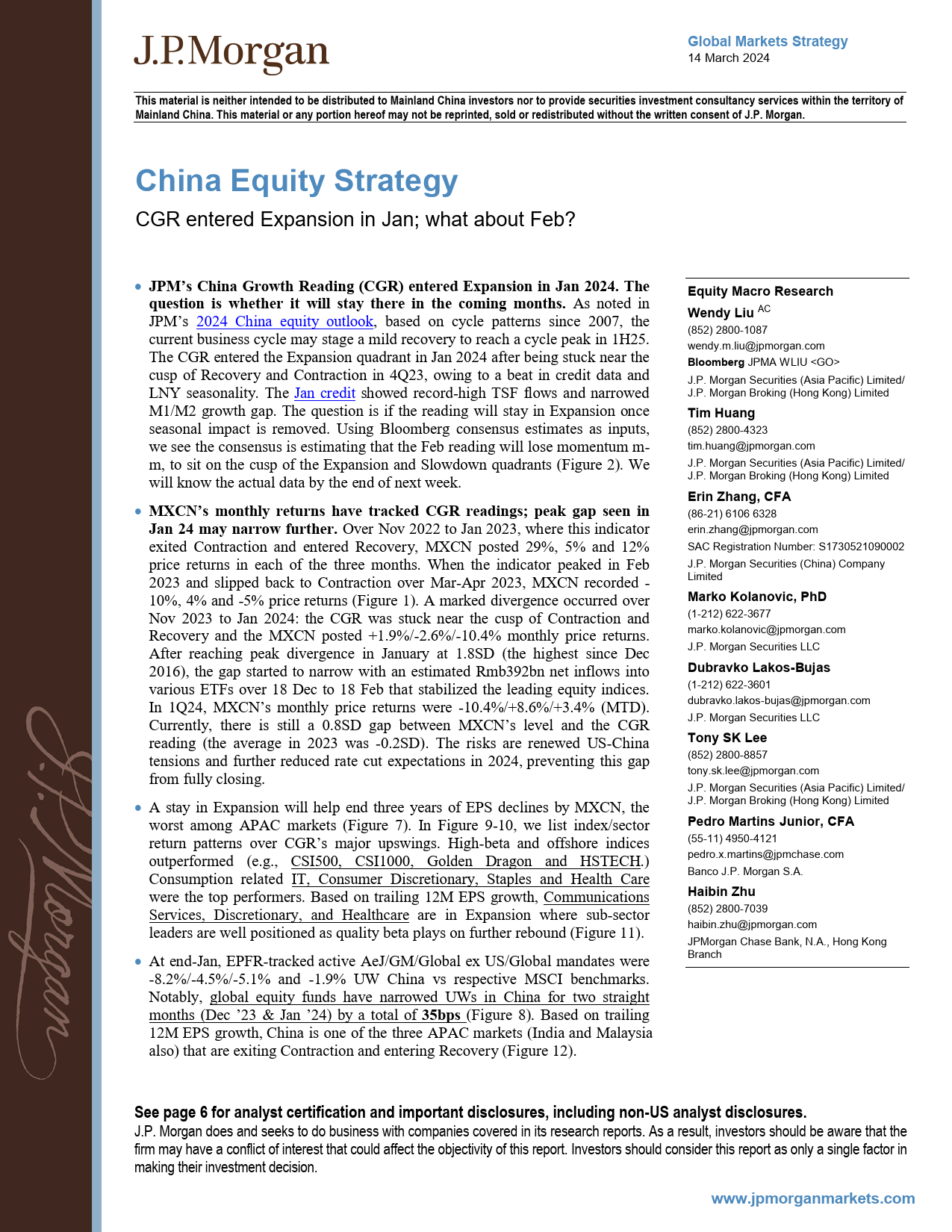

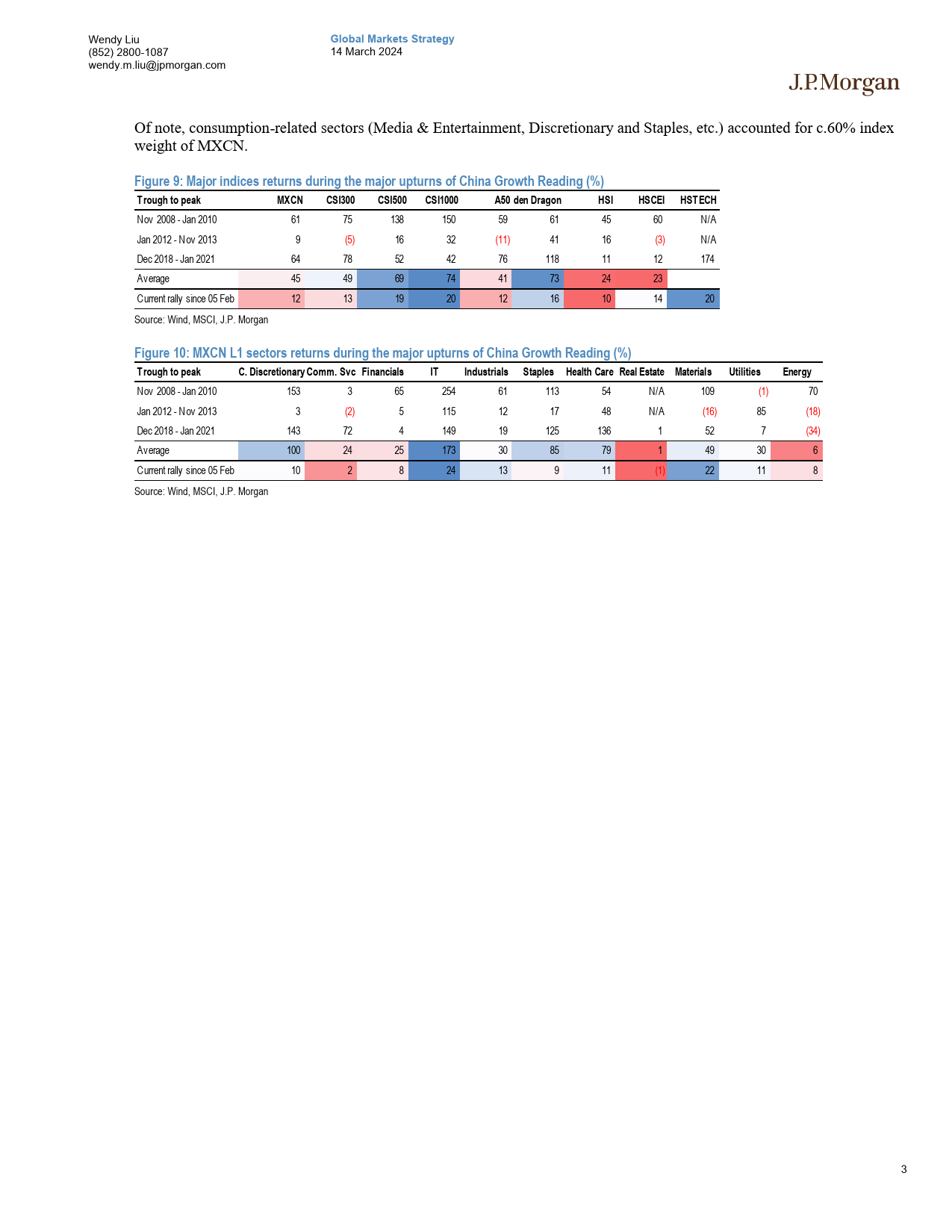

GlobalMarketsStrategy14March2024ThismaterialisneitherintendedtobedistributedtoMainlandChinainvestorsnortoprovidesecuritiesinvestmentconsultancyserviceswithintheterritoryofMainlandChina.Thismaterialoranyportionhereofmaynotbereprinted,soldorredistributedwithoutthewrittenconsentofJ.P.Morgan.ChinaEquityStrategyCGRenteredExpansioninJan;whataboutFeb?JPM’sChinaGrowthReading(CGR)enteredExpansioninJan2024.TheEquityMacroResearchquestioniswhetheritwillstaythereinthecomingmonths.AsnotedinWendyLiuACJPM’s2024Chinaequityoutlook,basedoncyclepatternssince2007,thecurrentbusinesscyclemaystageamildrecoverytoreachacyclepeakin1H25.(852)2800-1087TheCGRenteredtheExpansionquadrantinJan2024afterbeingstucknearthewendy.m.liu@jpmorgan.comcuspofRecoveryandContractionin4Q23,owingtoabeatincreditdataandBloombergJPMAWLIULNYseasonality.TheJancreditshowedrecord-highTSFflowsandnarrowedJ.P.MorganSecurities(AsiaPacific)Limited/M1/M2growthgap.ThequestionisifthereadingwillstayinExpansiononceJ.P.MorganBroking(HongKong)Limitedseasonalimpactisremoved.UsingBloombergconsensusestimatesasinputs,weseetheconsensusisestimatingthattheFebreadingwilllosemomentumm-TimHuangm,tositonthecuspoftheExpansionandSlowdownquadrants(Figure2).Wewillknowtheactualdatabytheendofnextweek.(852)2800-4323tim.huang@jpmorgan.comMXCN’smonthlyreturnshavetrackedCGRreadings;pe...

发表评论取消回复