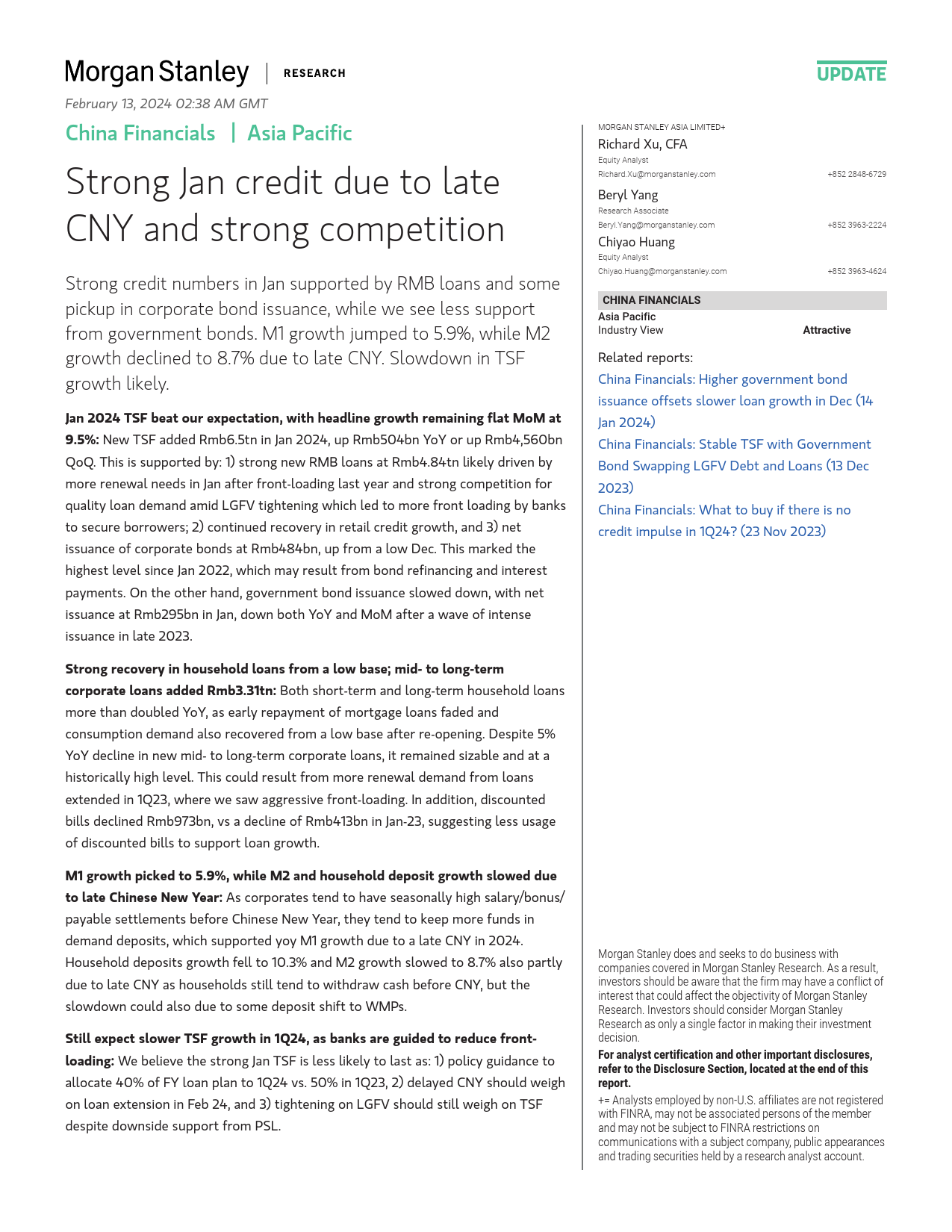

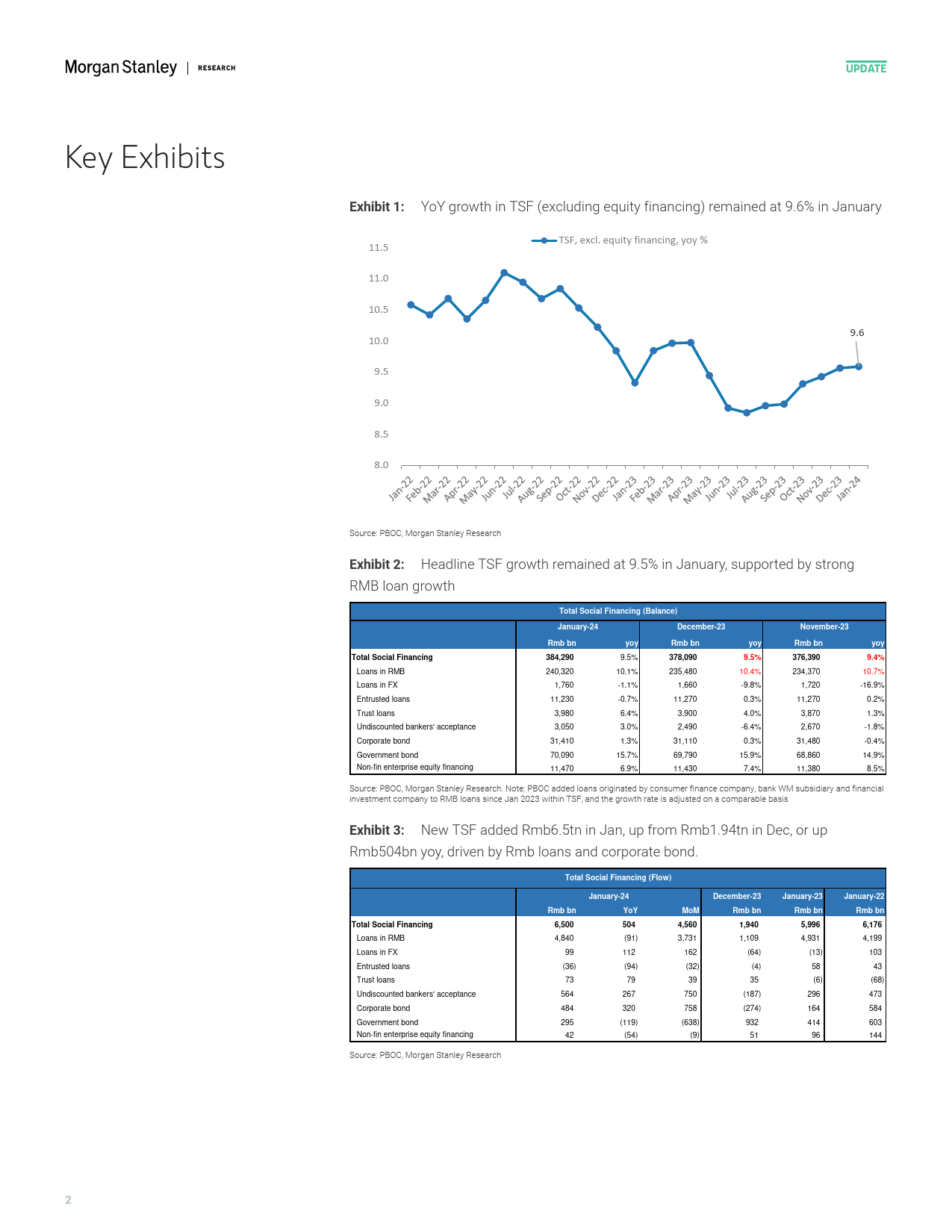

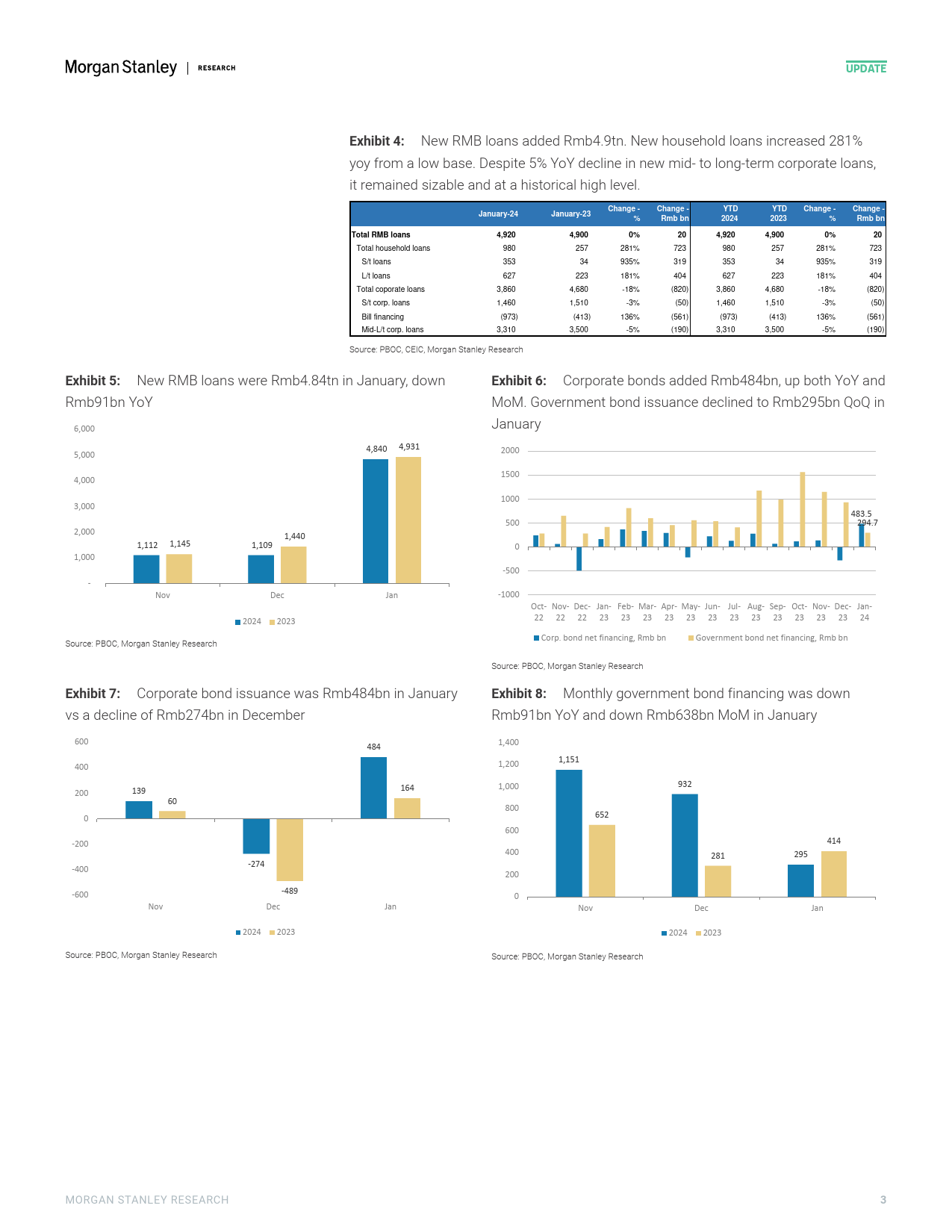

MFebruary13,202402:38AMGMTUpdateChinaFinancialsAsiaPacificMorganStanleyAsiaLimited++8522848-6729+8523963-2224StrongJancreditduetolateRichardXu,CFA+8523963-4624CNYandstrongcompetitionEquityAnalystStrongcreditnumbersinJansupportedbyRMBloansandsomeRichard.Xu@morganstanley.compickupincorporatebondissuance,whileweseelesssupportfromgovernmentbonds.M1growthjumpedto5.9%,whileM2BerylYanggrowthdeclinedto8.7%duetolateCNY.SlowdowninTSFgrowthlikely.ResearchAssociateBeryl.Yang@morganstanley.comJan2024TSFbeatourexpectation,withheadlinegrowthremainingflatMoMat9.5%:NewTSFaddedRmb6.5tninJan2024,upRmb504bnYoYorupRmb4,560bnChiyaoHuangQoQ.Thisissupportedby:1)strongnewRMBloansatRmb4.84tnlikelydrivenbymorerenewalneedsinJanafterfront-loadinglastyearandstrongcompetitionforEquityAnalystqualityloandemandamidLGFVtighteningwhichledtomorefrontloadingbybanksChiyao.Huang@morganstanley.comtosecureborrowers;2)continuedrecoveryinretailcreditgrowth,and3)netissuanceofcorporatebondsatRmb484bn,upfromalowDec.ThismarkedtheChinaFinancialsAttractivehighestlevelsinceJan2022,whichmayresultfrombondrefinancingandinterestpayments.Ontheotherhand,governmentbondissuancesloweddown,withnetAsiaPacificissuanceatRmb295bninJan,downbothYoYandMoMafterawaveofintenseIndustryViewissuanceinlate2023.Relatedreports:Strongrecoveryinhouseholdloansfromalowbase;mid-tolong-term...

发表评论取消回复