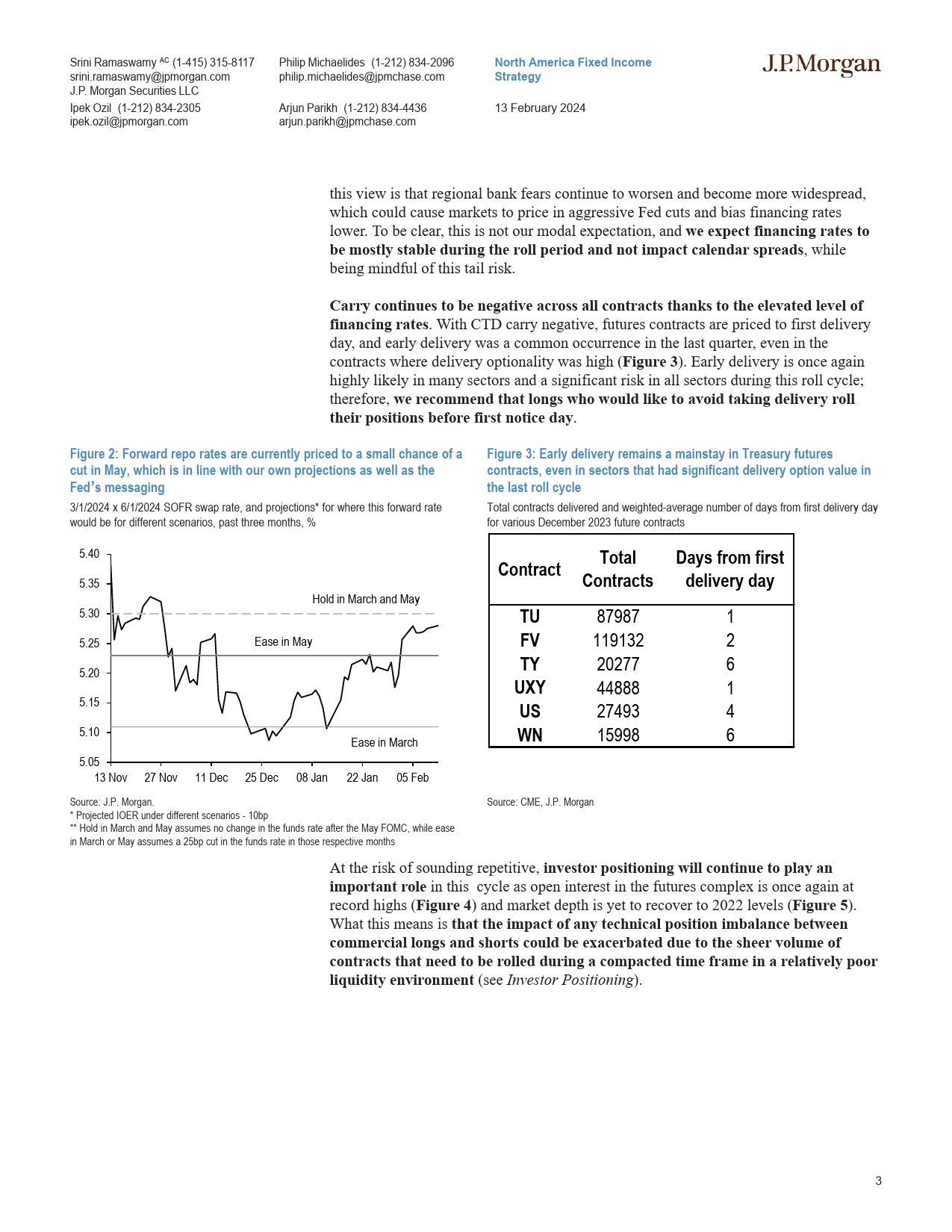

JPMORGANNorthAmericaFixedIncomeStrategy13February2024USbondfuturesrolloveroutlookMarch2024/June2024•Thisrollcycleisdifferentfromrecentexperience,withseveralUSRatesStrategydifferentfactorsatplayininfluencingcalendarspreadsindifferentSriniRamaswamyACsectors.Themacrobackdropisinterestingaswell.AlthoughFedexpectations–andthereforefinancingrates–shouldremainstable,tail(1-415)315-8117riskscontinuetolingerandcouldbiasreporateslowerifrealized.srini.ramaswamy@jpmorgan.com•Carryremainsnegative,andearlydeliveryisasignificantriskinallIpekOzilsectors.Longswhowishtoavoiddeliveryshouldrollbeforefirstnotice(1-212)834-2305day.Also,calendarspreadsaredirectionalwithyieldlevelsinallipek.ozil@jpmorgan.comsectors,andwerecommendrollingpositionsonabpv-weightedbasis.PhilipMichaelides•CTDswitchoptionalityissignificantintheclassicbondcontract,and(1-212)834-2096also–moreunusually–intheback-monthultra-longbondcontract.Inphilip.michaelides@jpmchase.comtheclassicbondcontract,optionvaluesareoverpricedandbasisconvergenceinthefrontpointstocalendarspreadwidening.IntheJuneArjunParikhWNsector,aswitchtothehighcouponNov53sislikelyandwouldresultinmuchlowerwildcardoptionalityifthatweretooccur.This(1-212)834-4436interplaybetweenwildcardandCTDswitchoptionality,inadditiontoarjun.parikh@jpmchase.comCTDrelativevalueconsiderations,leavesusbearishon...

发表评论取消回复