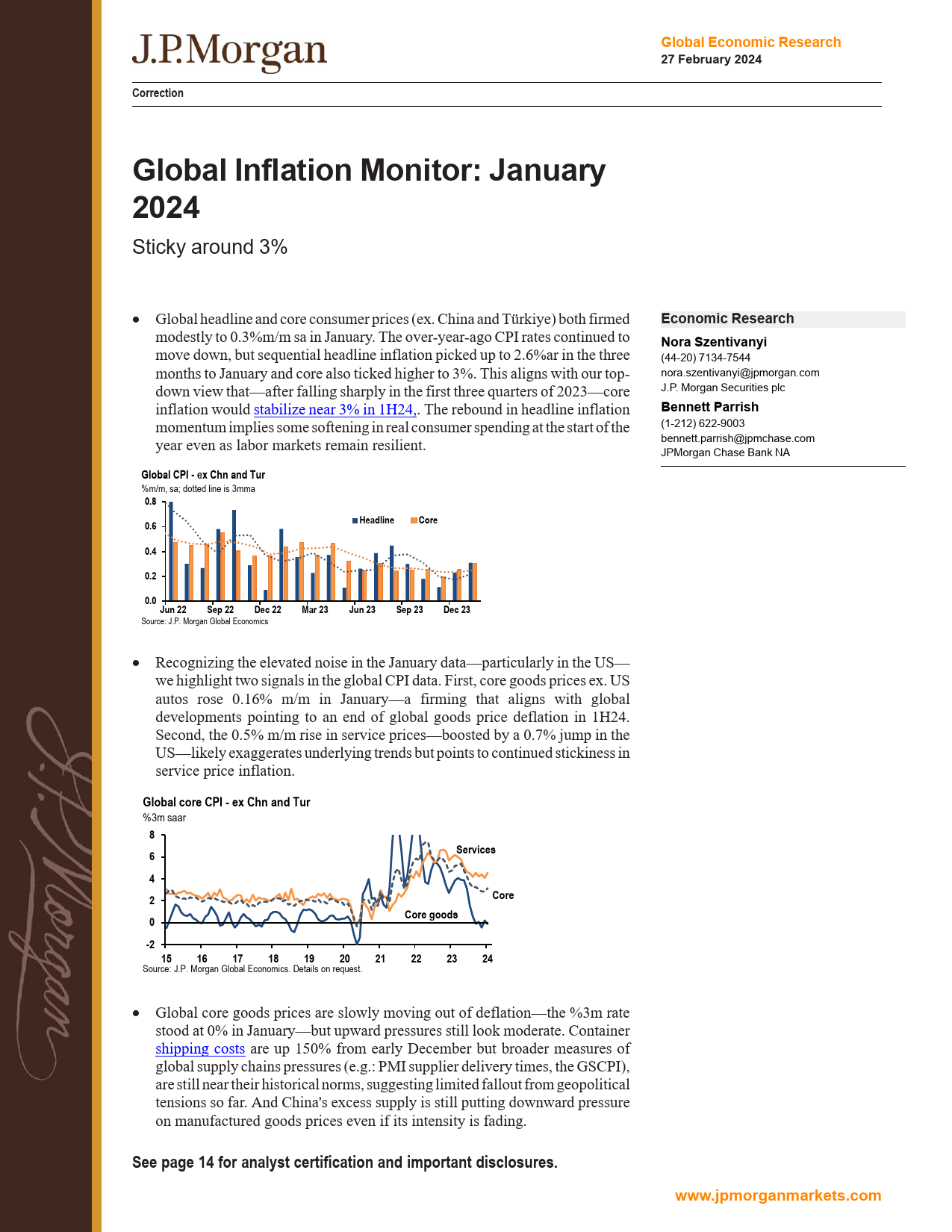

JPMORGANGlobalEconomicResearch27February2024CorrectionGlobalInflationMonitor:January2024Stickyaround3%•Globalheadlineandcoreconsumerprices(ex.ChinaandTürkiye)bothfirmedEconomicResearchmodestlyto0.3%m/msainJanuary.Theover-year-agoCPIratescontinuedtoNoraSzentivanyimovedown,butsequentialheadlineinflationpickedupto2.6%arinthethreemonthstoJanuaryandcorealsotickedhigherto3%.Thisalignswithourtop-(44-20)7134-7544downviewthat––afterfallingsharplyinthefirstthreequartersof2023––corenora.szentivanyi@jpmorgan.cominflationwouldstabilizenear3%in1H24,.ThereboundinheadlineinflationJ.P.MorganSecuritiesplcmomentumimpliessomesofteninginrealconsumerspendingatthestartoftheyearevenaslabormarketsremainresilient.BennettParrish(1-212)622-9003bennett.parrish@jpmchase.comJPMorganChaseBankNAGlobalCPI-exChnandTurHeadlineCore%m/m,sa;dottedlineis3mma0.80.60.40.20.0Sep22Dec22Mar23Jun23Sep23Dec23Jun22Source:J.P.MorganGlobalEconomics•RecognizingtheelevatednoiseintheJanuarydata––particularlyintheUS––wehighlighttwosignalsintheglobalCPIdata.First,coregoodspricesex.USautosrose0.16%m/minJanuary––afirmingthatalignswithglobaldevelopmentspointingtoanendofglobalgoodspricedeflationin1H24.Second,the0.5%m/mriseinserviceprices––boostedbya0.7%jumpintheUS––likelyexaggeratesunderlyingtrendsbutpointstocontinuedstickinessinservicepriceinflation...

发表评论取消回复