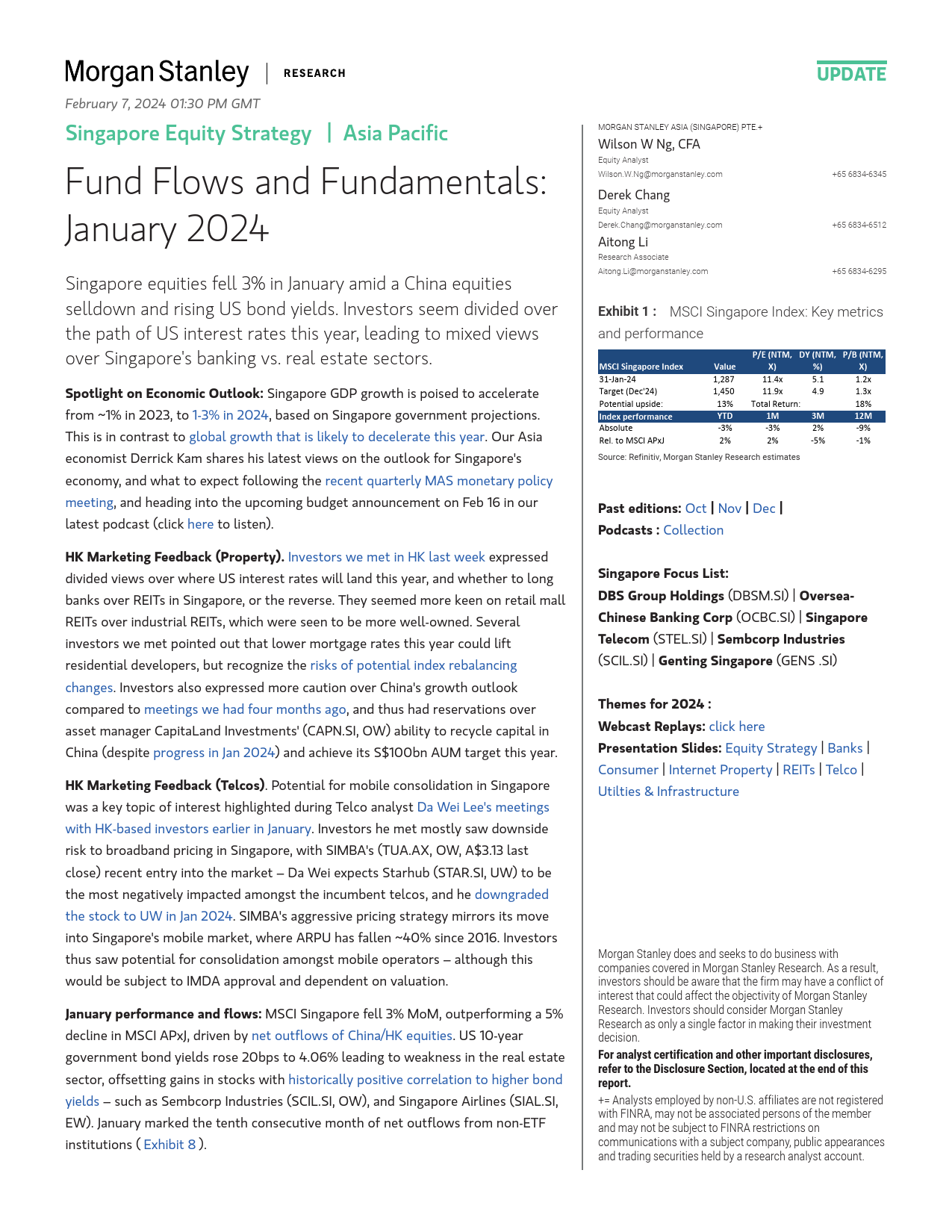

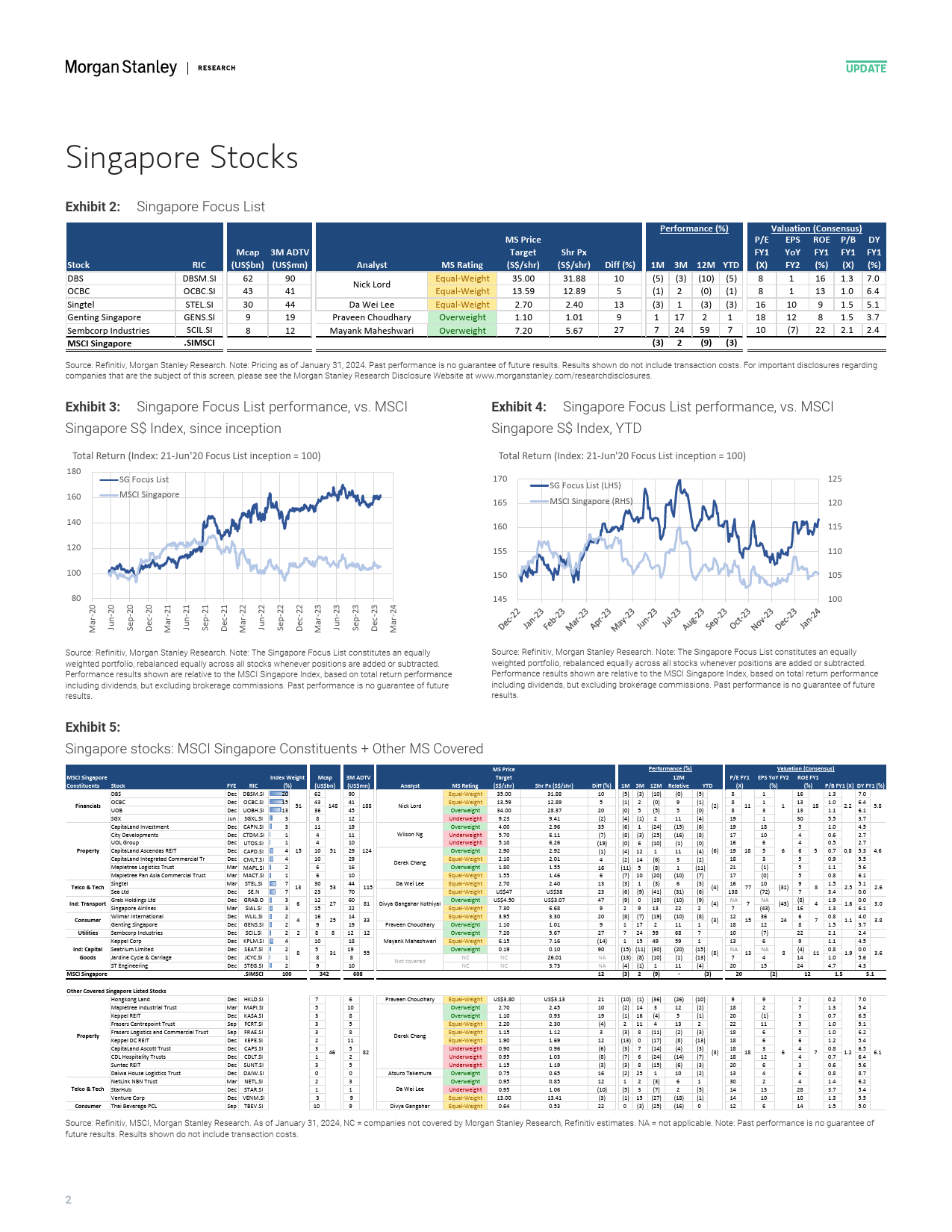

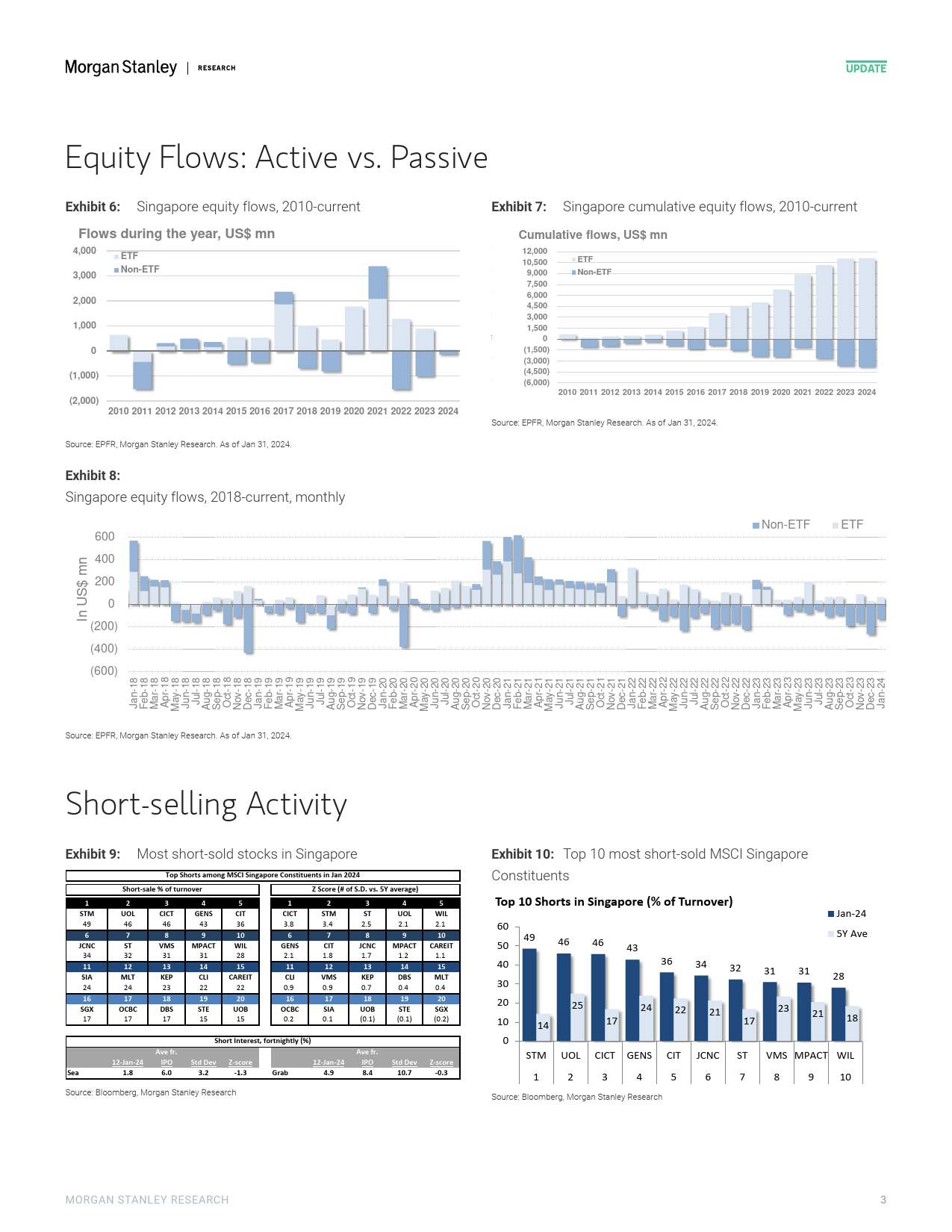

MFebruary7,202401:30PMGMTUpdateSingaporeEquityStrategyAsiaPacificMorganStanleyAsia(Singapore)Pte.++656834-6345+656834-6512FundFlowsandFundamentals:WilsonWNg,CFA+656834-6295January2024EquityAnalystSingaporeequitiesfell3%inJanuaryamidaChinaequitiesWilson.W.Ng@morganstanley.comselldownandrisingUSbondyields.InvestorsseemdividedoverthepathofUSinterestratesthisyear,leadingtomixedviewsDerekChangoverSingapore'sbankingvs.realestatesectors.EquityAnalystSpotlightonEconomicOutlook:SingaporeGDPgrowthispoisedtoaccelerateDerek.Chang@morganstanley.comfrom~1%in2023,to1-3%in2024,basedonSingaporegovernmentprojections.Thisisincontrasttoglobalgrowththatislikelytodeceleratethisyear.OurAsiaAitongLieconomistDerrickKamshareshislatestviewsontheoutlookforSingapore'seconomy,andwhattoexpectfollowingtherecentquarterlyMASmonetarypolicyResearchAssociatemeeting,andheadingintotheupcomingbudgetannouncementonFeb16inourAitong.Li@morganstanley.comlatestpodcast(clickheretolisten).Exhibit1:MSCISingaporeIndex:KeymetricsHKMarketingFeedback(Property).InvestorswemetinHKlastweekexpresseddividedviewsoverwhereUSinterestrateswilllandthisyear,andwhethertolongandperformancebanksoverREITsinSingapore,orthereverse.TheyseemedmorekeenonretailmallREITsoverindustrialREITs,whichwereseentobemorewell-owned.SeveralP/E(NTM,DY(NTM,P/B(NTM,investorswemetpointedoutthatlowe...

发表评论取消回复