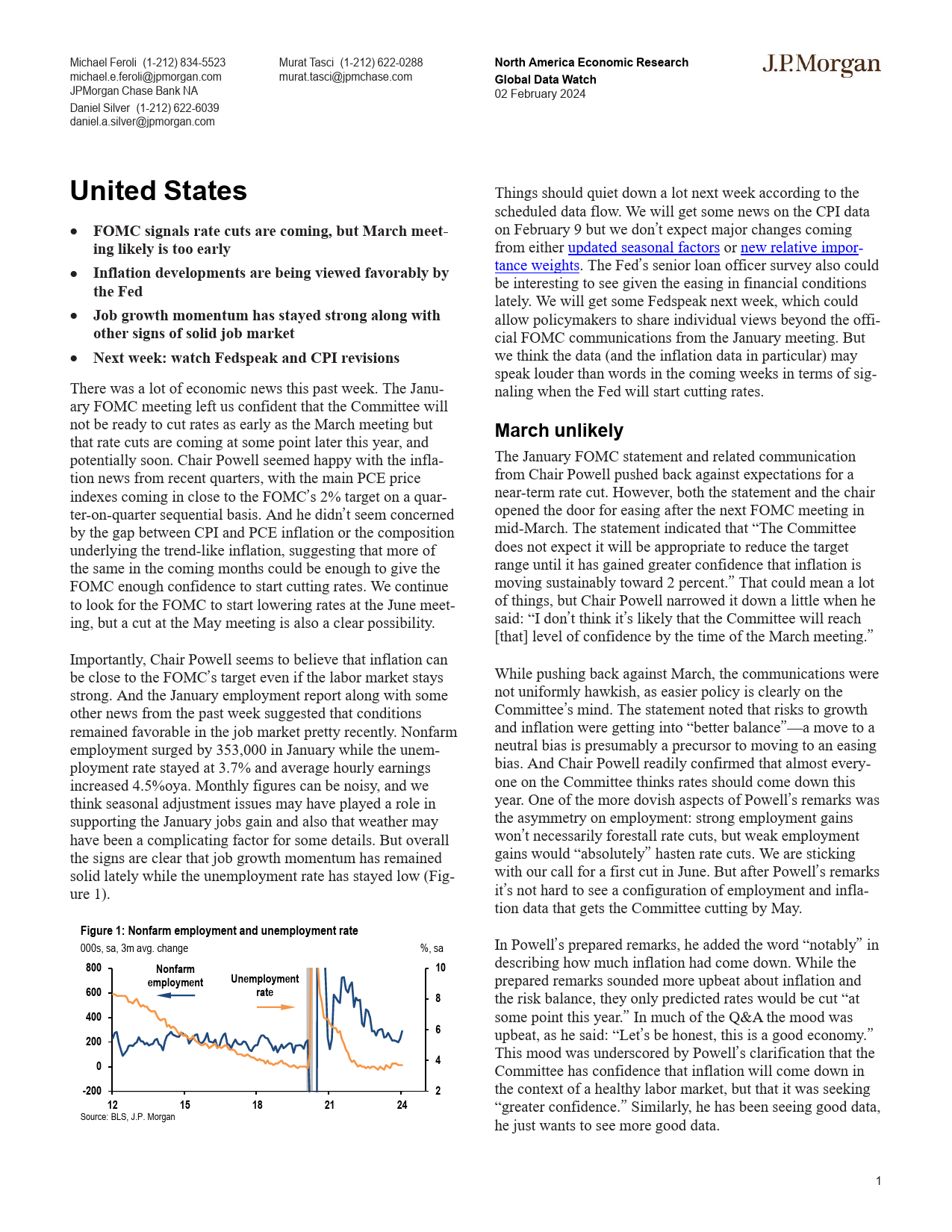

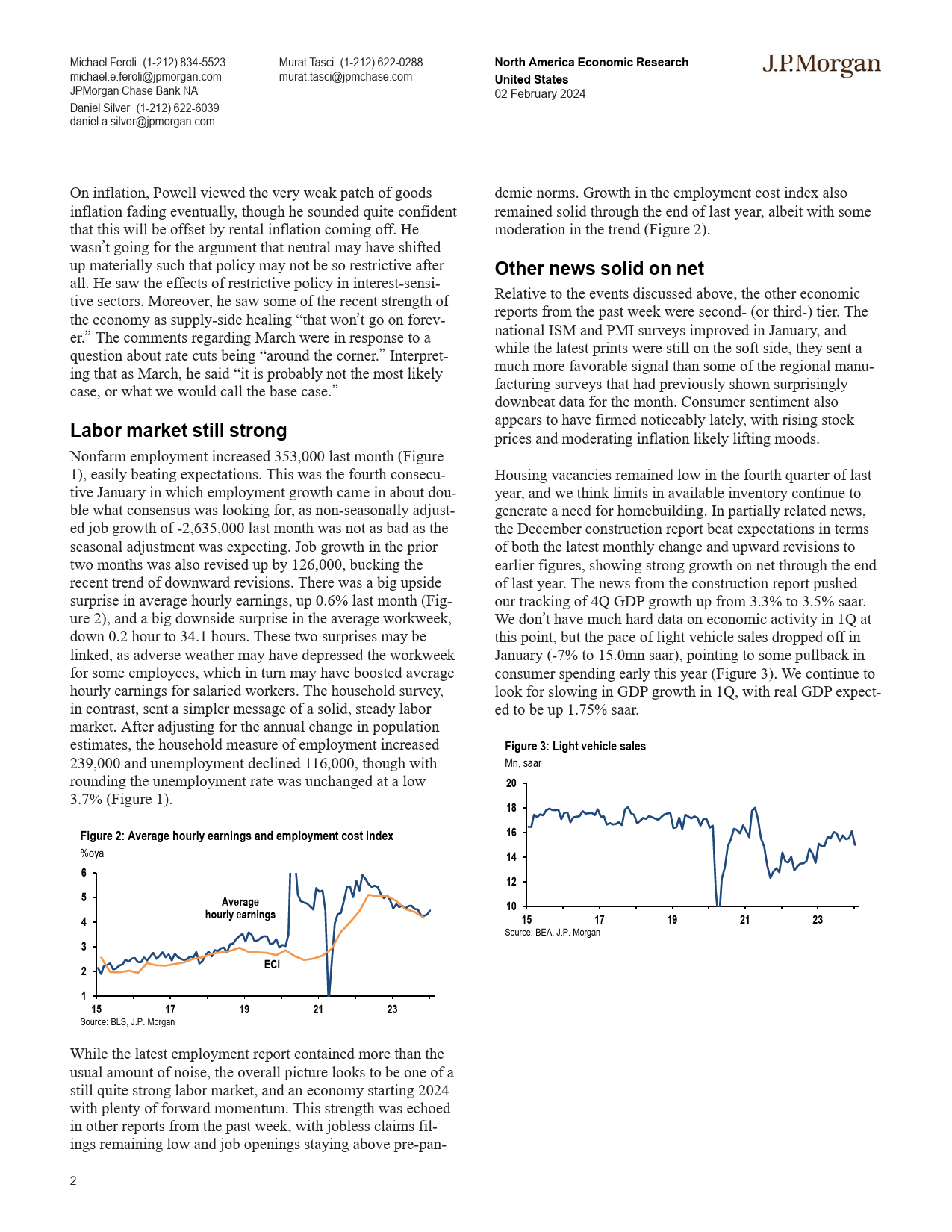

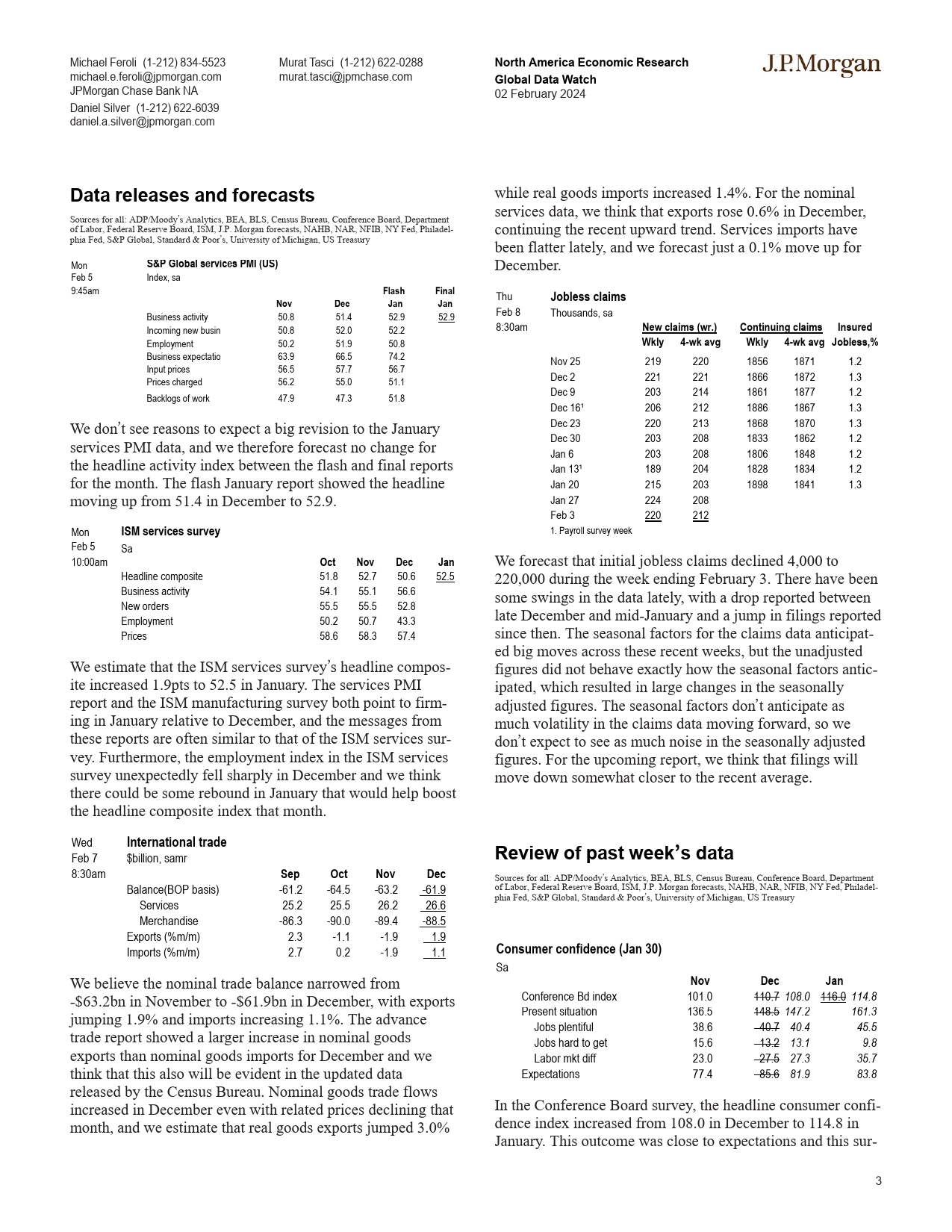

MichaelFeroli(1-212)834-5523MuratTasci(1-212)622-0288NorthAmericaEconomicResearchJPMORGANmichael.e.feroli@jpmorgan.commurat.tasci@jpmchase.comJPMorganChaseBankNAGlobalDataWatch02February2024DanielSilver(1-212)622-6039daniel.a.silver@jpmorgan.comUnitedStatesThingsshouldquietdownalotnextweekaccordingtothescheduleddataflow.WewillgetsomenewsontheCPIdata•FOMCsignalsratecutsarecoming,butMarchmeet-onFebruary9butwedon’texpectmajorchangescomingfromeitherupdatedseasonalfactorsornewrelativeimpor-inglikelyistooearlytanceweights.TheFed’sseniorloanofficersurveyalsocouldbeinterestingtoseegiventheeasinginfinancialconditions•Inflationdevelopmentsarebeingviewedfavorablybylately.WewillgetsomeFedspeaknextweek,whichcouldallowpolicymakerstoshareindividualviewsbeyondtheoffi-theFedcialFOMCcommunicationsfromtheJanuarymeeting.Butwethinkthedata(andtheinflationdatainparticular)may•Jobgrowthmomentumhasstayedstrongalongwithspeaklouderthanwordsinthecomingweeksintermsofsig-nalingwhentheFedwillstartcuttingrates.othersignsofsolidjobmarketMarchunlikely•Nextweek:watchFedspeakandCPIrevisionsTheJanuaryFOMCstatementandrelatedcommunicationTherewasalotofeconomicnewsthispastweek.TheJanu-fromChairPowellpushedbackagainstexpectationsforaaryFOMCmeetingleftusconfidentthattheCommitteewillnear-termratecut.However,boththestatementandthechairnotbereadyt...

发表评论取消回复