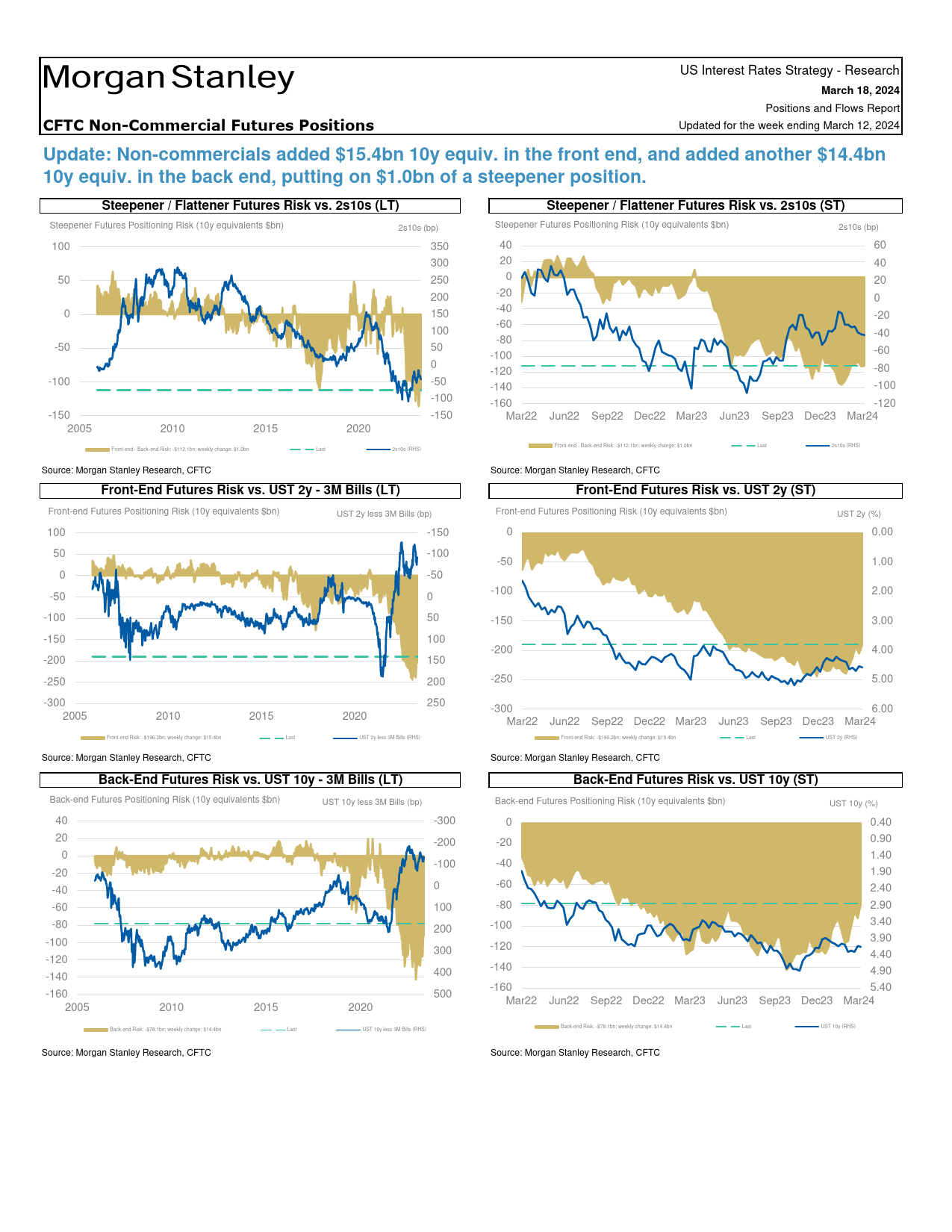

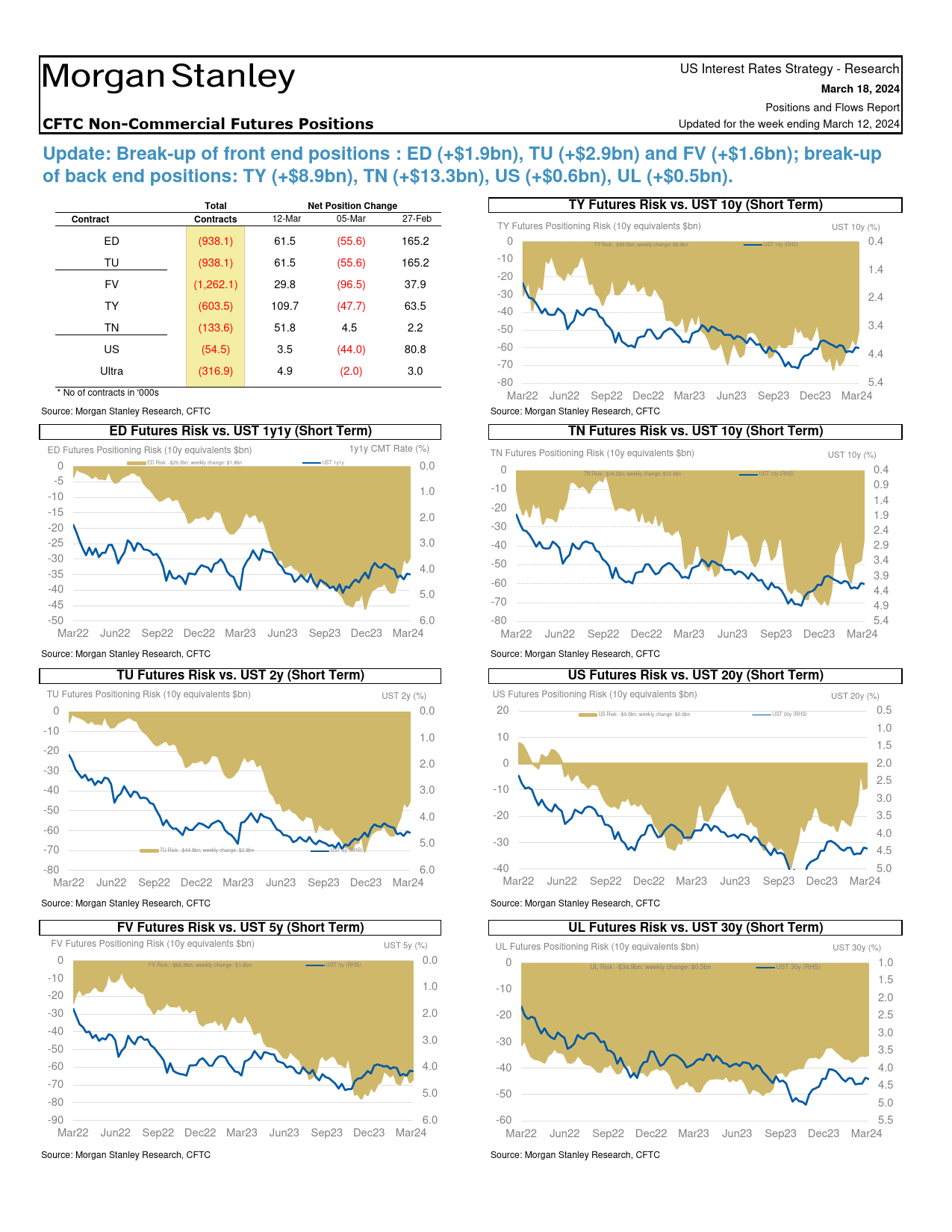

MORGANSTANLEYRESEARCHMarch18,202408:29AMGMTMorganStanley&Co.LLCFrancescoGrechiStrategistFrancesco.Grechi@morganstanley.com+1212761-1005NorthMarch18,2024AmericaaInterestRateStrategyAmericaPositionsandFlowsReportNorthWeeklyMarketPositioningDataCFTCNon-CommercialFuturesPositions(P.2)TICDataForeignFlows(P.16)(UpdatedfortheweekendingMarch12,2024,paramounts)WeeklyChange:(UpdatedforDecember,paramounts)Totalfrontend:$15.4bnED:$1.9bnTU:$2.9bnFV:$1.6bnDecembersawnetinflowsintheEquities,ledbyprivateTotalbackend:$14.4bnTY:$8.9bnTN:$13.3bnUS:$0.6bnUL:$0.5bninvestors.Japan(+$16.6bn)andFrance(+$5.8bn)werethetopTreasurybuyersinDecember.HongKong(-$-15.9bn)andCanada(-$10.8bn)werethetopTreasurysellers.TradersinFinancialFutures(P.4)PFRPrimerP.18(UpdatedfortheweekendingMarch12,2024,paramounts)AssetManagers:ChartoftheWeek:Update:Puton$19.7bnofasteepenerposition.IncreasedtheirAssetManagersincreasedtheirnetlongs(%ofOI)tothelowestlevelnetlongs(%ofOI)tothelowestlevelinlastsixmonthsinFVinlastsixmonthsinFVcontracts.contracts.LeveragedFunds:Source:MorganStanleyResearch,CFTCUpdate:Puton$10.5bnofasteepenerposition.Increasedtheirnetshorts(%ofOI)tothelowestlevelinsixmonthsinTYcontracts.Dealers:Update:Puton-$15.8bnofaflattenerposition.Increasedtheirnetshorts(%ofOI)tothelowestlevelinlastthreemonthsinUScontracts.OtherReportables:Update:Puton-$1...

发表评论取消回复