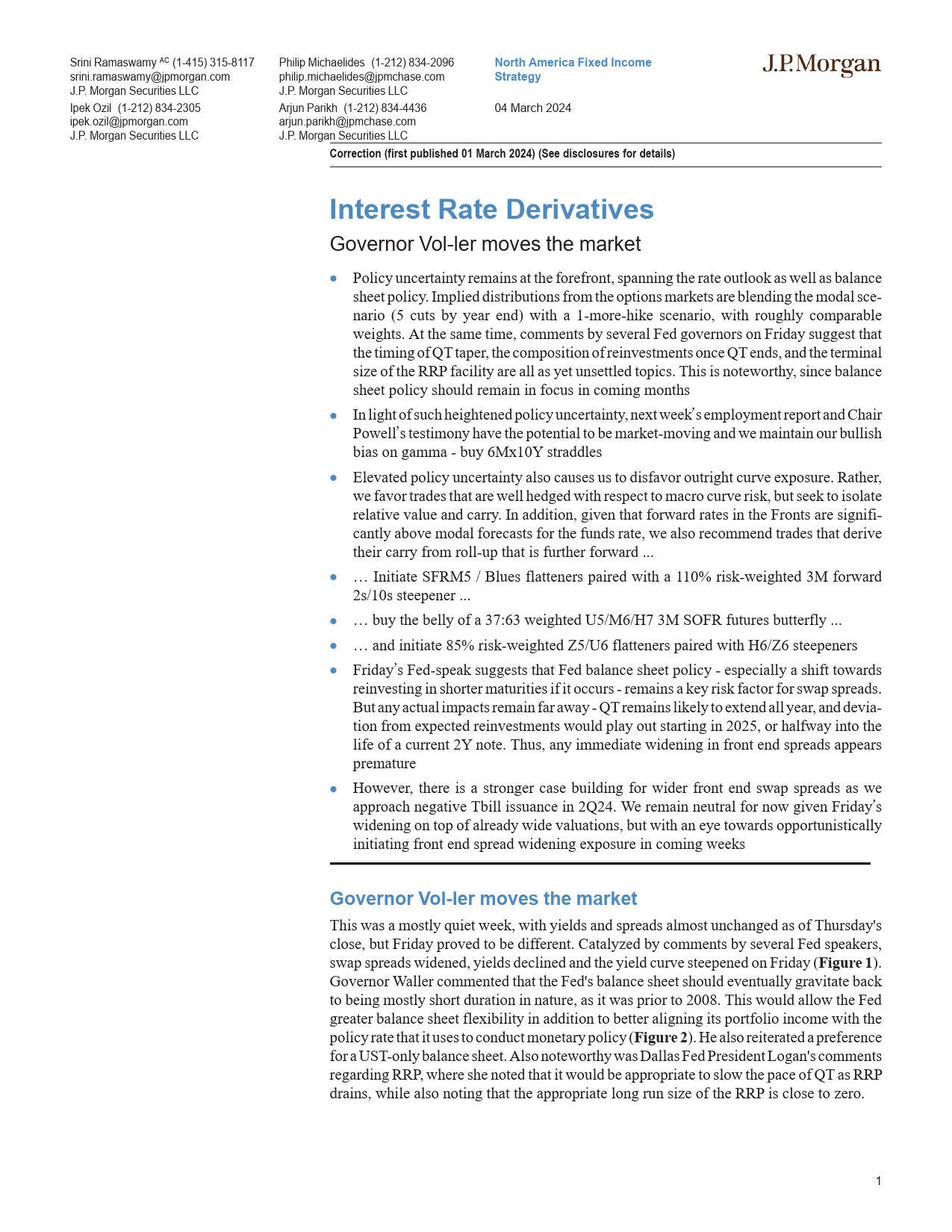

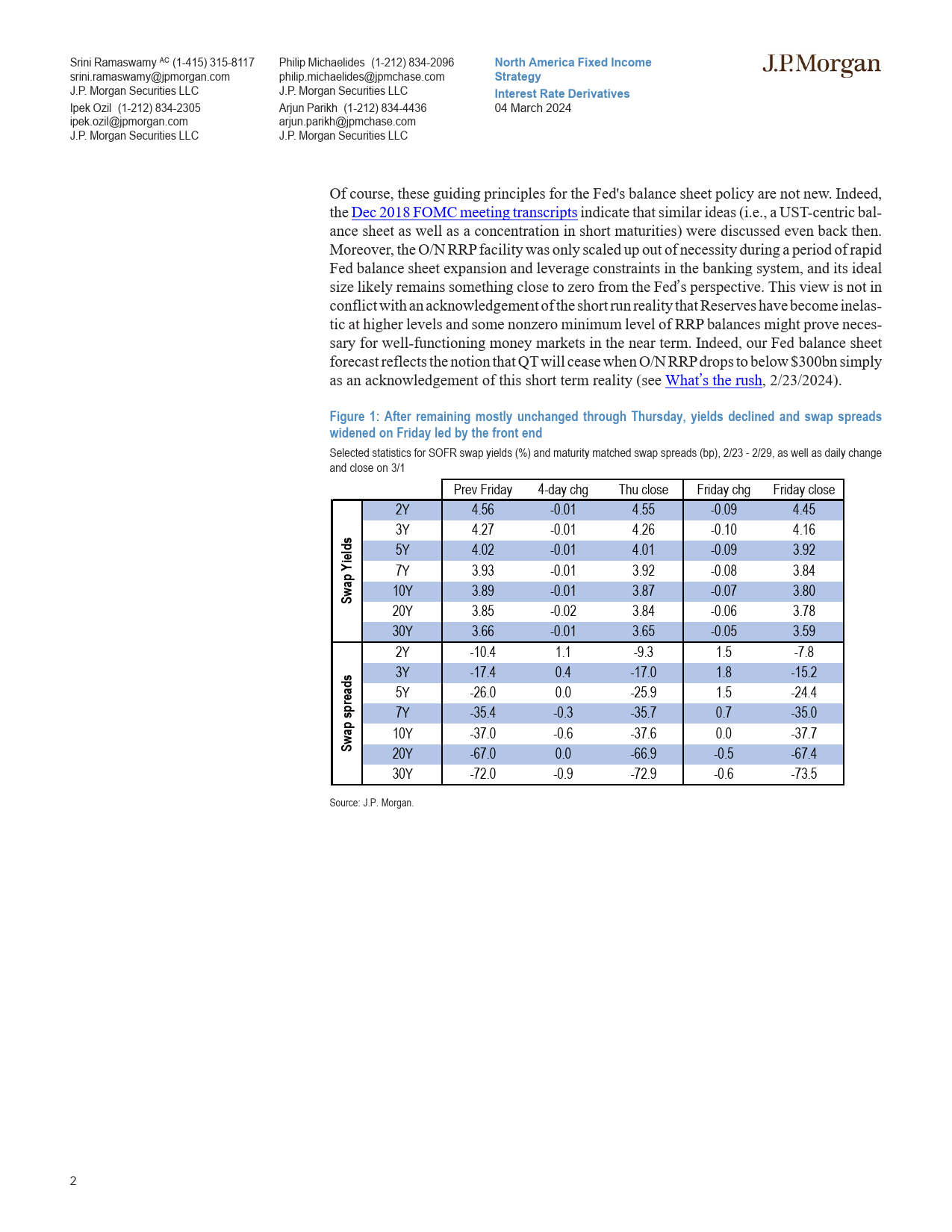

SriniRamaswamyAC(1-415)315-8117PhilipMichaelides(1-212)834-2096NorthAmericaFixedIncomeJPMORGANsrini.ramaswamy@jpmorgan.comphilip.michaelides@jpmchase.comStrategyJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesLLCIpekOzil(1-212)834-2305ArjunParikh(1-212)834-443604March2024ipek.ozil@jpmorgan.comarjun.parikh@jpmchase.comJ.P.MorganSecuritiesLLCJ.P.MorganSecuritiesLLCCorrection(firstpublished01March2024)(Seedisclosuresfordetails)InterestRateDerivativesGovernorVol-lermovesthemarket•Policyuncertaintyremainsattheforefront,spanningtherateoutlookaswellasbalancesheetpolicy.Implieddistributionsfromtheoptionsmarketsareblendingthemodalsce-nario(5cutsbyyearend)witha1-more-hikescenario,withroughlycomparableweights.Atthesametime,commentsbyseveralFedgovernorsonFridaysuggestthatthetimingofQTtaper,thecompositionofreinvestmentsonceQTends,andtheterminalsizeoftheRRPfacilityareallasyetunsettledtopics.Thisisnoteworthy,sincebalancesheetpolicyshouldremaininfocusincomingmonths•Inlightofsuchheightenedpolicyuncertainty,nextweek’semploymentreportandChairPowell’stestimonyhavethepotentialtobemarket-movingandwemaintainourbullishbiasongamma-buy6Mx10Ystraddles•Elevatedpolicyuncertaintyalsocausesustodisfavoroutrightcurveexposure.Rather,wefavortradesthatarewellhedgedwithrespecttomacrocurverisk,butseektoisolaterelativevalueandcarry.Inaddition,give...

发表评论取消回复