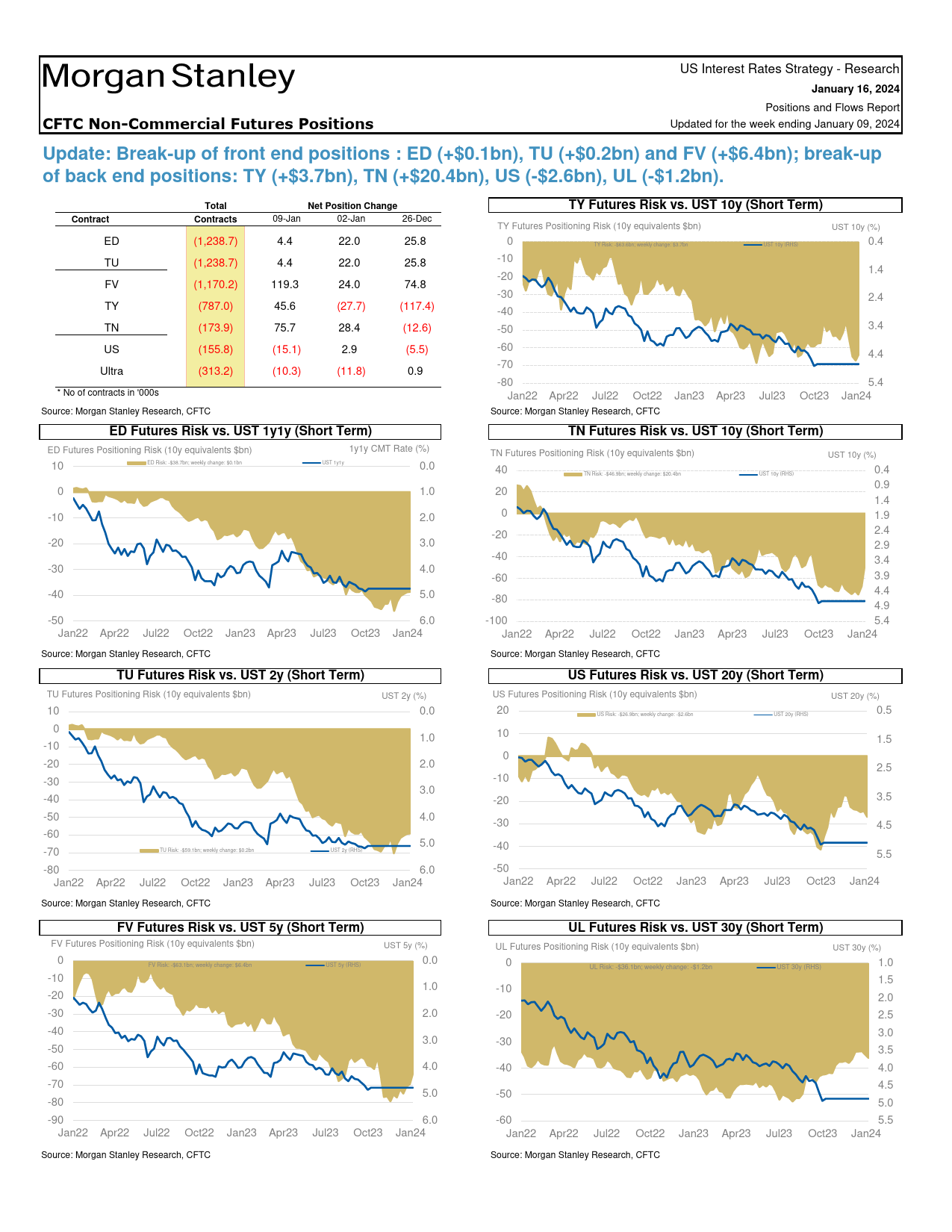

MORGANSTANLEYRESEARCHJanuary16,202401:52PMGMTMorganStanley&Co.LLCFrancescoGrechiStrategistFrancesco.Grechi@morganstanley.com+1212761-1005NorthInterestRateStrategyAmericaPositionsandFlowsReportaAmericaWeeklyMarketPositioningDataNorthCFTCNon-CommercialFuturesPositions(P.2)TICDataForeignFlows(P.16)(UpdatedfortheweekendingJanuary09,2024,paramounts)(UpdatedforOctober,paramounts)WeeklyChange:OctobersawnetoutflowsintheUSTreasuries,ledbyprivateinvestors.Totalfrontend:$10.5bnLuxemborg(+$16.9bn)andBelgium(+$14.0bn)werethetopTreasuryED:$0.1bnTU:$0.2bnFV:$6.4bnbuyersinOctober.UnitedKingdom(-$33.8bn)andJapan(-$26.4bn)Totalbackend:$16.6bnwerethetopsellers.TY:$3.7bnTN:$20.4bnUS:-$2.6bnUL:-$1.2bnPFRPrimerP.18TradersinFinancialFutures(P.4)(UpdatedfortheweekendingJanuary09,2024,paramounts)ChartoftheWeek:AssetManagers:AssetManagers'fundpositioninginSOFRfuturesisatitshighestlevelUpdate:Puton$0.6bnofasteepenerposition.Increasedtheiroverthepastsixmonths.netshorts(%ofOI)tothehighestlevelinlastsixmonthsinSOFRcontracts.Source:MorganStanleyResearch,CFTCLeveragedFunds:Update:Puton$1.2bnofasteepenerposition.Decreasedtheirnetshorts(%ofOI)tothelowestlevelinsixmonthsinTNcontracts.Dealers:Update:Puton-$1.3bnofaflattenerposition.Increasedtheirnetshorts(%ofOI)tothehighestlevelinlastsixmonthsinULcontracts.OtherReportables:Update:Puton$4.5bnofa...

发表评论取消回复