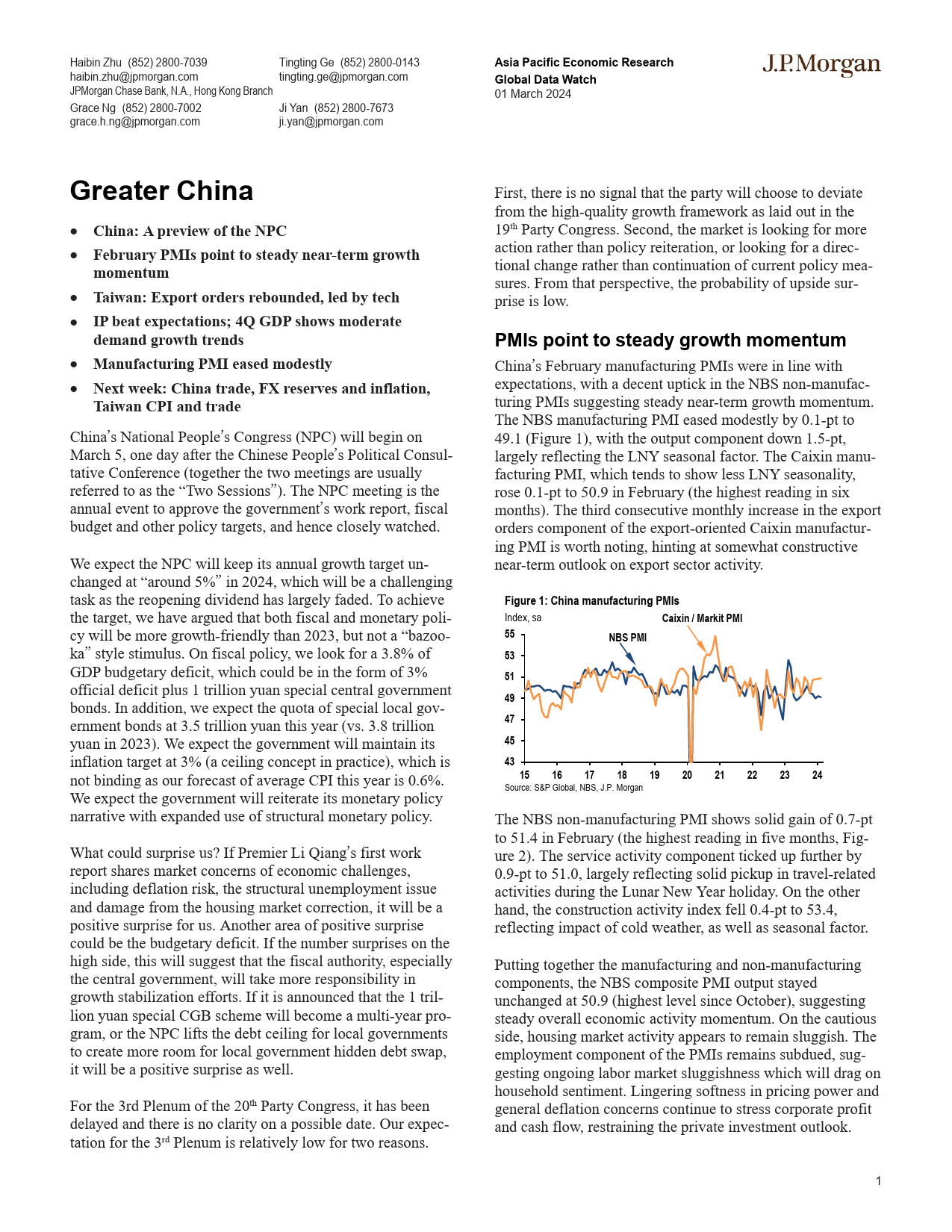

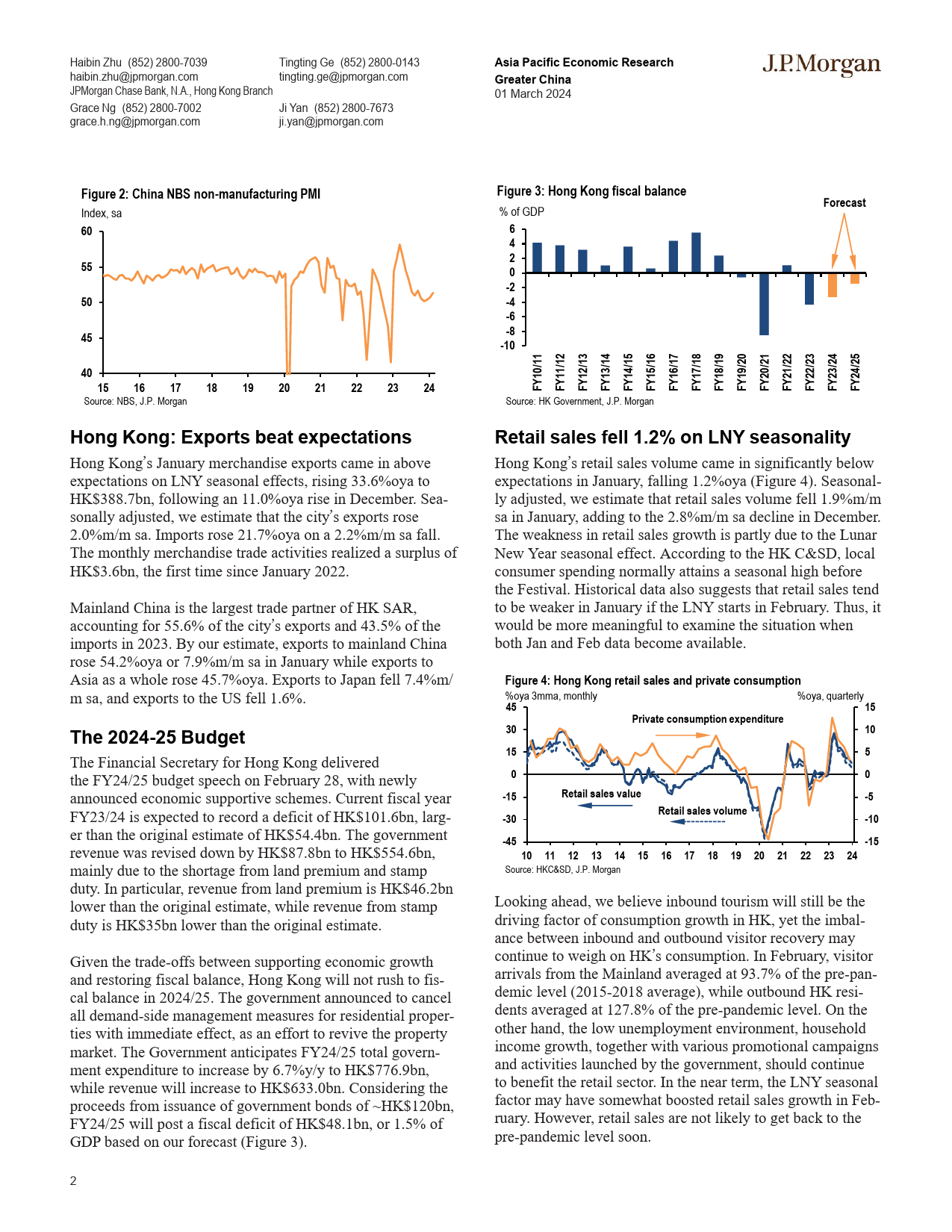

HaibinZhu(852)2800-7039TingtingGe(852)2800-0143AsiaPacificEconomicResearchJPMORGANhaibin.zhu@jpmorgan.comtingting.ge@jpmorgan.comJPMorganChaseBank,N.A.,HongKongBranchGlobalDataWatchJiYan(852)2800-767301March2024GraceNg(852)2800-7002ji.yan@jpmorgan.comgrace.h.ng@jpmorgan.comGreaterChinaFirst,thereisnosignalthatthepartywillchoosetodeviatefromthehigh-qualitygrowthframeworkaslaidoutinthe•China:ApreviewoftheNPC19thPartyCongress.Second,themarketislookingformore•FebruaryPMIspointtosteadynear-termgrowthactionratherthanpolicyreiteration,orlookingforadirec-tionalchangeratherthancontinuationofcurrentpolicymea-momentumsures.Fromthatperspective,theprobabilityofupsidesur-priseislow.•Taiwan:Exportordersrebounded,ledbytech•IPbeatexpectations;4QGDPshowsmoderatePMIspointtosteadygrowthmomentumdemandgrowthtrendsChina’sFebruarymanufacturingPMIswereinlinewithexpectations,withadecentuptickintheNBSnon-manufac-•ManufacturingPMIeasedmodestlyturingPMIssuggestingsteadynear-termgrowthmomentum.•Nextweek:Chinatrade,FXreservesandinflation,TheNBSmanufacturingPMIeasedmodestlyby0.1-ptto49.1(Figure1),withtheoutputcomponentdown1.5-pt,TaiwanCPIandtradelargelyreflectingtheLNYseasonalfactor.TheCaixinmanu-facturingPMI,whichtendstoshowlessLNYseasonality,China’sNationalPeople’sCongress(NPC)willbeginonrose0.1-ptto50.9inFebruary(thehighestreadi...

发表评论取消回复