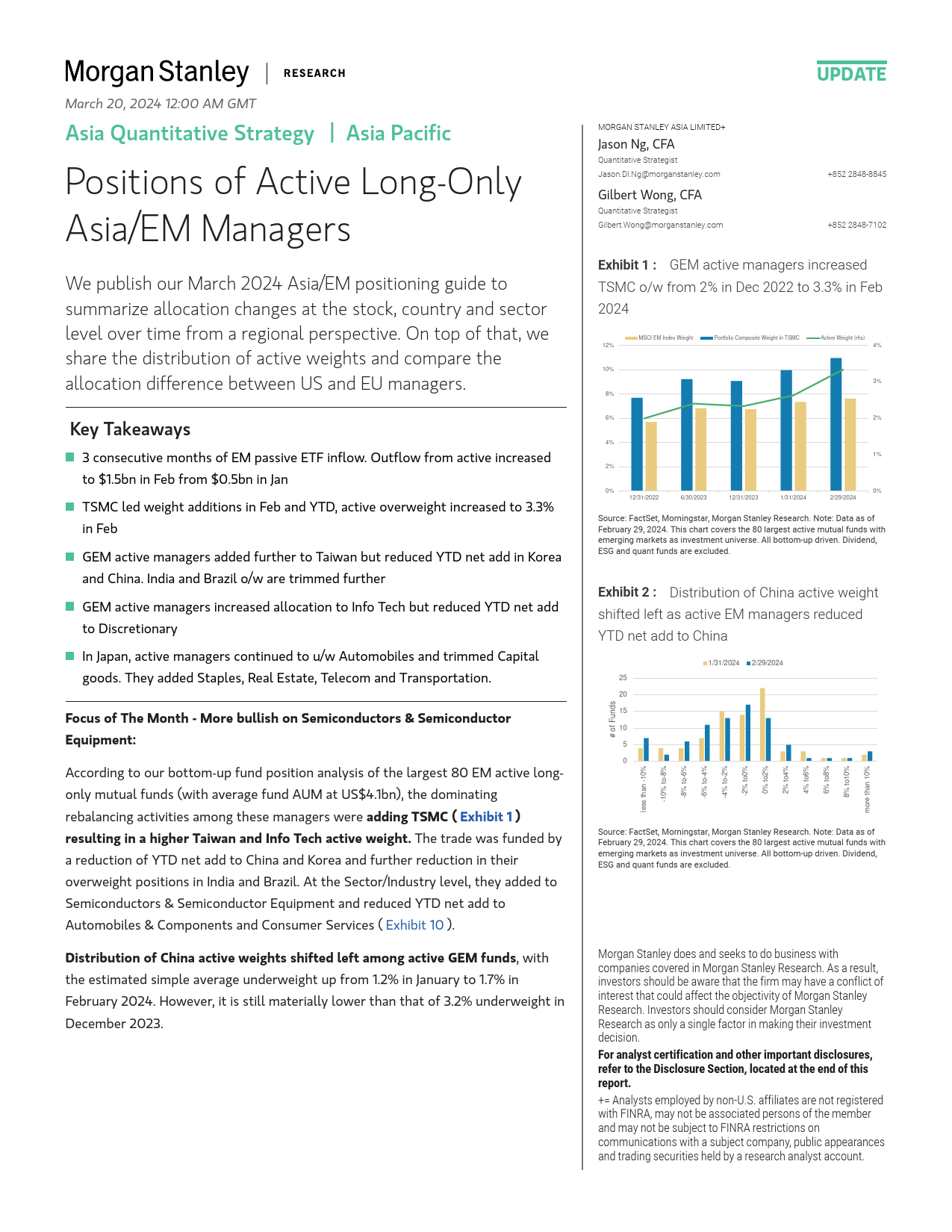

MMarch20,202412:00AMGMTUpdateAsiaQuantitativeStrategyAsiaPacificMorganStanleyAsiaLimited++8522848-8845+8522848-7102PositionsofActiveLong-OnlyJasonNg,CFAAsia/EMManagersQuantitativeStrategistWepublishourMarch2024Asia/EMpositioningguidetoJason.Dl.Ng@morganstanley.comsummarizeallocationchangesatthestock,countryandsectorlevelovertimefromaregionalperspective.Ontopofthat,weGilbertWong,CFAsharethedistributionofactiveweightsandcomparetheallocationdifferencebetweenUSandEUmanagers.QuantitativeStrategistGilbert.Wong@morganstanley.comKeyTakeawaysExhibit1:GEMactivemanagersincreased3consecutivemonthsofEMpassiveETFinflow.OutflowfromactiveincreasedTSMCo/wfrom2%inDec2022to3.3%inFebto$1.5bninFebfrom$0.5bninJan2024TSMCledweightadditionsinFebandYTD,activeoverweightincreasedto3.3%MSCIEMIndexWeightPortfolioCompositeWeightinTSMCActiveWeight(rhs)inFeb4%12%GEMactivemanagersaddedfurthertoTaiwanbutreducedYTDnetaddinKoreaandChina.IndiaandBrazilo/waretrimmedfurther10%3%GEMactivemanagersincreasedallocationtoInfoTechbutreducedYTDnetaddtoDiscretionary8%InJapan,activemanagerscontinuedtou/wAutomobilesandtrimmedCapital6%2%goods.TheyaddedStaples,RealEstate,TelecomandTransportation.4%FocusofTheMonth-MorebullishonSemiconductors&Semiconductor1%Equipment:2%Accordingtoourbottom-upfundpositionanalysisofthelargest80EMactivelong-onlymutualfunds(withaver...

发表评论取消回复