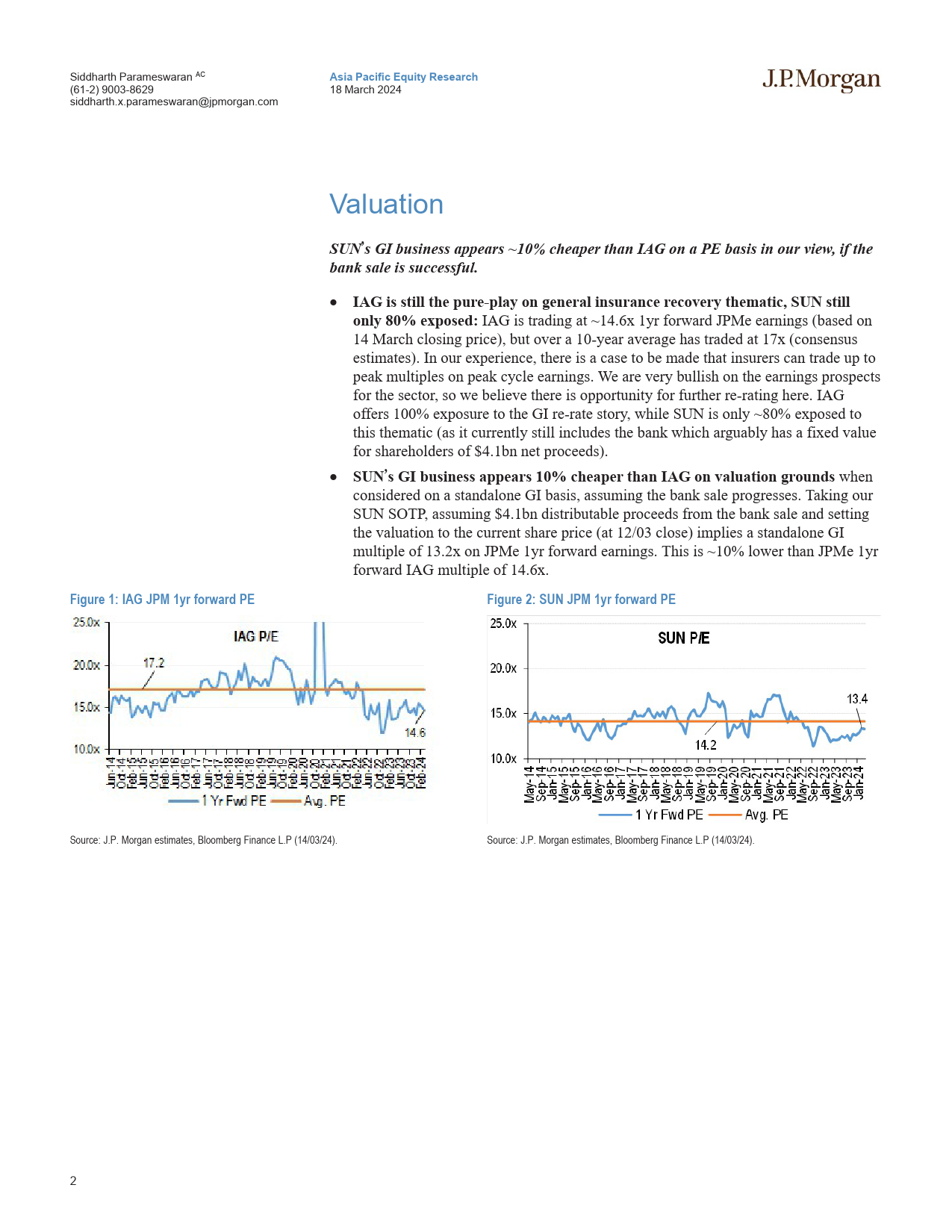

JPMORGANAsiaPacificEquityResearch18March2024ThePriceIsNotRight...IAGvsSUNWhatP/EshouldSUNGItradeonrelativetoIAG?Aswehavehighlightedpreviously,wethinkitishighlylikelythatSUN’sbanksaleAustraliawillproceed.Thisleavesthequestion:“whatmultipleshouldSUN’sGIbusinesstradeonrelativetoIAG?”.WehaveconsideredwhatwebelievetobekeypointsInsuranceandDiversifiedFinancialsofdifferenceforthetwobusinessesthatarelikelytodriveshareprices,andconcludethatSUNshouldtradeonatleastthesamemultipleasIAG(weseeSiddharthParameswaranACnodiscernibledifferenceonaweightedblendofissues),althoughwethinkmorebullishinvestorscouldmountanargumentthatitdeservesasmallP/Epremiumto(61-2)9003-8629IAG.Somekeyargumentsare:(1)SUNhasdemonstratedstrongergrowth;(2)siddharth.x.parameswaran@jpmorgan.comSUNhasdisplayedmorestableearningsovertime;(3)ithasalowerdebttoequityJ.P.MorganSecuritiesAustraliaLimitedratiointhecapitalstructureofthegeneralinsurer;and(4)theydon’thavematerialJVsdilutingearningsfromtheirmostlucrativedivisions.WenotesomeoffsettingTharanJeyathasanpositivesthatimplyapremiumforIAGare:(1)IAGhasaquotasharereinsurancepossiblysupportingmorestableearnings;(2)IAGhashigherRoNTA.Inthisnote(61-2)9003-6098weprovideadetailedanalysiscomparingtheissuesandtheimpliedPEdifferentialtharan.jeyathasan@jpmorgan.comforeachissue.WehaveOWratingsonbothnames.J.P.MorganSe...

发表评论取消回复