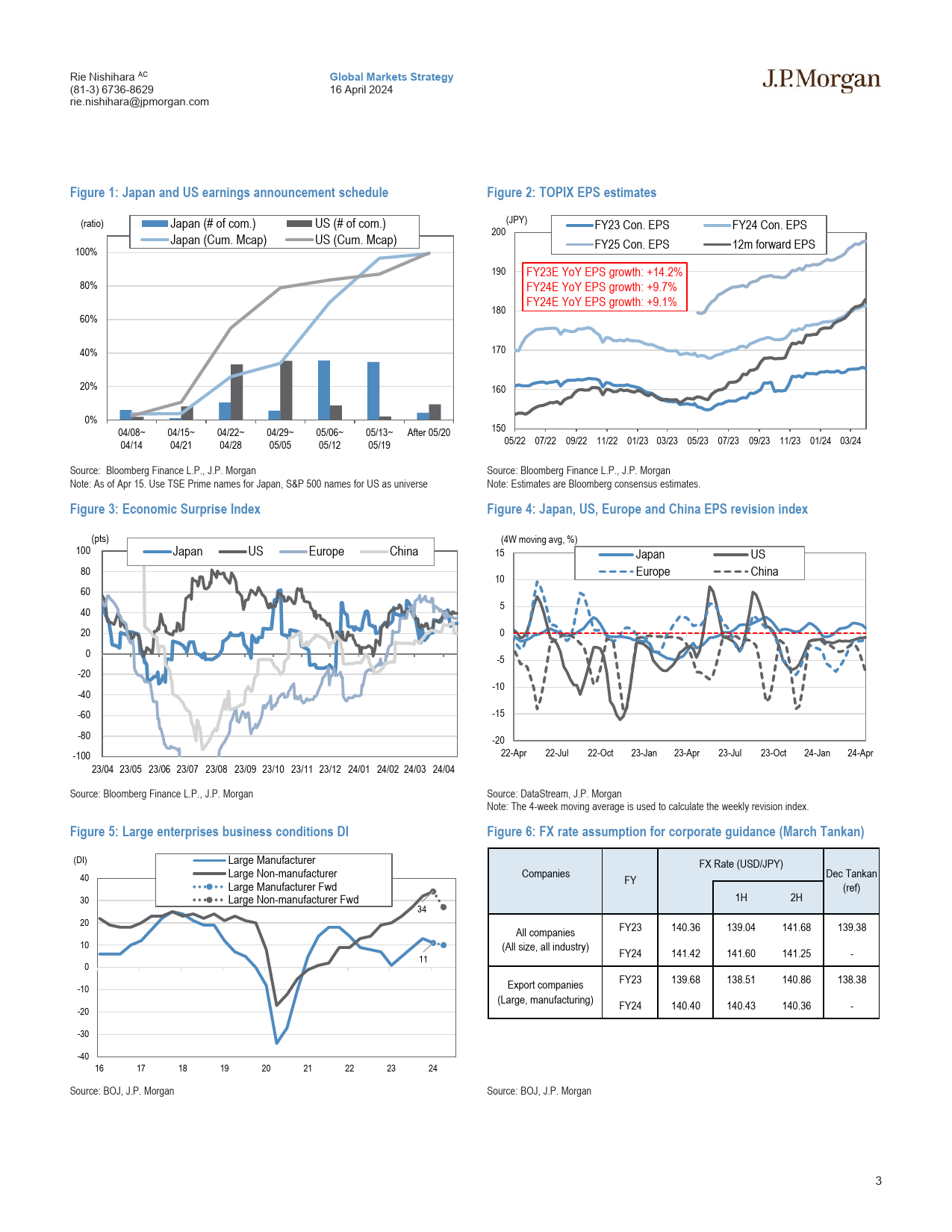

JPMORGANGlobalMarketsStrategy16April2024JapanEquityStrategyJanuary-Marchearningsoutlook:Expectcautiousguidance,leavingroomforrevisingupTOPIXcompanieswillissueinitialFY2024guidance,andwethinktheymayguideEquityStrategyforabiggernetprofitdeclinethanthepast10-yearaverage,despiteexpectingtop-linegrowth.However,werecommendnotworryingtoomuchifthisdoeshappen.ThatisRieNishiharaACtosay,oneyearagotheyissuedFY2023netprofitguidancethatwasweakerthaninitialFY2024guidance,mainlyduetocautiouscostpass-throughassumptions,but(81-3)6736-8629earningsthenovershotsotheynowguidefor10.9%netprofitgrowth.Companiesrie.nishihara@jpmorgan.comassumeacautiousUSD/JPYexchangerateof¥141.4inFY2024,andgivenalsotheJPMorganSecuritiesJapanCo.,Ltd.yen’scurrentfurtherweakeningduetohighUSinterestratespersisting(highforlong),wethinktheywillraiseguidancelater.Weexpectearningsturnaroundsintheenergy,YongGuo,CFAtransportation,realestate,food,informationservices,andconstructionsectors.(81-3)6736-8623•January–Marchearningslikelytobeatguidancebutmatchmarketyong.guo@jpmorgan.comJPMorganSecuritiesJapanCo.,Ltd.expectations?:WeexpectJanuary–Marchquarterearningstobeatcompanyguidance.Japan’seconomicsurpriseindexwaspositive(Figure3),whilerealMansiDasGDPgrowthwasfirmintheUS,andimprovedeveninChina.Further,USD/JPYrose(theyendepreciated)YoYinJanuary–March,andthiss...

发表评论取消回复