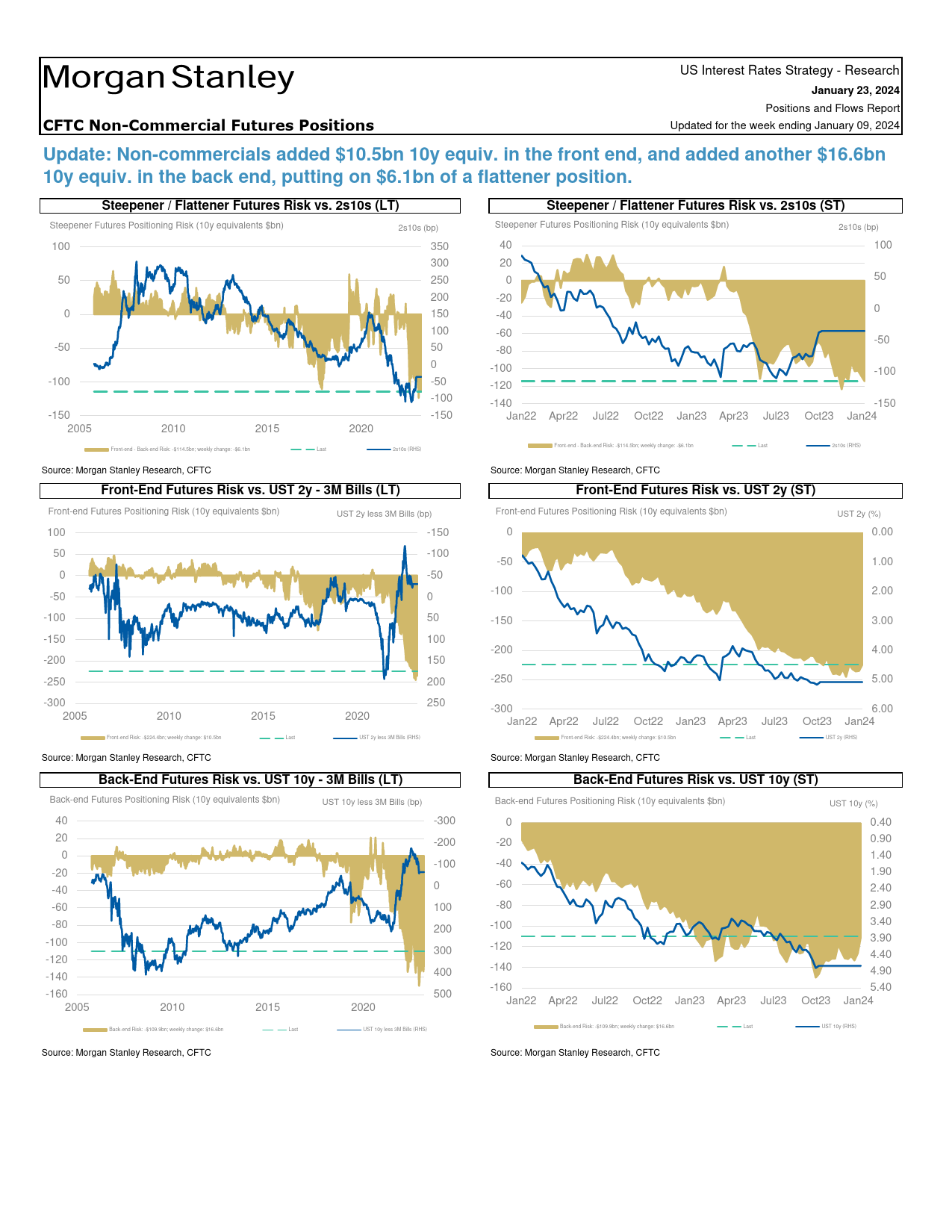

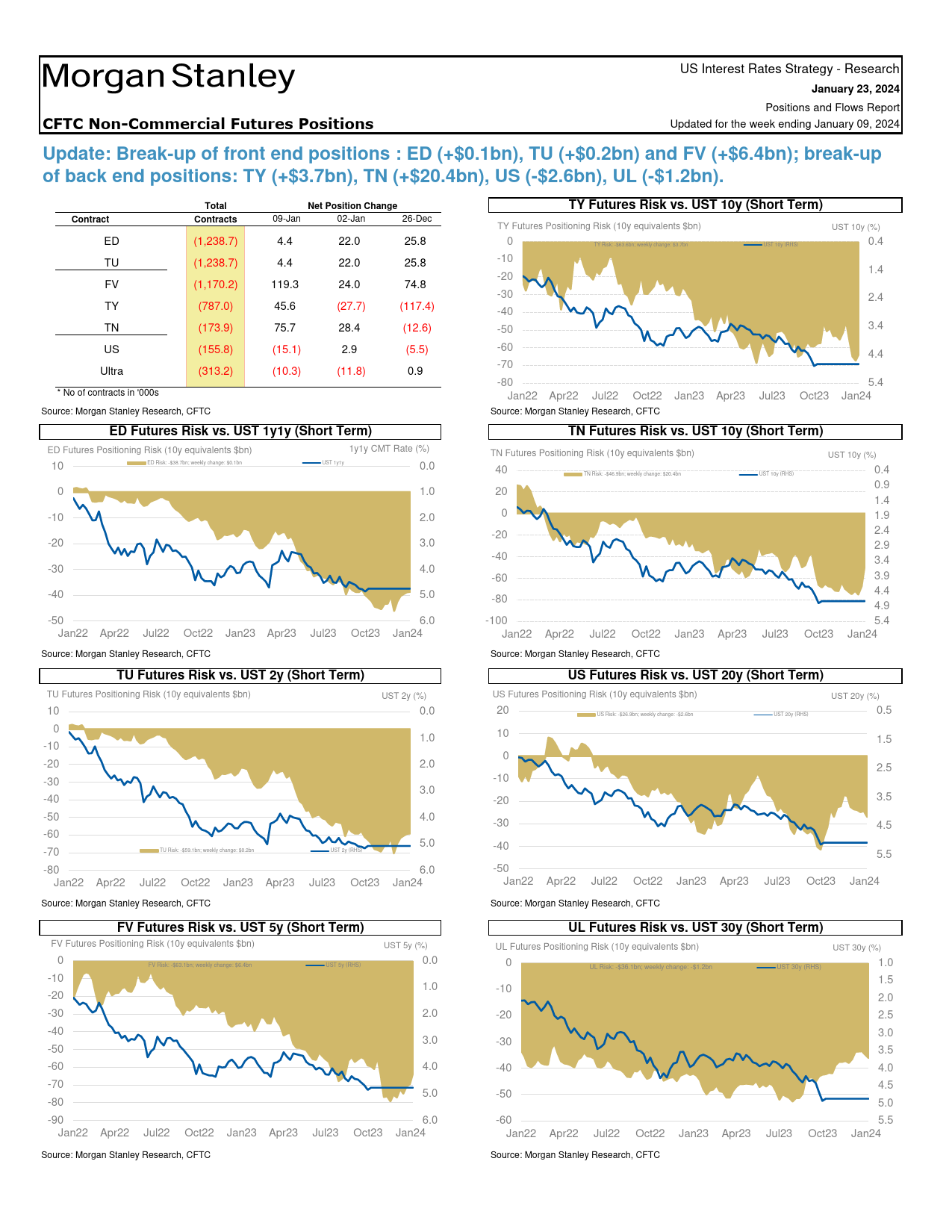

MORGANSTANLEYRESEARCHJanuary23,202411:31AMGMTMorganStanley&Co.LLCFrancescoGrechiStrategistFrancesco.Grechi@morganstanley.com+1212761-1005NorthJanuary23,2024AmericaaInterestRateStrategyAmericaPositionsandFlowsReportNorthWeeklyMarketPositioningDataCFTCNon-CommercialFuturesPositions(P.2)TICDataForeignFlows(P.16)(UpdatedfortheweekendingJanuary09,2024,paramounts)(UpdatedforNovember,paramounts)WeeklyChange:NovembersawnetinflowsinthelongtermUSTreasuries,ledbyTotalfrontend:$10.5bnprivateinvestors.China(+$15.0bn)andNorway(+$10.1bn)wereED:$0.1bnTU:$0.2bnFV:$6.4bnthetopTreasurybuyersinNovember.Canada(-$30.4bn)andTotalbackend:$16.6bnFrance(-$23.4bn)werethetopTreasurysellers.TY:$3.7bnTN:$20.4bnUS:-$2.6bnUL:-$1.2bnPFRPrimerP.18TradersinFinancialFutures(P.4)(UpdatedfortheweekendingJanuary16,2024,paramounts)ChartoftheWeek:AssetManagers:LevergaedFundsdecreasedtheirnetshorts(%ofOI)tothelowestUpdate:Puton$11.8bnofasteepenerposition.DecreasedlevelinsixmonthsinTNcontracts.theirnetlongs(%ofOI)tothelowestlevelinlastsixmonthsinTNcontracts.Source:MorganStanleyResearch,CFTCLeveragedFunds:Update:Puton-$0.7bnofaflattenerposition.Decreasedtheirnetshorts(%ofOI)tothelowestlevelinsixmonthsinTNcontracts.Dealers:Update:Puton-$14.0bnofaflattenerposition.Increasedtheirnetshorts(%ofOI)tothehighestlevelinlastsixmonthsinTUcontracts.OtherReportable...

发表评论取消回复