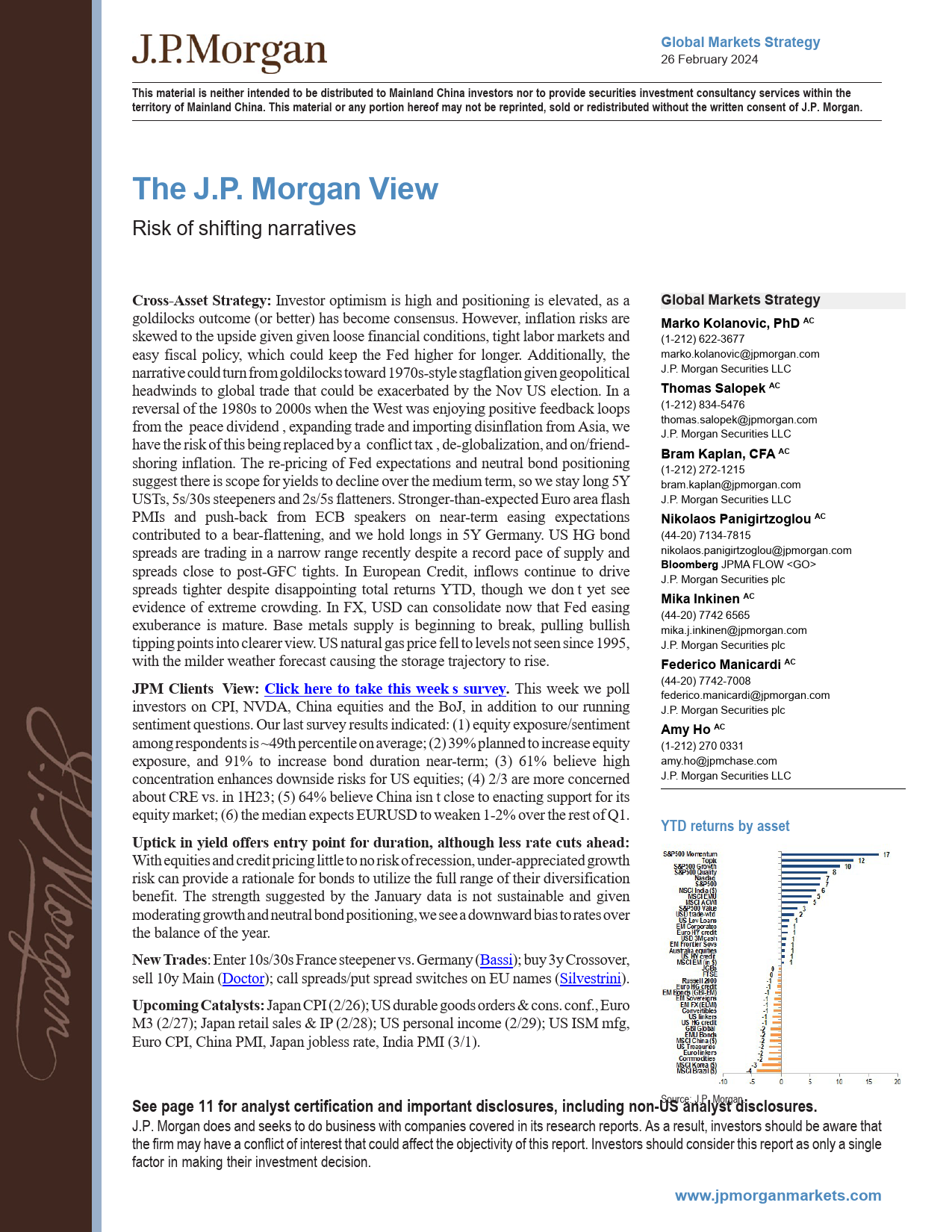

JPMORGANGlobalMarketsStrategy26February2024ThismaterialisneitherintendedtobedistributedtoMainlandChinainvestorsnortoprovidesecuritiesinvestmentconsultancyserviceswithintheterritoryofMainlandChina.Thismaterialoranyportionhereofmaynotbereprinted,soldorredistributedwithoutthewrittenconsentofJ.P.Morgan.TheJ.P.MorganViewRiskofshiftingnarrativesCross-AssetStrategy:Investoroptimismishighandpositioningiselevated,asaGlobalMarketsStrategygoldilocksoutcome(orbetter)hasbecomeconsensus.However,inflationrisksareskewedtotheupsidegivengivenloosefinancialconditions,tightlabormarketsandMarkoKolanovic,PhDACeasyfiscalpolicy,whichcouldkeeptheFedhigherforlonger.Additionally,thenarrativecouldturnfromgoldilockstoward1970s-stylestagflationgivengeopolitical(1-212)622-3677headwindstoglobaltradethatcouldbeexacerbatedbytheNovUSelection.Inamarko.kolanovic@jpmorgan.comreversalofthe1980sto2000swhentheWestwasenjoyingpositivefeedbackloopsJ.P.MorganSecuritiesLLCfromthe‘peacedividend’,expandingtradeandimportingdisinflationfromAsia,wehavetheriskofthisbeingreplacedbya‘conflicttax’,de-globalization,andon/friend-ThomasSalopekACshoringinflation.There-pricingofFedexpectationsandneutralbondpositioningsuggestthereisscopeforyieldstodeclineoverthemediumterm,sowestaylong5Y(1-212)834-5476USTs,5s/30ssteepenersand2s/5sflatteners.Stronger-than-expectedEur...

发表评论取消回复