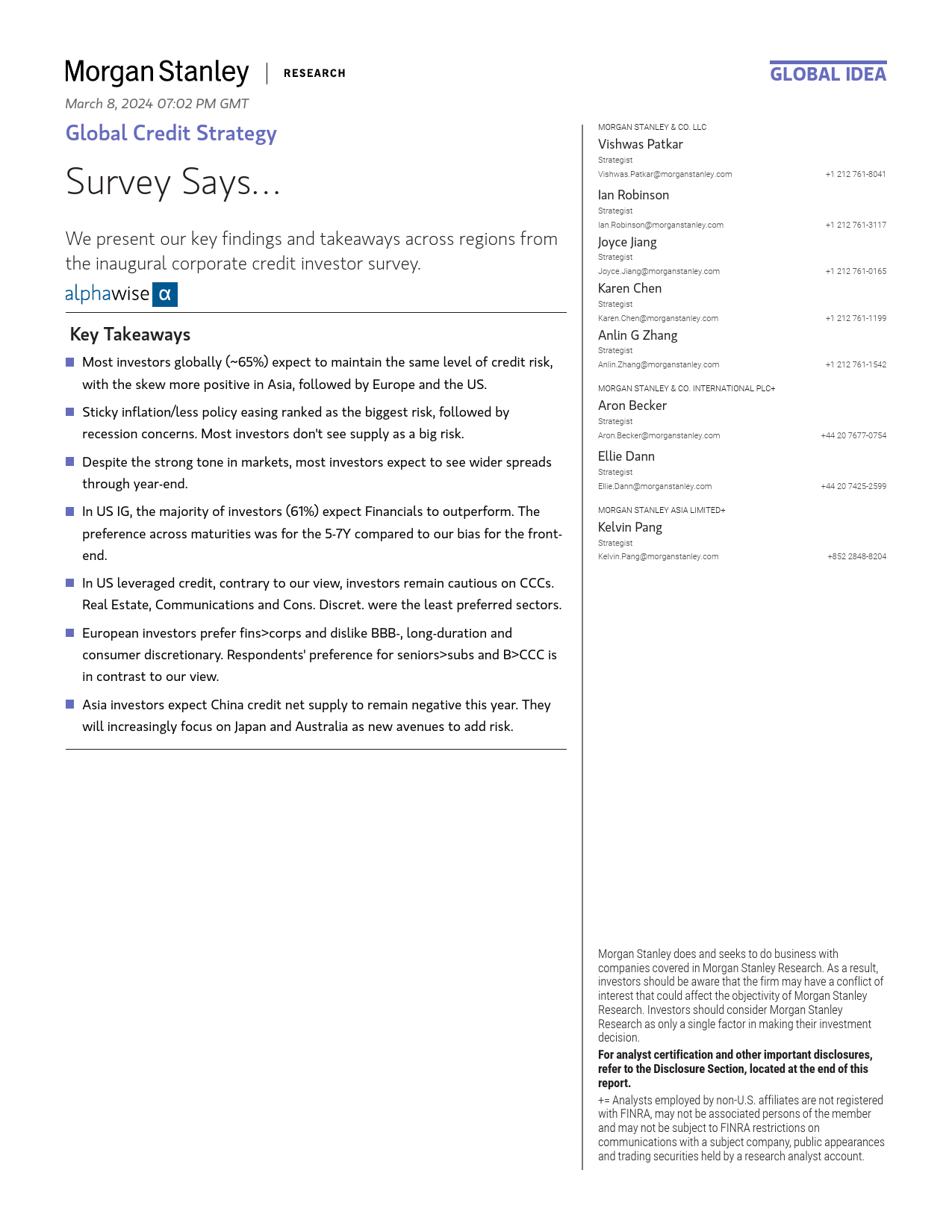

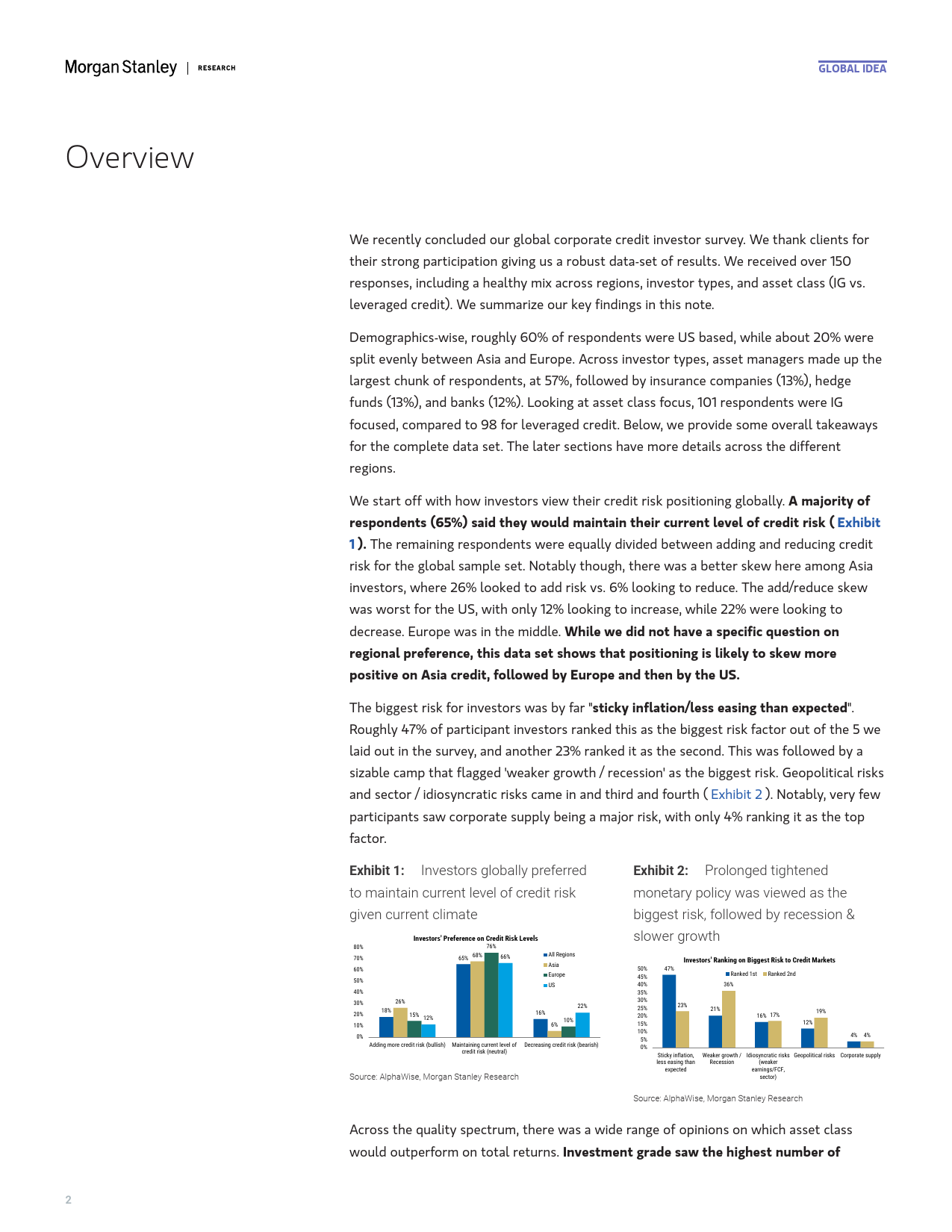

MMarch8,202407:02PMGMTGlobalIdeaGlobalCreditStrategyMorganStanley&Co.LLC+1212761-8041+1212761-3117SurveySays…VishwasPatkar+1212761-0165+1212761-1199WepresentourkeyfindingsandtakeawaysacrossregionsfromStrategist+1212761-1542theinauguralcorporatecreditinvestorsurvey.Vishwas.Patkar@morganstanley.com+44207677-0754MIanRobinson+44207425-2599KeyTakeawaysStrategist+8522848-8204Ian.Robinson@morganstanley.comMostinvestorsglobally(~65%)expecttomaintainthesamelevelofcreditrisk,withtheskewmorepositiveinAsia,followedbyEuropeandtheUS.JoyceJiangStickyinflation/lesspolicyeasingrankedasthebiggestrisk,followedbyStrategistrecessionconcerns.Mostinvestorsdon'tseesupplyasabigrisk.Joyce.Jiang@morganstanley.comDespitethestrongtoneinmarkets,mostinvestorsexpecttoseewiderspreadsKarenChenthroughyear-end.StrategistInUSIG,themajorityofinvestors(61%)expectFinancialstooutperform.TheKaren.Chen@morganstanley.compreferenceacrossmaturitieswasforthe5-7Ycomparedtoourbiasforthefront-end.AnlinGZhangInUSleveragedcredit,contrarytoourview,investorsremaincautiousonCCCs.StrategistRealEstate,CommunicationsandCons.Discret.weretheleastpreferredsectors.Anlin.Zhang@morganstanley.comEuropeaninvestorspreferfins>corpsanddislikeBBB-,long-durationandMorganStanley&Co.Internationalplc+consumerdiscretionary.Respondents'preferenceforseniors>subsandB>CCCisincontrastto...

发表评论取消回复