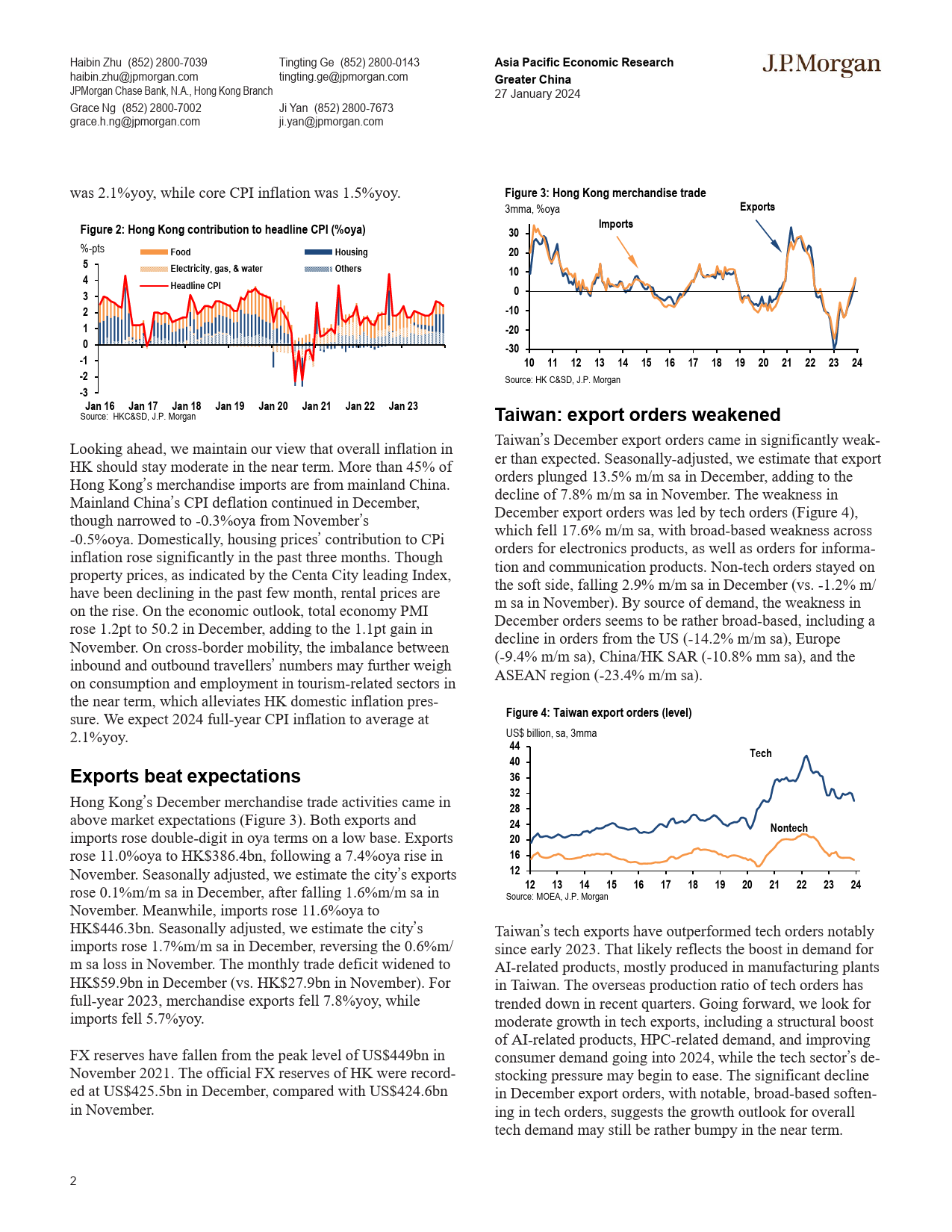

HaibinZhu(852)2800-7039TingtingGe(852)2800-0143AsiaPacificEconomicResearchJPMORGANhaibin.zhu@jpmorgan.comtingting.ge@jpmorgan.comJPMorganChaseBank,N.A.,HongKongBranchGlobalDataWatchJiYan(852)2800-767327January2024GraceNg(852)2800-7002ji.yan@jpmorgan.comgrace.h.ng@jpmorgan.comGreaterChinaimpliesamoreessentialroleofstructuralmonetarypolicyinstrumentsinthePBOC’spolicyoperation,comparedto•China:ThePBOCeasesearlierthanexpected;50bpaggregatequantitative(e.g.universalRRR)orprice-based(e.g.policyrate)policyinstruments.RRRcutand25bpre-lending/rediscountratecutInourbaselineforecast,wehaveassumeda1-trillionyuan•HongKong:DecemberCPIinflationfellto2.4%oyapackagefundedbyPSLtosupportpublichousingandurban•Decembermerchandisetradeactivitiesbeatmarketvillagedevelopments,whichhasbeenechoedbythe350bnyuannetPSLinjectioninDecember.Wealsolookforanexpectations;FXreservesrosetoUS$425.5bnexpansionofre-lendingfacilitytosupportdebtrestructuringaspartoflocalgovernments’hiddendebtresolution.These•Taiwan:Decemberexportordersweakened,draggedquasi-fiscalmeasuresaretargetedataddressingimminentvulnerabilitiesintheeconomyandfinancialsystem,andplaybyslowingtechordersanimportantroleinourrelativelyconstructiveviewontheChineseeconomyin2024.Theannouncementoffurtherlow-•DecemberIPweaker-than-expected;techproductioneringthere-lendingandrediscou...

发表评论取消回复