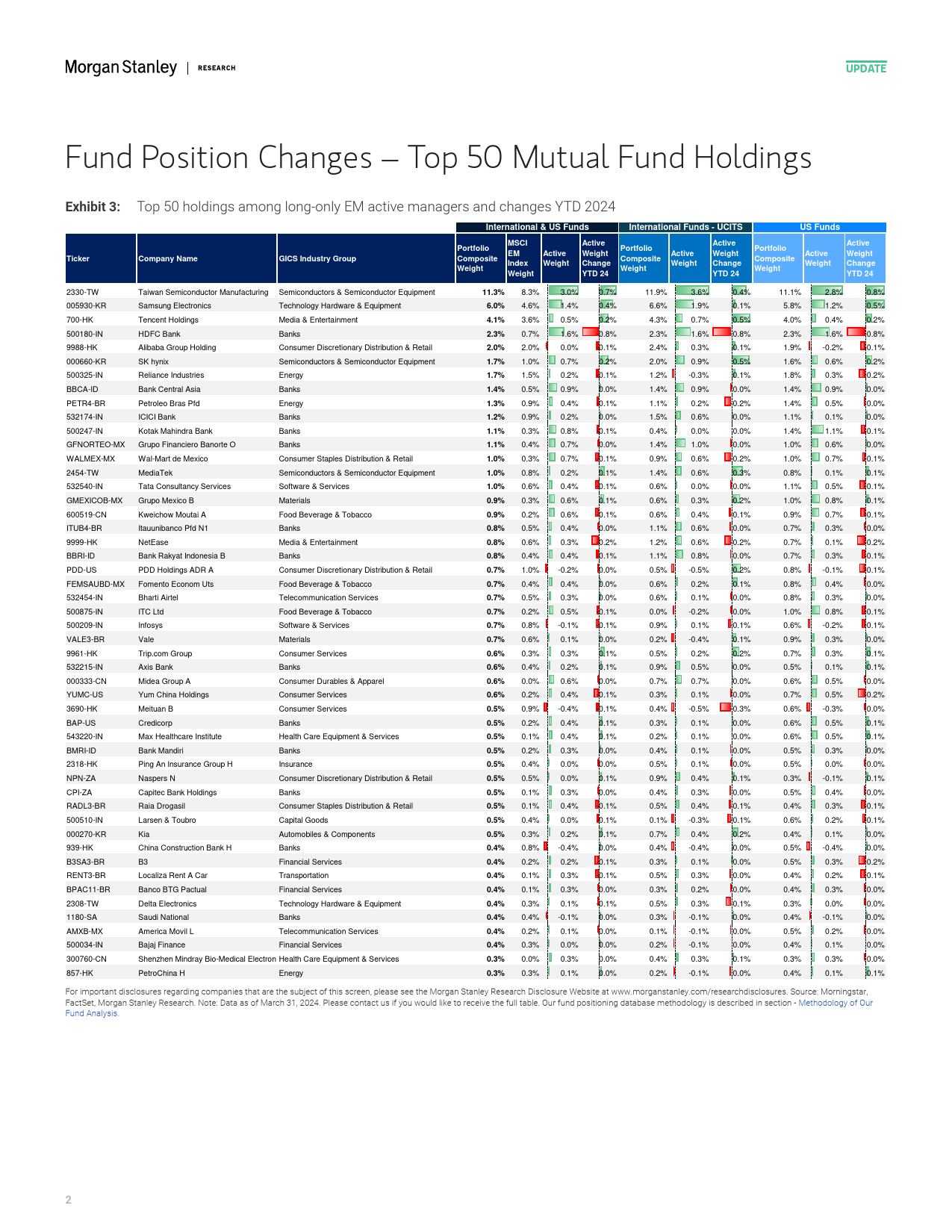

MApril17,202412:00AMGMTUpdateAsiaQuantitativeStrategyAsiaPacificMorganStanleyAsiaLimited++8522848-8845+8522848-7102PositionsofActiveLong-OnlyJasonNg,CFAManagersinAsia/EMQuantitativeStrategistWepublishourApril2024Asia/EMpositioningguidetoJason.Dl.Ng@morganstanley.comsummarizeallocationchangesatthestock,countryandsectorlevelovertimefromaregionalperspective.Ontopofthat,weGilbertWong,CFAsharethedistributionofactiveweightsandcomparetheallocationdifferencebetweenUSandEUmanagers.QuantitativeStrategistGilbert.Wong@morganstanley.comKeyTakeawaysExhibit1:GEMactivemanagerreduceu/winUS$2.7bnoutflowfromactiveGEMfundsandUS$186moutflowfromGEMpassiveproductsamiddelayinFedpivotexpectations.cyclicalsectorsEnergyandIndustrialsby0.7%InMarch,GEMactivemanagersreducedTaiwanandaddedtoSaudiArabia,TurkeyandUnitedArabEmiratesMSCIEMIndexWeightOnasectorlevel,managersincreasedallocationtocyclicalsectors,EnergyandPortfolioCompositeWeightinEnergyandIndustrialsIndustrialsActiveWeight(rhs)GEMactivemanagerstrimmedTSMCandHDFCBankandaddedtoSamsungElectronics,TencentandSKHynix.14.0%2/29/20240.0%InJapan,activemanagerscontinuedtou/wAutomobilesando/wMaterials.12.0%-0.5%CapitalgoodsandAutomobilesarereducedmostYTD.10.0%-1.0%3/31/2024-1.5%FocusofTheMonth-Activemanagersreducingu/winEnergyandIndustrials:8.0%6.0%Accordingtoourbottom-upfundpositionanalysiso...

发表评论取消回复