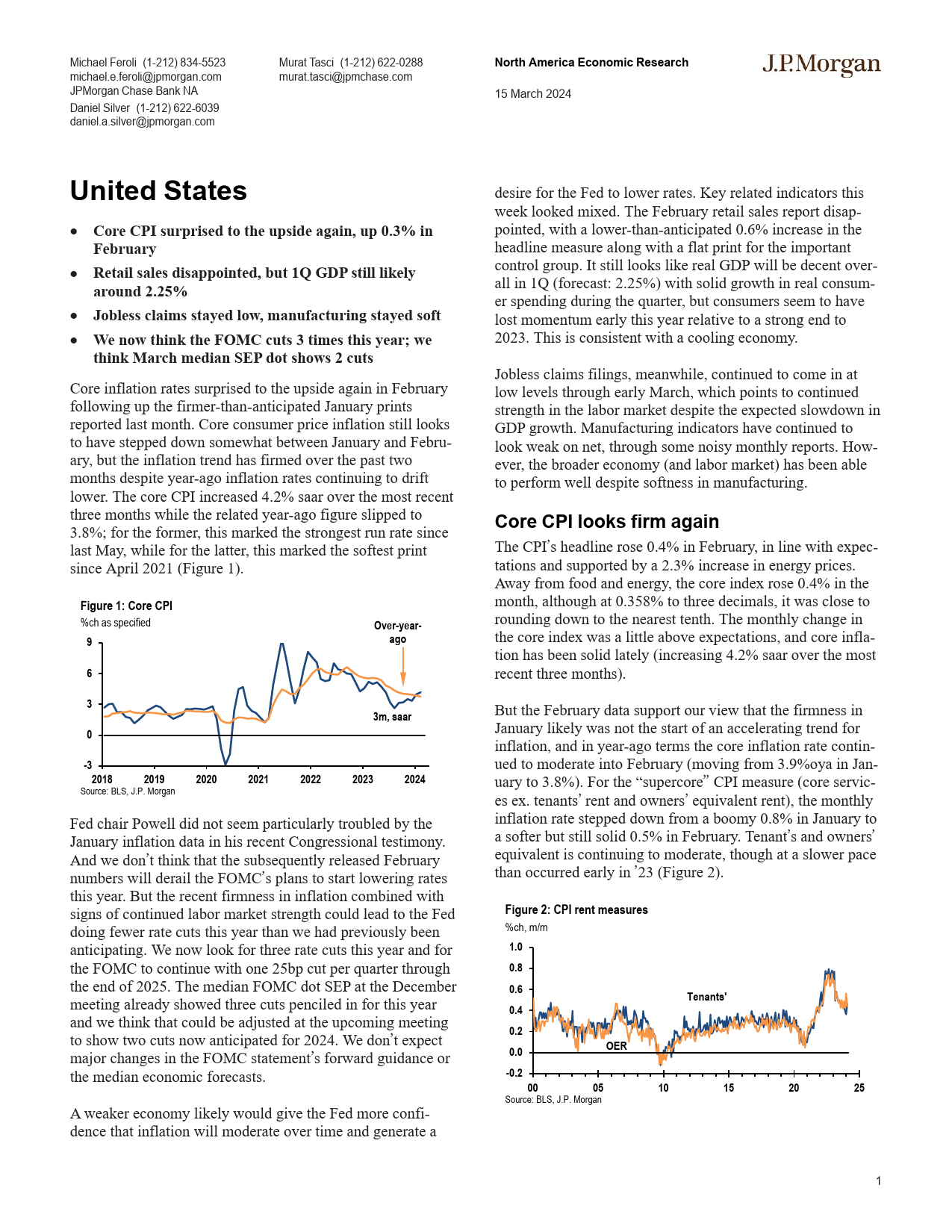

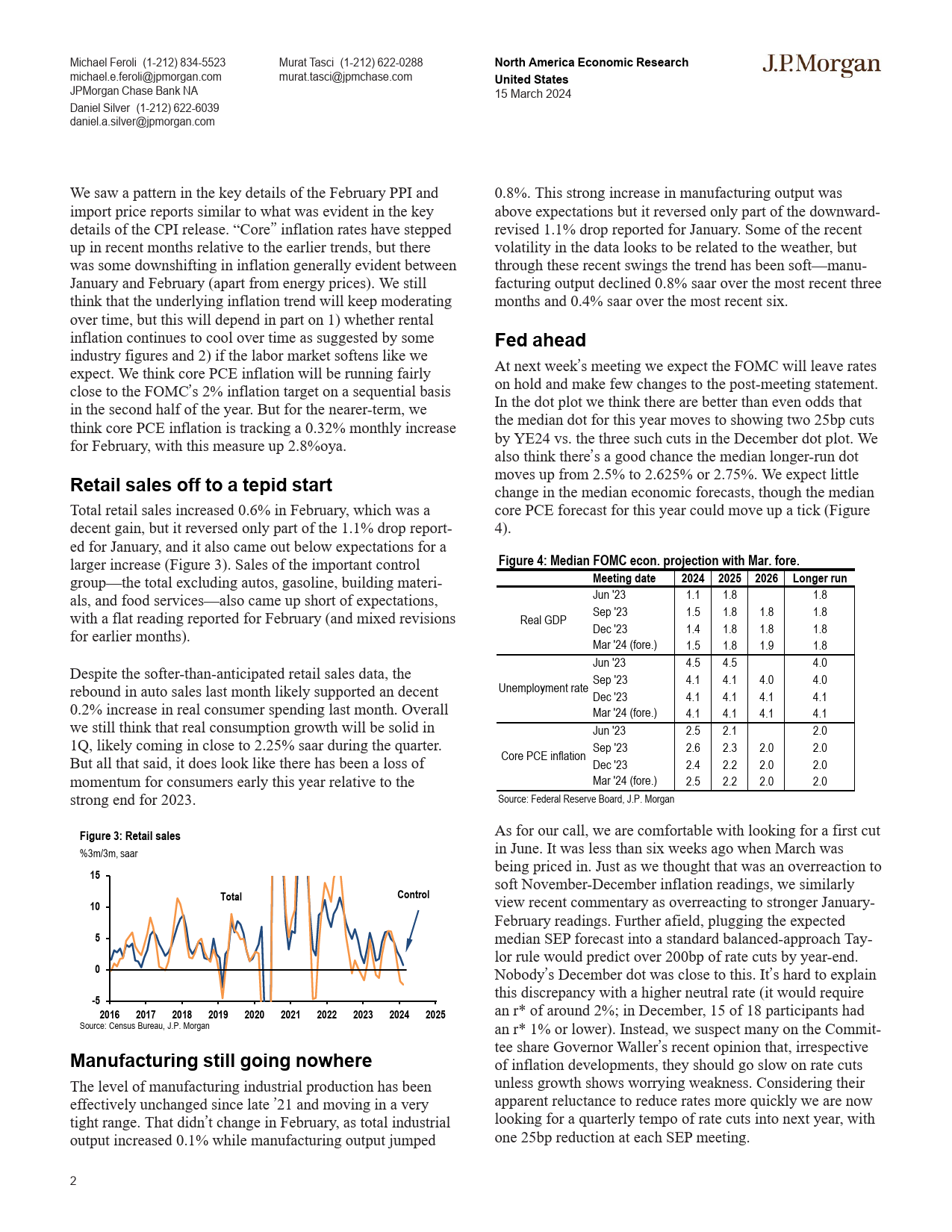

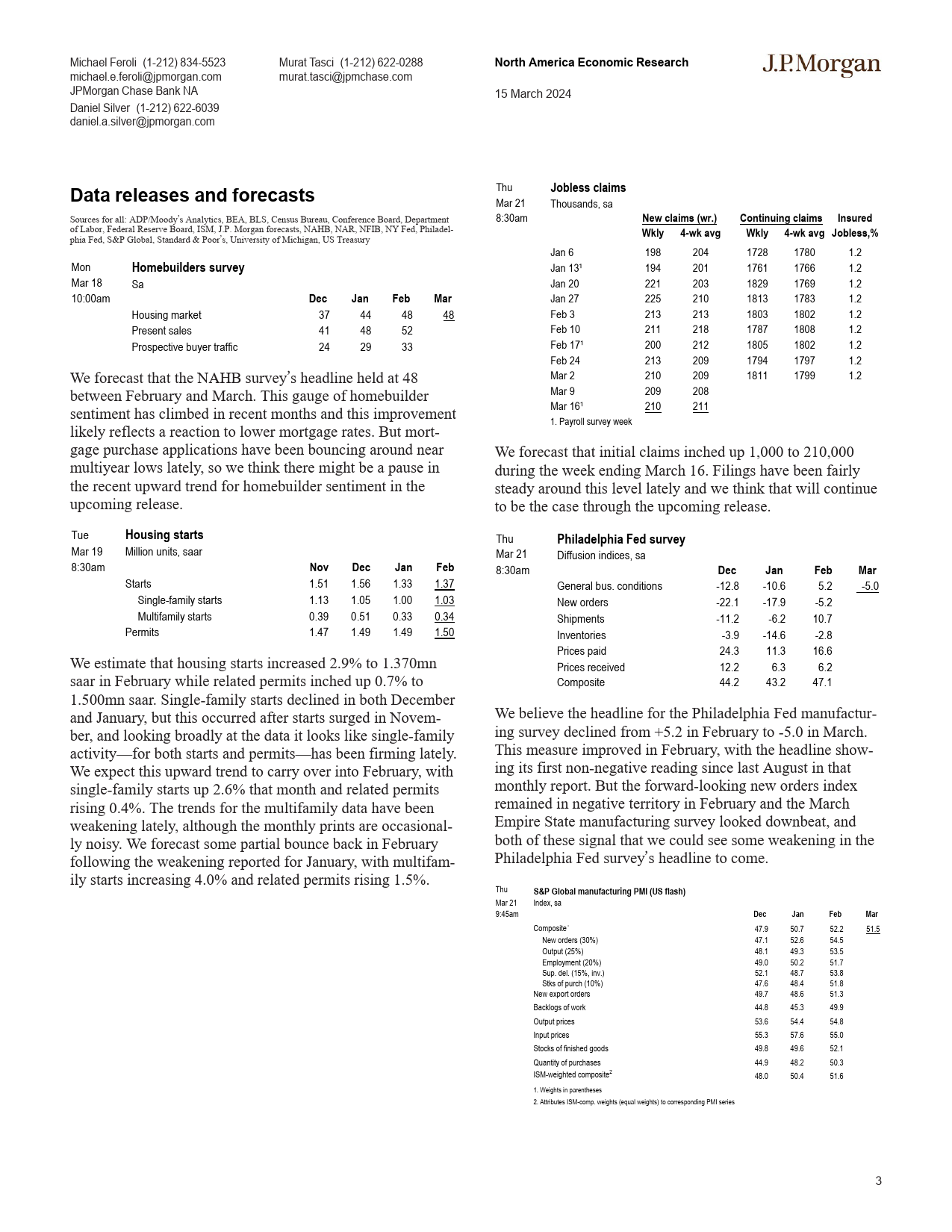

MichaelFeroli(1-212)834-5523MuratTasci(1-212)622-0288NorthAmericaEconomicResearchJPMORGANmichael.e.feroli@jpmorgan.commurat.tasci@jpmchase.com15March2024JPMorganChaseBankNADanielSilver(1-212)622-6039daniel.a.silver@jpmorgan.comUnitedStatesdesirefortheFedtolowerrates.Keyrelatedindicatorsthisweeklookedmixed.TheFebruaryretailsalesreportdisap-•CoreCPIsurprisedtotheupsideagain,up0.3%inpointed,withalower-than-anticipated0.6%increaseintheheadlinemeasurealongwithaflatprintfortheimportantFebruarycontrolgroup.ItstilllookslikerealGDPwillbedecentover-allin1Q(forecast:2.25%)withsolidgrowthinrealconsum-•Retailsalesdisappointed,but1QGDPstilllikelyerspendingduringthequarter,butconsumersseemtohavelostmomentumearlythisyearrelativetoastrongendtoaround2.25%2023.Thisisconsistentwithacoolingeconomy.•Joblessclaimsstayedlow,manufacturingstayedsoftJoblessclaimsfilings,meanwhile,continuedtocomeinat•WenowthinktheFOMCcuts3timesthisyear;welowlevelsthroughearlyMarch,whichpointstocontinuedstrengthinthelabormarketdespitetheexpectedslowdowninthinkMarchmedianSEPdotshows2cutsGDPgrowth.Manufacturingindicatorshavecontinuedtolookweakonnet,throughsomenoisymonthlyreports.How-CoreinflationratessurprisedtotheupsideagaininFebruaryever,thebroadereconomy(andlabormarket)hasbeenablefollowingupthefirmer-than-anticipatedJanuaryprintstoperformwelldespite...

发表评论取消回复