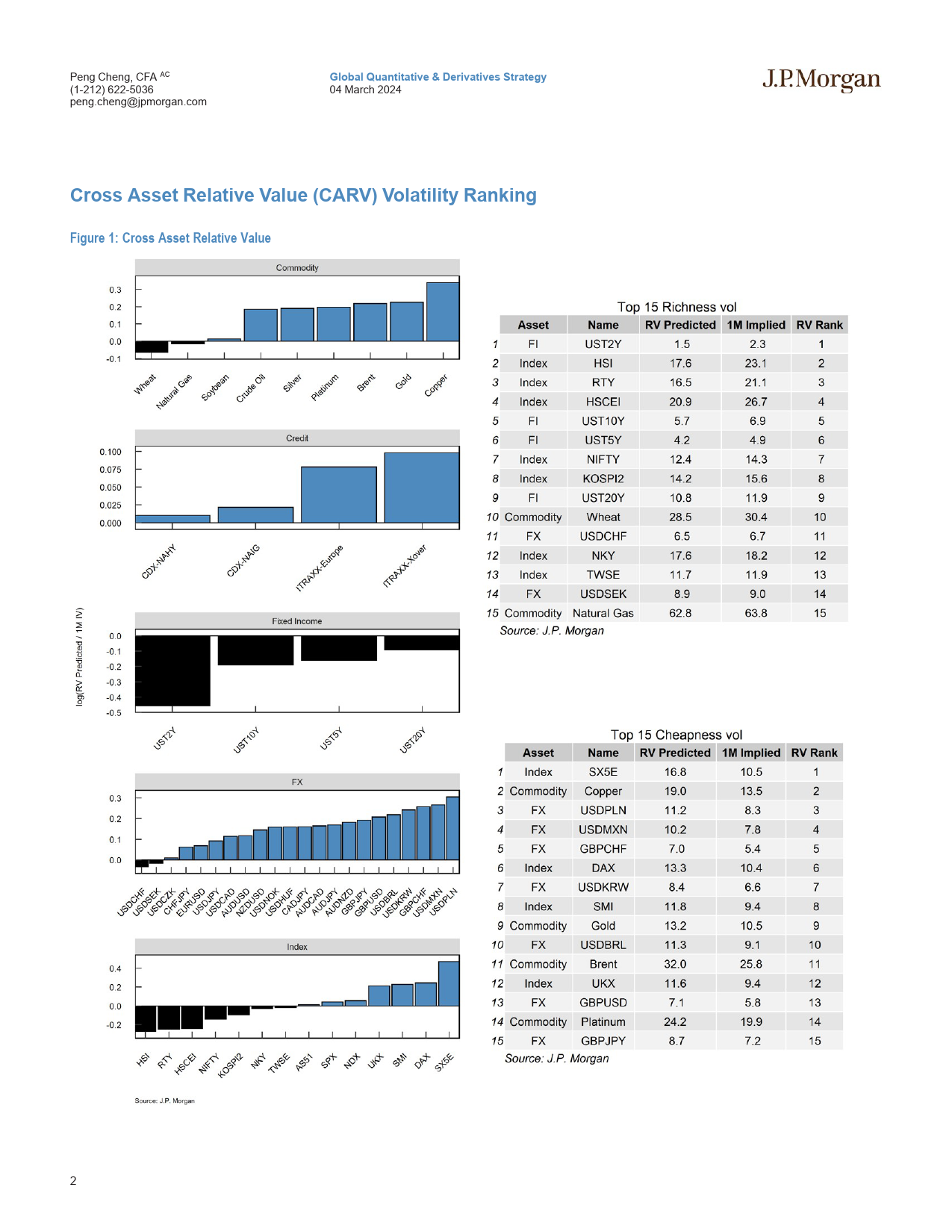

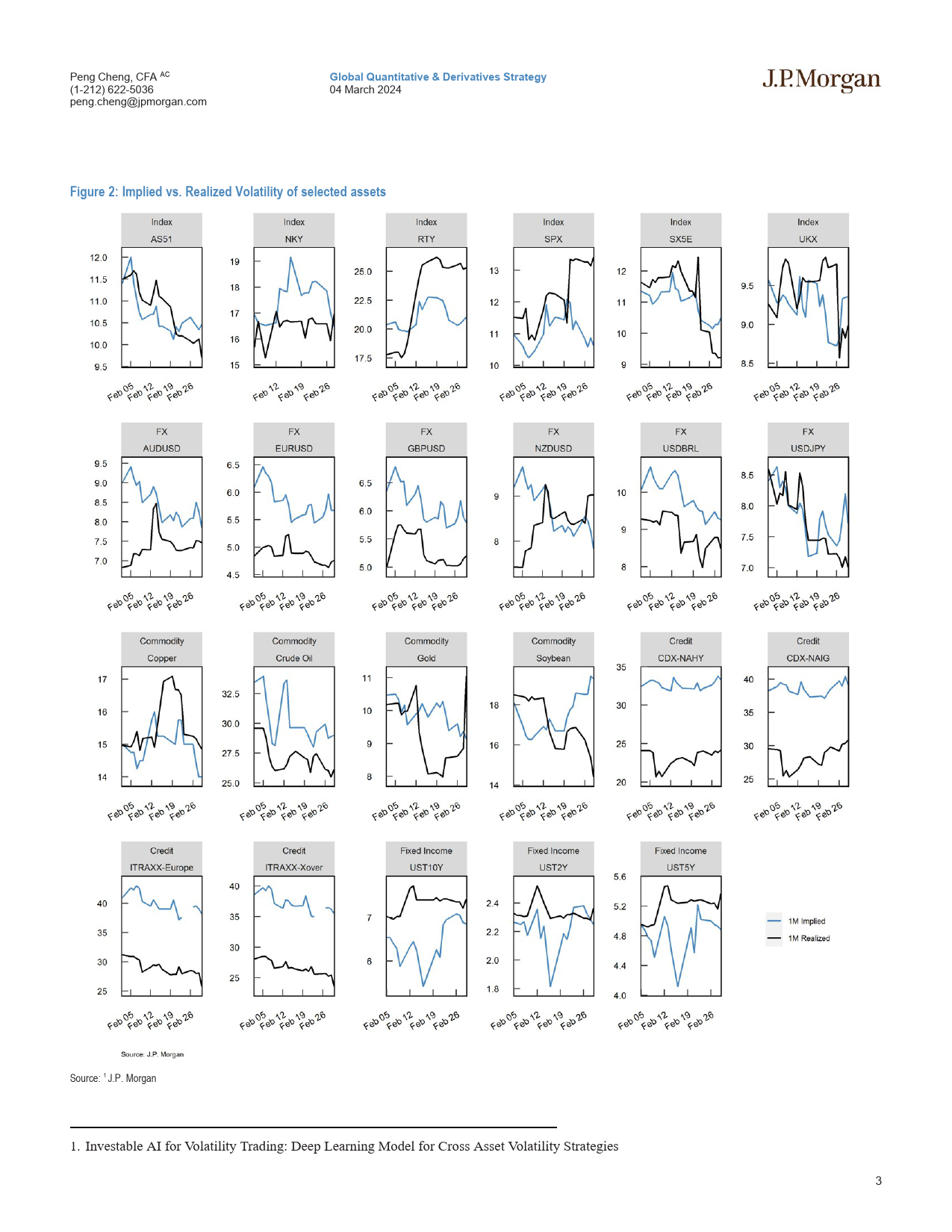

JPMORGANGlobalQuantitative&DerivativesStrategy04March2024CrossAssetVolatilityMachineLearningBasedTradeRecommendations•Atthecross-assetlevel,theCARVmodelisbroadlydefensiveinFXandGlobalQuantitativeandDerivativesStrategyCredit,screeningRatesasrichandmixedonCommodityandEquityIndices(Figure1).ThereisashiftfromrichtocheapinUSD/JPY,USD/CHFandPengCheng,CFAACCrosAetRlaivVu(1-212)622-5036peng.cheng@jpmorgan.comiTraxxXover,andcheaptorichinAS51andwheat(Figure2).Impliedvs.RazVotyfcLadislavJankovicAC•InETFRVmodel,EEMandFXIscreenasoneoneofthecheapest/richestfrom(1-212)834-9618ladislav.jankovic@jpmchase.comthemodel,makinganattractivevolarbitrageopportunitygiventhehighcorrelationofthetwo.Therefore,werecommendtakingadvantageoftheEmmaWuACtechnicaldislocationandgoingshort1MATMvolonFXIvs.longEEM.Inaddition,EMBtopstherichendofthespectrum,andIWMandHYGvolalso(1-212)834-2174appeartoembedsubstantialriskpremiumfollowingthestrongUSdatalastemma.wu@jpmorgan.comweek.Ourportfolioshowsa3-weekgainsof+2.6,+1.4and+2.4vegainselling1MvolinHYG,EMBandLQD,respectively.Therefore,werecommendMarkoKolanovic,PhDholdingtheirshortvolpositionsuntilmaturity(Figure3).(1-212)622-3677ETFsRelativVumarko.kolanovic@jpmorgan.comJ.P.MorganSecuritiesLLC•SimilartotheETFRVmodel,EEMappeartobeanattractivevarbuyingcandidateintheVarSwapmodelfromlongerendofthecurve.Addit...

发表评论取消回复