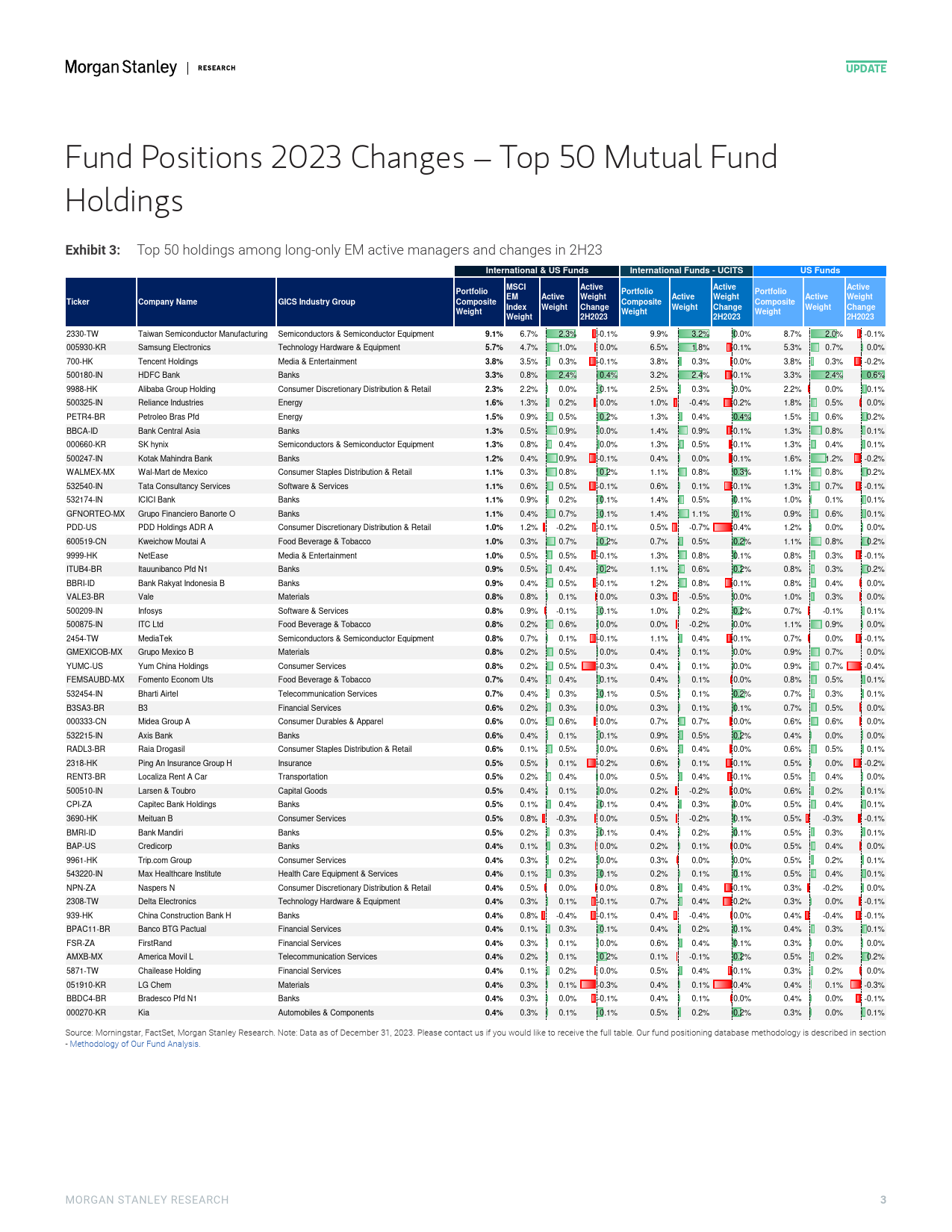

MJanuary18,202406:35AMGMTUpdateAsiaQuantitativeStrategyAsiaPacificMorganStanleyAsiaLimited++8522848-8845+8522848-7102PositionsofActiveLong-OnlyJasonNg,CFAAsia/EMManagersQuantitativeStrategistWepublishourfirstAsia/EMpositioningguidetosummarizeJason.Dl.Ng@morganstanley.comallocationchangesonstock,countryandsectorlevelovertimefromaregionalperspective.Ontopofthat,wealsosharetheGilbertWong,CFAdistributionofactiveweightsandcompareallocationdifferencebetweenUSandEUmanagers.QuantitativeStrategistGilbert.Wong@morganstanley.comKeyTakeawaysMorganStanleyappreciatesyoursupportinActivefundoutflowofGEMequityfundsacceleratedin2H23,whilstPassivethe2024InstitutionalInvestorAll-Asiafundsalsorecordednetoutflows."DollarTrade"wasthemainthemedrivingResearchTeamSurvey.Requestyourballotthese.here.GEMactivemanagerspreferIndia,BrazilandMexico,whilemostunderweightExhibit1:Distributionof"ActiveWeightonChina,SaudiArabiaandTaiwan.China"Amongthe80LargestGEMFundsOnindustrygrouplevel,activemanagerspreferSemiconductorsandStaples,No.ofUSDomiciledGEMFundsNo.ofEUDomiciledGEMFundswhiletheyunderweightMaterials,TechHardwareandAutomobiles&Components.2018Throughout2023,Tencent,SamsungandTSMCledtheweightadditions,while16JD.com,YumChinaandRelianceIndustrieswerecutthemostonstocklevel.1412InJapan,globalactivemanagerswerebuyingintoMaterials,TechHardware,an...

发表评论取消回复