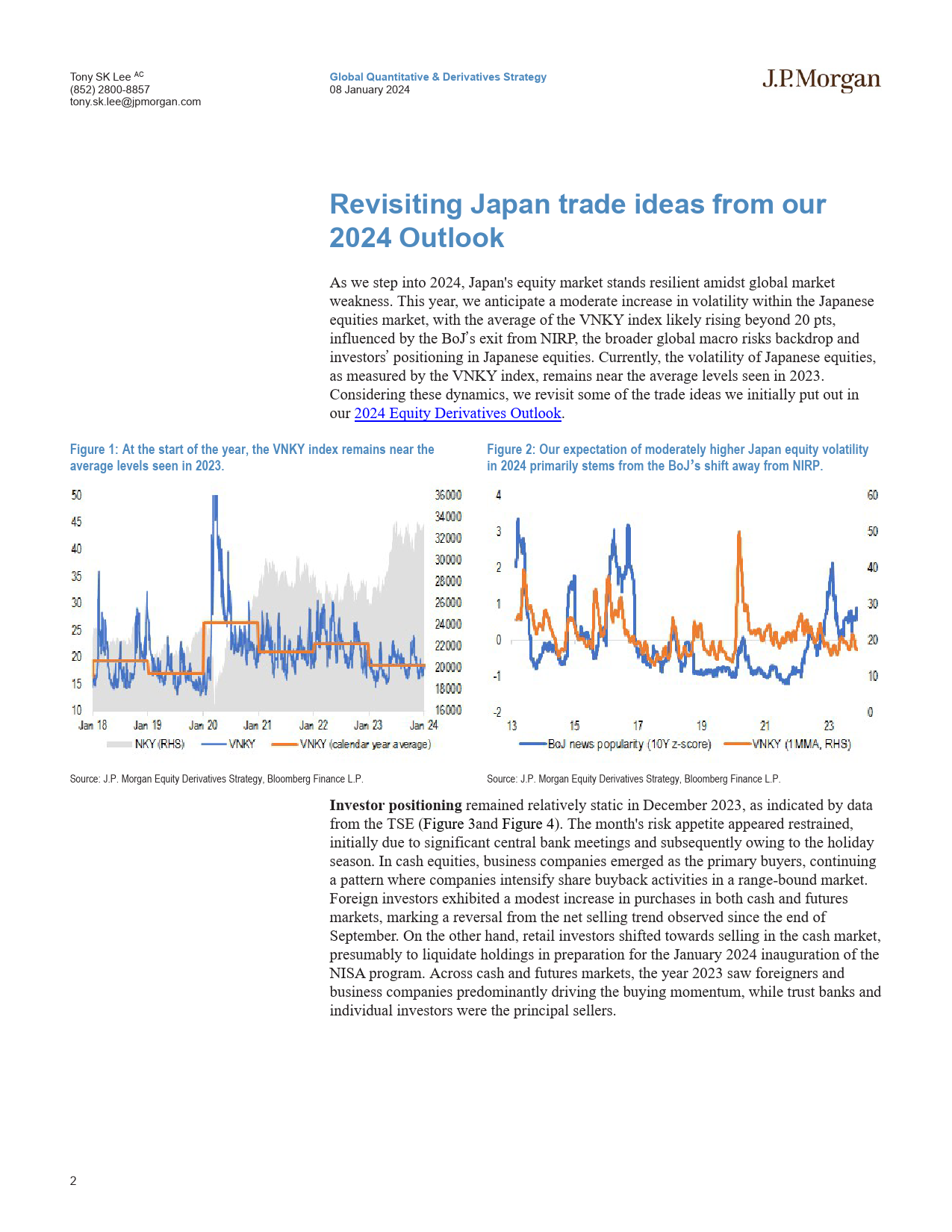

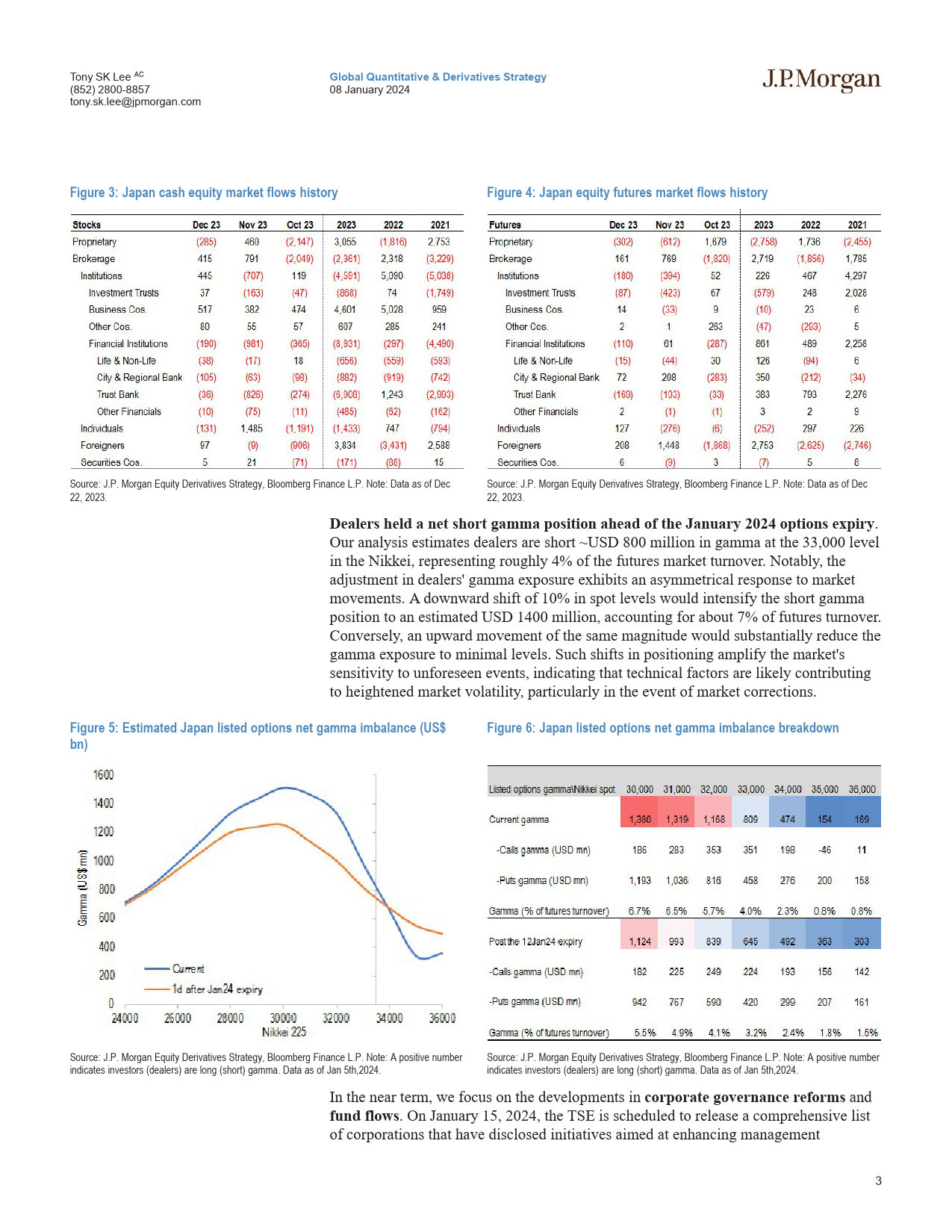

JPMORGANGlobalQuantitative&DerivativesStrategy08January2024AsiaPacificEquityDerivativesHighlightsRevisitingJapantradeideasfromour2024Outlook•Entering2024,Japan'sequitymarketexhibitsresiliencedespiteglobalmarketGlobalQuantitativeandDerivativesStrategyweaknesses.Despiteourexpectationsofamoderateincreaseinvolatility,theVNKYindexcloselyalignswiththeaveragelevelsobservedin2023.InvestorTonySKLeeACactivityinDecember2023remainedrelativelystatic,withbusinessescompaniesactivelybuyingincashequitiesandforeigninvestorsreversing(852)2800-8857theirsellingtrend.DealersholdasizableshortgammapositionintheNikkei,tony.sk.lee@jpmorgan.comindicatingthattechnicalfactorsarelikelycontributingtoheightenedmarketBloombergJPMATONYLEEvolatility,particularlyintheeventofmarketcorrections.CorporateJ.P.MorganSecurities(AsiaPacific)Limited/J.P.governancereformsandtherelaunchoftheNISAprogramarekeynear-termMorganBroking(HongKong)Limitedcatalysts.ThisbackdropunderpinsourpreferenceofstartingtheyearwithbullishJapaneseequitiestradesandTSEreformthematictrades.HaoshunLiuAC•LeveragingcorrelationsforJapaneseequityupside:Forinvestorsagreeing(852)2800-7736haoshun.liu@jpmorgan.comwithourview,werecommendleveragingcorrelationstobuildlongexposureBloombergJPMAHLIUinJapaneseequitiesviathefollowingstructures:a)BuyTPXcallscontingentJ.P.MorganSecurities(...

发表评论取消回复