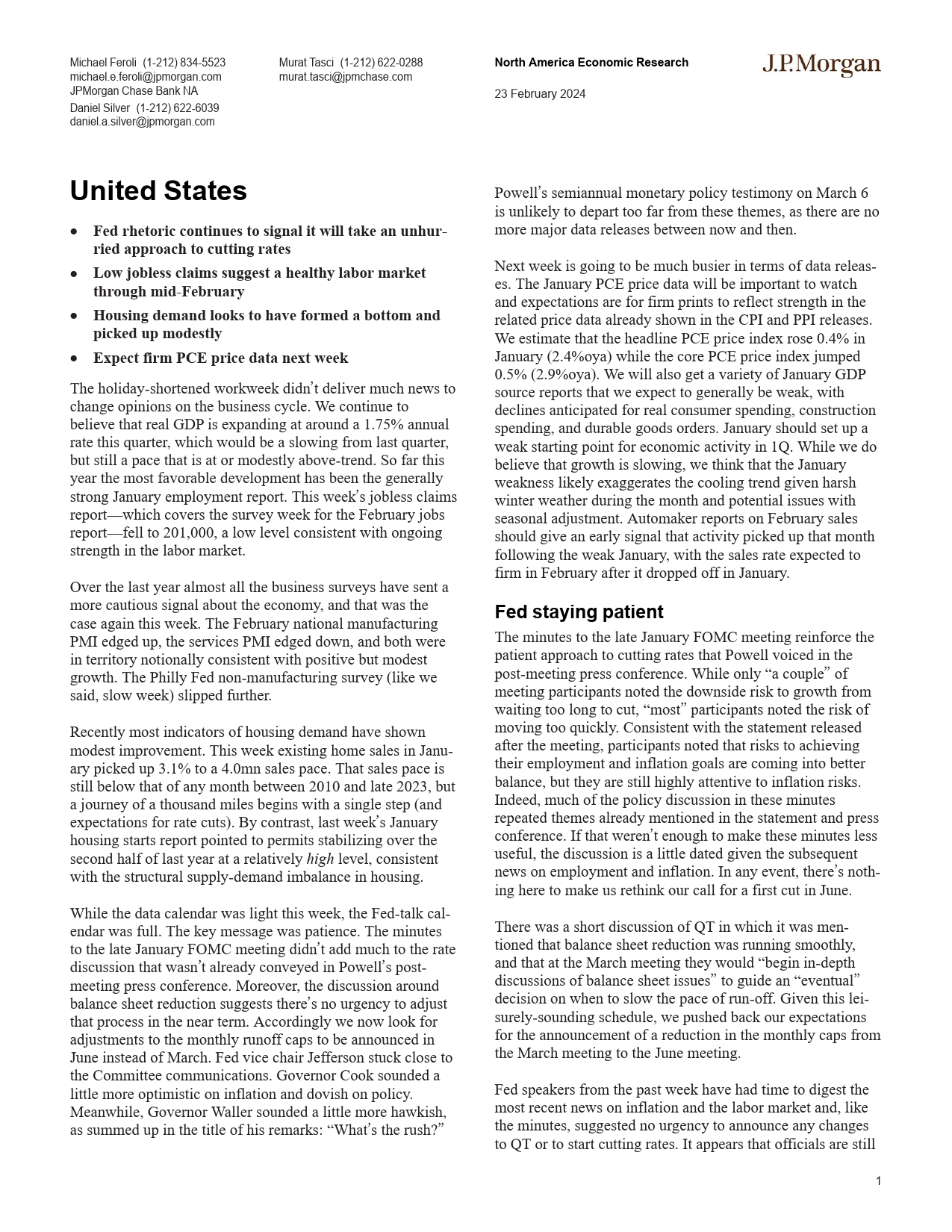

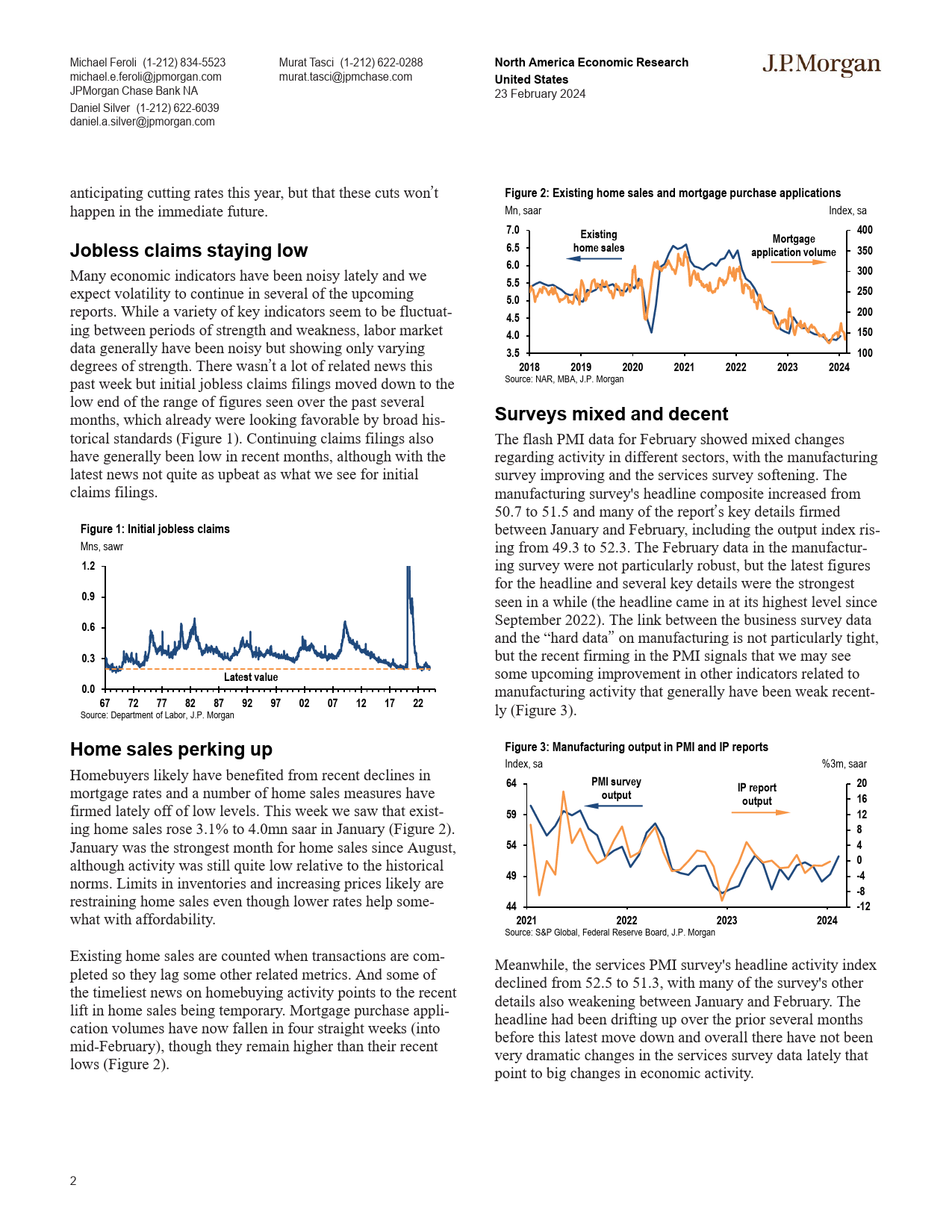

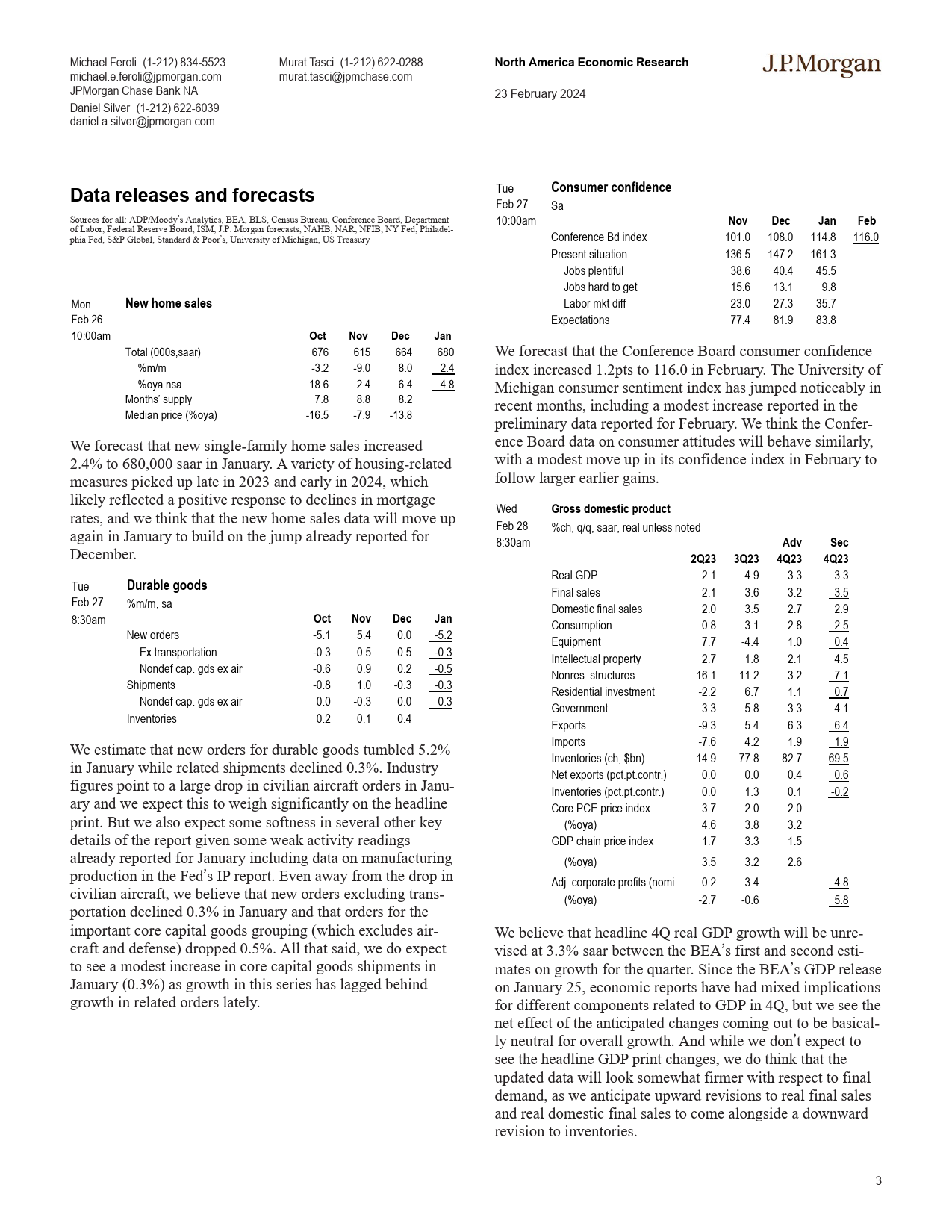

MichaelFeroli(1-212)834-5523MuratTasci(1-212)622-0288NorthAmericaEconomicResearchJPMORGANmichael.e.feroli@jpmorgan.commurat.tasci@jpmchase.com23February2024JPMorganChaseBankNADanielSilver(1-212)622-6039daniel.a.silver@jpmorgan.comUnitedStatesPowell’ssemiannualmonetarypolicytestimonyonMarch6isunlikelytodeparttoofarfromthesethemes,asthereareno•Fedrhetoriccontinuestosignalitwilltakeanunhur-moremajordatareleasesbetweennowandthen.riedapproachtocuttingratesNextweekisgoingtobemuchbusierintermsofdatareleas-es.TheJanuaryPCEpricedatawillbeimportanttowatch•LowjoblessclaimssuggestahealthylabormarketandexpectationsareforfirmprintstoreflectstrengthintherelatedpricedataalreadyshownintheCPIandPPIreleases.throughmid-FebruaryWeestimatethattheheadlinePCEpriceindexrose0.4%inJanuary(2.4%oya)whilethecorePCEpriceindexjumped•Housingdemandlookstohaveformedabottomand0.5%(2.9%oya).WewillalsogetavarietyofJanuaryGDPsourcereportsthatweexpecttogenerallybeweak,withpickedupmodestlydeclinesanticipatedforrealconsumerspending,constructionspending,anddurablegoodsorders.Januaryshouldsetupa•ExpectfirmPCEpricedatanextweekweakstartingpointforeconomicactivityin1Q.Whilewedobelievethatgrowthisslowing,wethinkthattheJanuaryTheholiday-shortenedworkweekdidn’tdelivermuchnewstoweaknesslikelyexaggeratesthecoolingtrendgivenharshchangeopinionsonthebusines...

发表评论取消回复