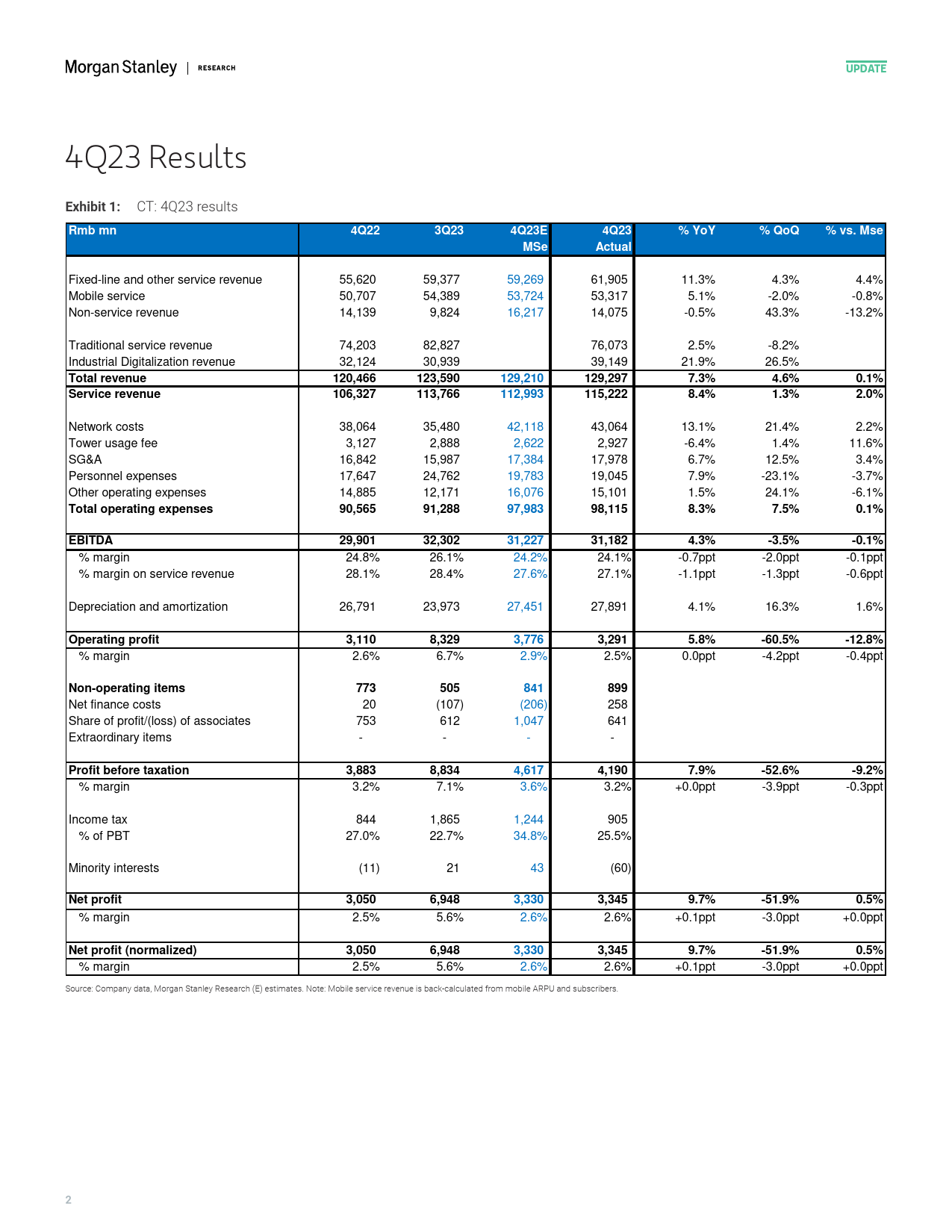

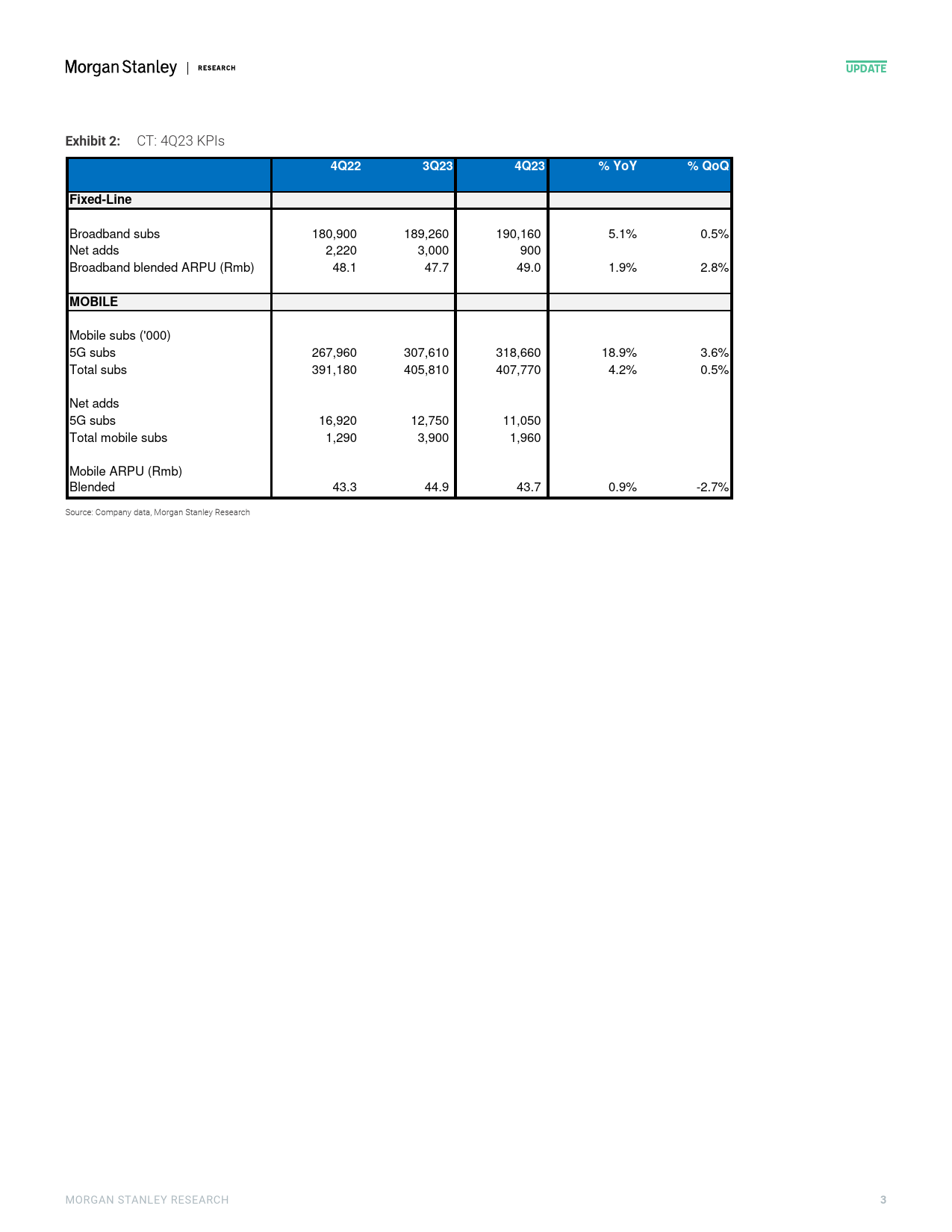

MMarch26,202410:00PMGMTUpdateChinaTelecomAsiaPacificMorganStanleyAsiaLimited++8522848-6918+8522848-7320VisibleandAttractiveDividendGaryYuGrowthEquityAnalystGary.Yu@morganstanley.comAndyHuangEquityAnalystAndy.Huang@morganstanley.comChinaTelecom(0728.HK,728HK)GreaterChinaTelecomsChinaReactiontoearningsIn-lineLargelyunchangedStockRatingOverweightFinancialresultsversusconsensusImpacttonext12-monthIndustryViewAttractiveUnchangedconsensusEPSPricetargetHK$5.00ImpacttoourinvestmentthesisUp/downsidetopricetarget(%)22Shrprice,close(Mar26,2024)HK$4.102023resultsandbriefinghadnomajorsurprise,andthe52-WeekRangemessagesweresimilartopeers'.Weforecasta2023-26dividendShout,dil,curr(mn)HK$4.58-3.32CAGRof10%,giventhecompany'scommitmenttoincreaseMktcap,curr(mn)13,877payoutto>75%by2026andsolidearnings,makingits~7%EV,curr(mn)2024eyieldattractive.StayOWonCT-H.Avgdailytradingvalue(mn)US$70,475US$53,606Overallhealthygrowthin2024:Weforecastservicerevenuetogrow6.3%andnetprofittogrow7.5%in2024,slightlymoderatingfrom2023.ManagementdidnotUS$33provideanyquantitativegrowthguidance.Traditionalservicesshouldbelargelysteady;thecompanyexpectsstablegrowthinmobileandbroadbandARPU.ForFiscalYearEnding12/2312/24e12/25e12/26eIndustrialDigitalization,weforecastrevenuetogrow14%(vs.+18%in2023),ascloudrevenuemoderatesfromahighbase,partiallyoffsetbyrecove...

发表评论取消回复